Ethereum Options trade aggressively on call/buys; post-halving rally intact?

Even after the halving event, volatility in the space has continued to persist.

Two days ago, it was identified that Ethereum was noting massive bearish sentiment from investors as the 3-month and 6-month skew moved under zero to -11.1% and -8.4%, respectively, on 10 May, indicating that the panic of the fall contributed to many opting out of the ETH Options market.

However, the tides of sentiment have changed direction once again.

Source: Skew

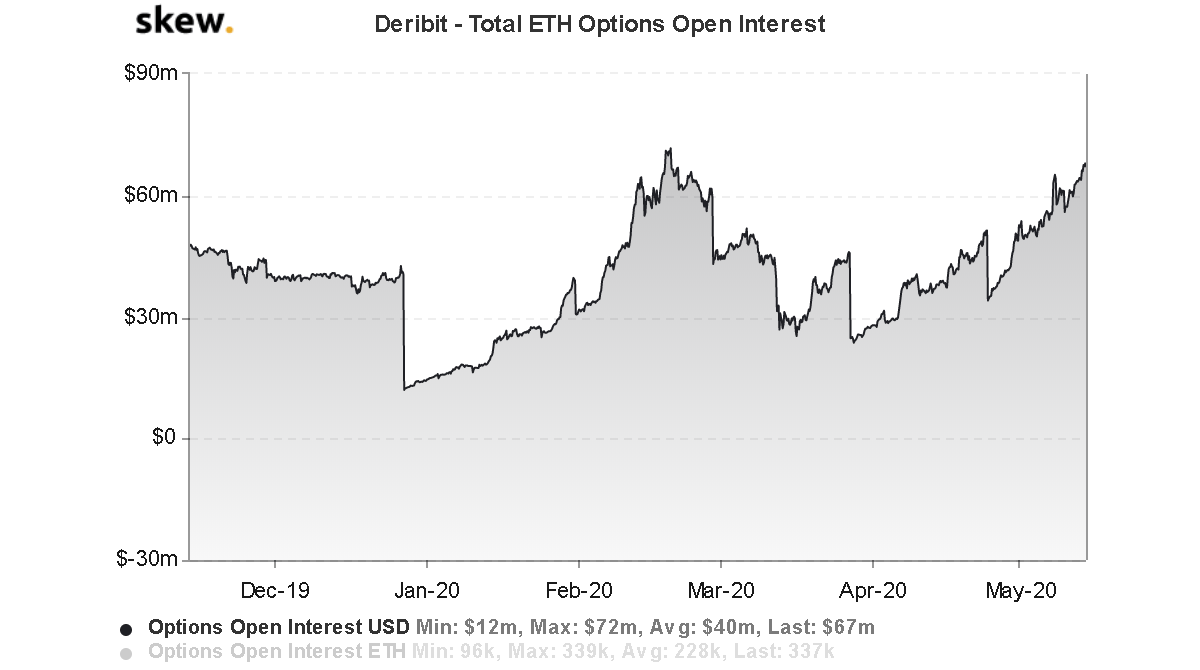

According to data from Skew markets, the total Ethereum Options Open Interest on Deribit exchange reached its 6-monthly high range, a level that was last seen in February 2020. It is also important to note that Ethereum was valued at $284 back then, in comparison to the press time price of $202.

