Bitcoin Options contracts report ATH as traders hedge against possible risk

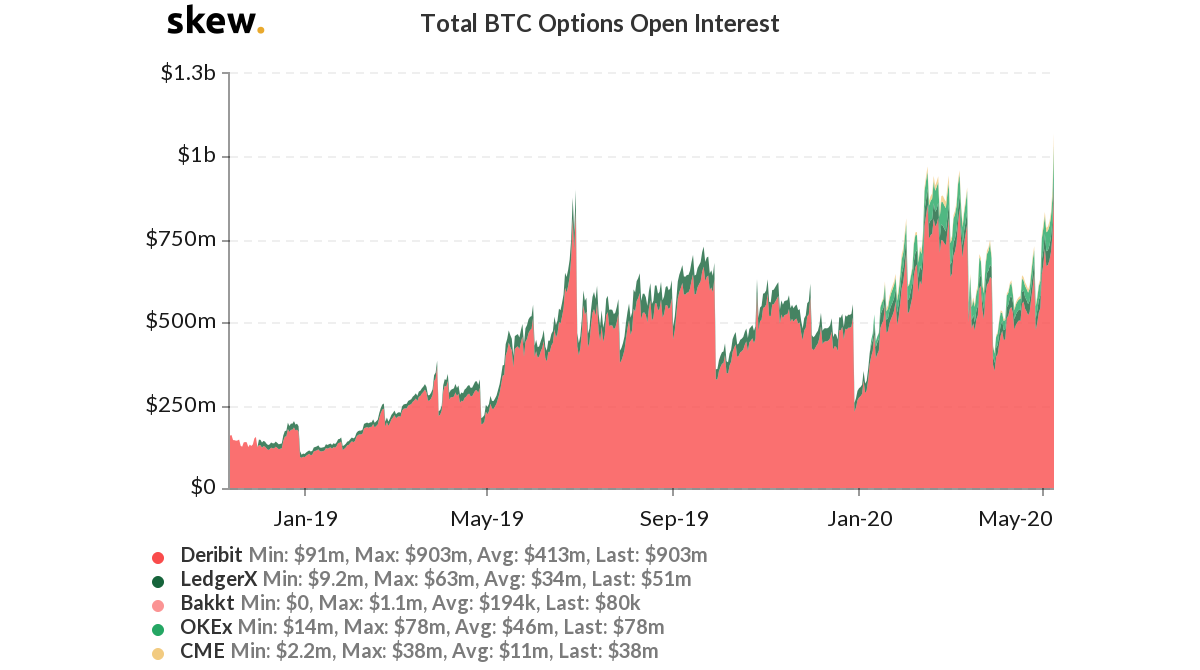

Bitcoin Options market has been picking pace like the BTC futures market. As the price of Bitcoin moved up in the market, there has been a growing number of positions on the Options platforms. According to data provider, Skew the open interest on options contracts rose to an all-time high of over $1 billion, on 7 May.

Source: Skew

The Open Interest was close to this high in February 2020 when the price of Bitcoin pushed a little above $10k, before succumbing to the bearish pressure and falling tremendously. The interest dipped as low as $410 million in March. Ever since the March collapse, the Bitcoin options market had seen restricted interest until the coin regained at least half of its lost value and began consolidating.

The Open Interest on OKEx was $78 million, closely followed by Ledger X with $51 million. CME reported open contracts worth $38 million, whereas, Bakkt remained restrained with $80k.

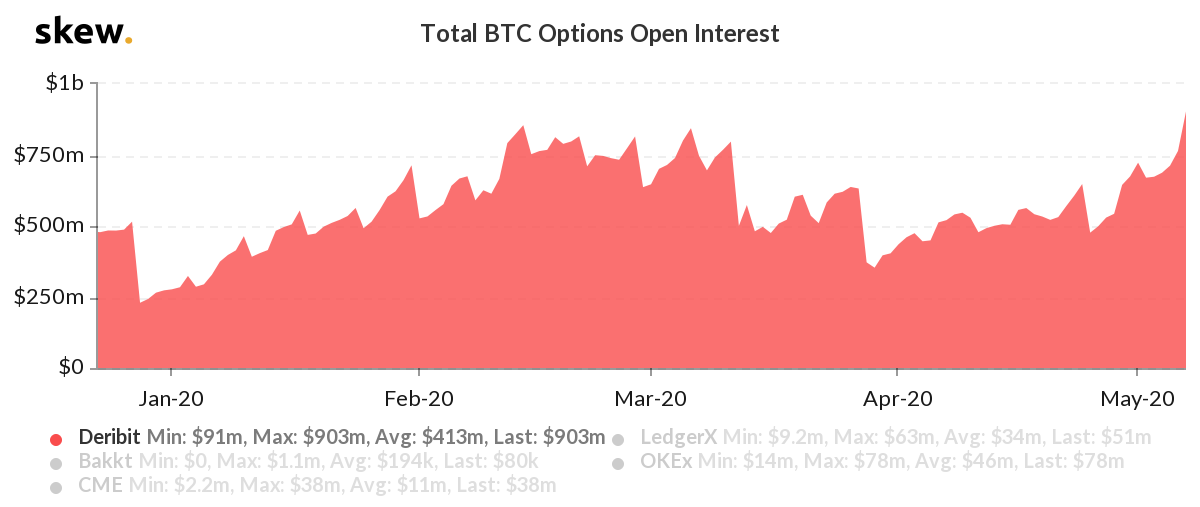

According to the data provided by major Bitcoin options exchange Deribit, it was the major contributor to BTC’s options by volume. It represented nearly 90% of the total volume on 7 May.

Source: Skew

As Deribit marked a volume of $189 million on Thursday, other major BTC options platforms like OKEx marked $21 million, followed by Ledger X and CME, with each contributing close to $2 million in volume. As of 8 May, The options volume reported n Deribit has been $112 million, at press time.

Along with the open contracts reaching an all-time high, the Put/Call ratio has reached a six-monthly peak too on 7 May. The ratio had been rising for the past couple of days and marked a peak at 0.81, a value last seen in 2019. The rising ration was considered to be a bearish sign in the traditional market as it indicated that traders were buying more puts than calls.

This could be due to their speculation of the price moving lower or a measure to hedge their portfolios in case there is a sell-off. The top OI exchange for BTC reflected this evolving trend as four-largest contracts on 7 May were puts. The rising ratio was indicative of traders practicing caution in the market that is about to see an important event as halving, with only predictions about its implications.