Bitcoin growing strong as investors’ fears fade away

One would think that in a market as tumultuous as the one we’re facing, coupled with Bitcoin’s decreasing supply, a risk-on cryptocurrency would be the scariest asset on the market. However, contrary as it may seem, the opposite is true.

Bitcoin, which began the year below $7,000 and broke $10,000 twice, dipping below each time before March, had a massive sell-off before Q1 closed, and is now trading at a YTD profit of over 42 percent. As global markets are in a freefall, the cryptocurrency, believe it or not, is looking safer than ever in the eyes of potential investors.

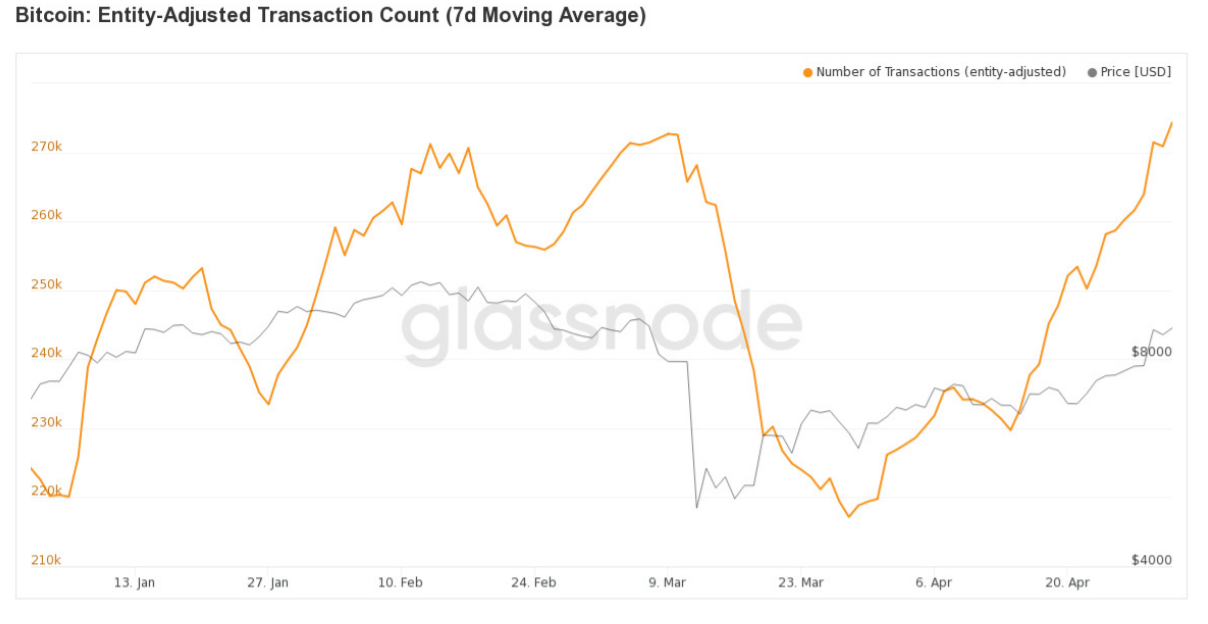

According to a recent report by crypto-analytics firm Glassnode titled “The Market Compass” for April 2020, on-chain data points to the reduction of “fear among investors.” The report cites the increase in Transaction Count, based on a custom entity adjusted method, which has been increasing since the end of March, following a plummet after ‘Black Thursday.’

Bitcoin Transaction Count [entity adjusted] | Source: The Market Compass

According to Glassnode, this metric maps “multiple addresses to a single entity,” holding a given number of Bitcoins. This is done to provide a demarcation between “entities,” “users,” and “individuals.” This method of grouping addresses helps view at a glance which “entity” holds the most amount of Bitcoins through several addresses. No prize for guessing its cryptocurrency exchanges.

The entity adjusted “Transaction Count” was “uninterrupted throughout April,” as a growing number of on-chain transactions linked to varied entities indicated a fall in fear among investors, despite the price drop. Since this increase surged over the “pre-cash value” [as seen in the chart] and showed “no signs of slowing down,” it is likely to have continued further into May.

With the halving not resulting in a massive price drop [yet], even after mining rewards were cut, the lack of fear among investors may have sustained.

Liquidity, based on The Market Compass report, is “the only real winner of the turmoil experienced in March,” owing to the nearly 50 percent single-day drop. As volatility spiked, a larger swathe of traders became active to take advantage of the plummeting price.

According to Glassnode, this metric maps “multiple addresses to a single entity,” holding a given number of Bitcoins. This is done to provide a demarcation between “entities,” “users,” and “individuals.” This method of grouping addresses helps view at a glance which “entity” holds the most amount of Bitcoins through several addresses. No prize for guessing its cryptocurrency exchanges.

Two factors spike liquidity, as per the report – volatility, unsurprisingly was one of them, with the other being the collapse of other financial markets. The report stated that the fall in trading liquidity in April can be seen as a gain for Bitcoin,

“Viewed in this light, the subsequent decrease in Trading Liquidity during April can thus be interpreted as a vote of confidence in Bitcoin. The selling pressure has ebbed and this return to normalcy has manifested itself in the strength of Bitcoin.”