Source: Skew

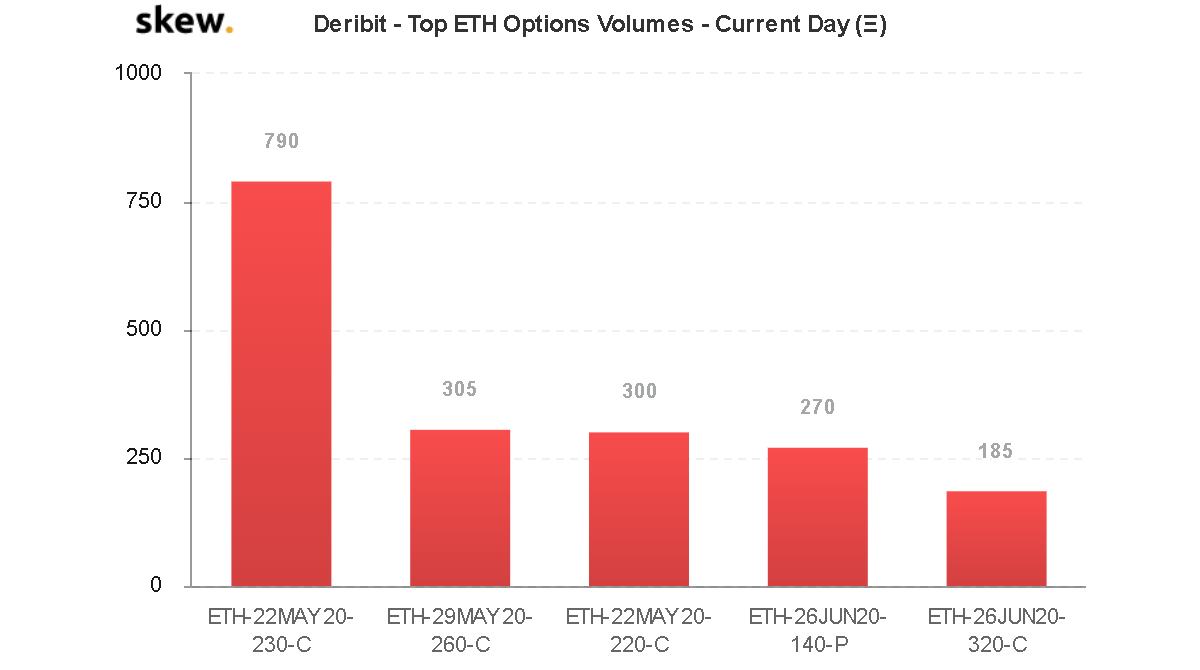

Matching the spike in OI, the current ETH Options volume noted an aggressive move for traders. Setting up a completely bullish outlook, the most-traded contract had a strike price of $230 with an option to call/buys with an expiry date on 22 May. The 2nd most traded contract was also largely bullish with a strike valuation of $260. However, the expiry date of the contract was towards the end of the month.

