Bitcoin Options Put/Call ratio doubles; selling pressure ahead?

Well, if you thought Bitcoin’s momentary move above $7,000 was a sign of things to come, you’re out of luck. The push back to $6,700 coupled with the sideways movement since, has pushed optimism, not necessarily to pessimism, but at least to reality.

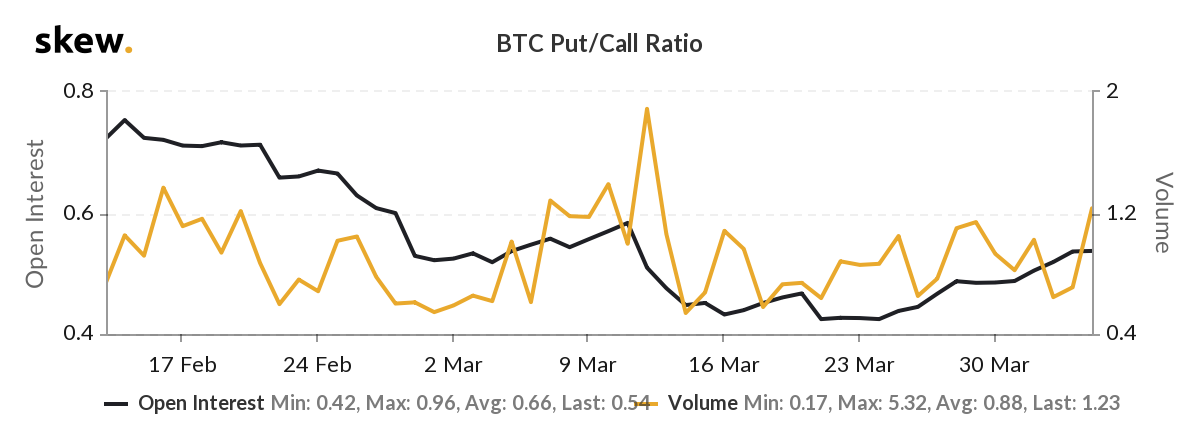

During the previous run-up to $7,000, both the spot markets are the derivatives markets were hopeful. Prior to the move up, the Put-Call ratio on Bitcoin Options contracts dropped from 1.02 on April 1 to 0.64 on April 2, a sign of increasing buying pressure as traders were preferring call options, or right-to-buy contracts to put options, or right-to-sell contracts.

However, this has been undone, and by significant proportions no less. According to data from skew markets, on April 4, the Put Call ratio which was just two days prior at 0.64, more than doubled to 1.23, its highest point in over three weeks.

Bitcoin Options Put/Call ratio | Source: skew

This reversal of the aforementioned change on April 1 signals high selling pressure as traders are opting for sell contracts over buy contracts, possibly expecting a drop in prices. The last time the Put-Call ratio was higher than its current value of 1.23, was on March 12, when the ratio was at 1.89. On the same day, the spot price of Bitcoin dropped from a high of $7,800 to a low of $3,800 in less than 24-hours.

The open interest for puts over calls has been consistently rising. On 21 March the Put/Call OI was 0.42 and since then it has increase to 0.54 percent, not a significant move up, but consistent, and the cryptocurrency options contract’s biggest and longest move up since January 1.

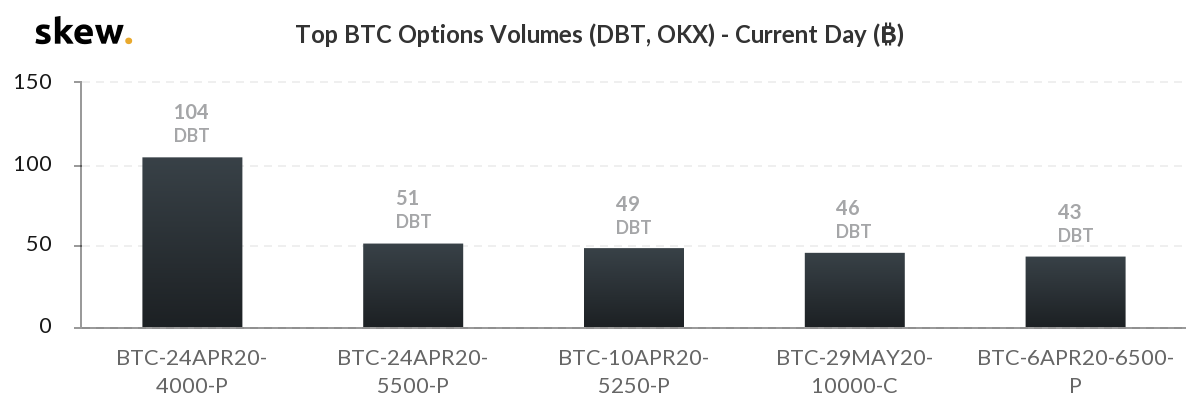

Bitcoin Options trading volume current day | Source: skew

Further, the contracts with the most trading volume portrays the Put-Call divergence. Current day options contracts traded on Deribit and OKEx each have a strike price lower than the current price of Bitcoin, starting at $6,750, $50 lower than the current spot price and dropping as low as $4,000, $2,800 lower than the current spot price.

Given that most options contracts are traded with an expiry date of Friday of every week, the most immediate expiry is scheduled for 10 April, With a large amount of contracts, mostly puts as the data above indicates, currently open and traded in the market, and five days before expiry, selling pressure will look to hit the market.