Source: Skew

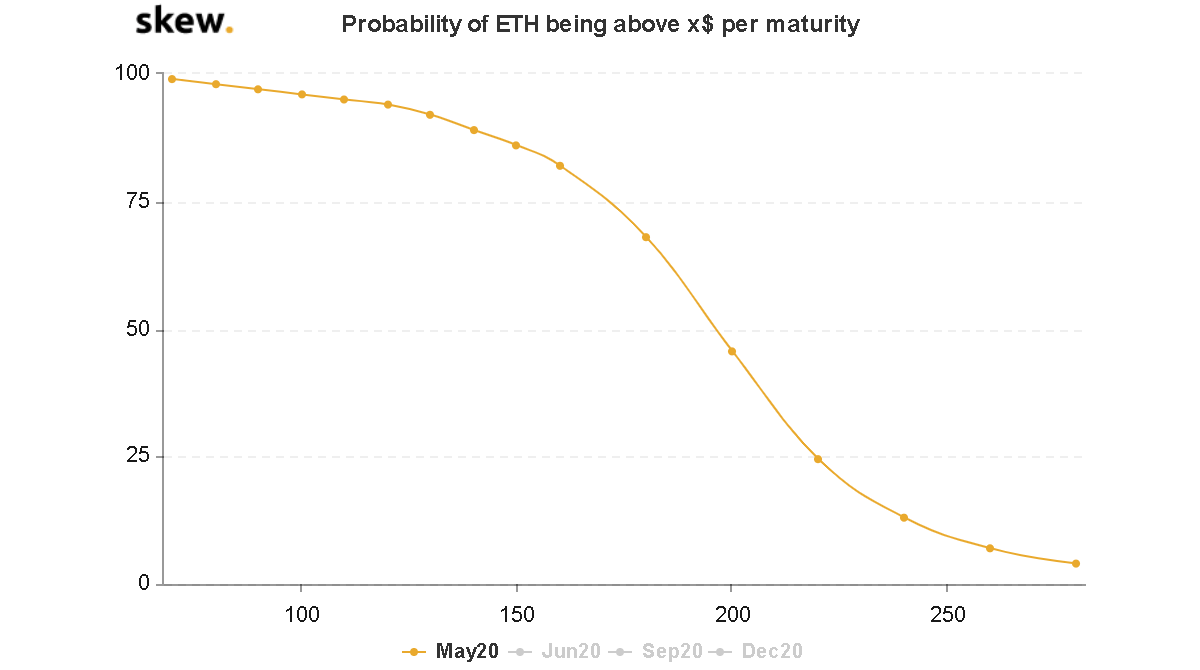

Additionally, the probability of Ethereum crossing $230 in May is also high at 25 percent, a finding that completes the array of bullish sentiment from the side of the traders. However, they may not be wrong to put their bets on ETH as market analysis suggests a lucrative period for the world’s largest altcoin as well.

Ethereum eyeing a bullish breakout

Source: ETH/USD on Trading View

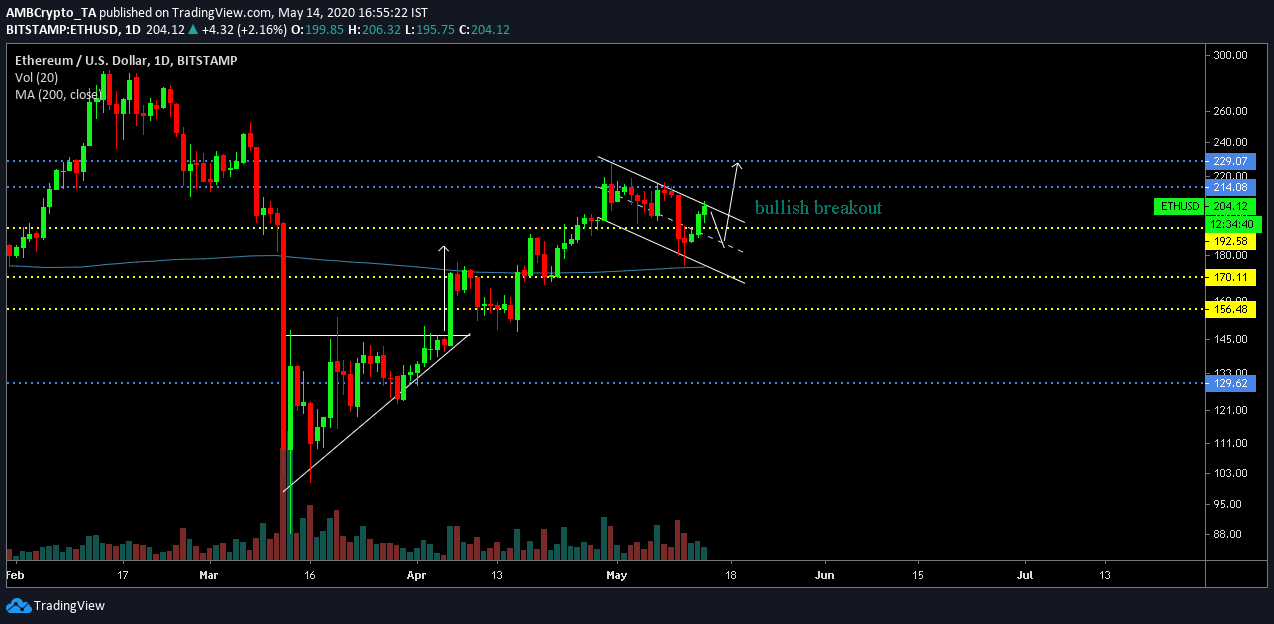

On analyzing Ethereum’s 1-day chart, it can be observed that the crypto-asset is presently navigating within a descending channel and it is at a prime position to go on a bullish breakout. A breakout may allow Ethereum to go as high as $230 or $215, in under a week.

Hence, the bullish nature of the traders is not out of bounds, and crypto-markets continue to remain hot in the industry.