Bitcoin Futures depict growing investor confidence, despite market corrections

Showing clear signs of revival, Bitcoin went up by a whopping 21% between 23 and 24 March. During this time, the king coin’s price climbed close to the $7,000 level. However, despite continuously trying to establish a higher foothold after the great fall in the second week of March, Bitcoin again retraced its steps back to the $6,560-mark

Source: BTC/USD on TradingView

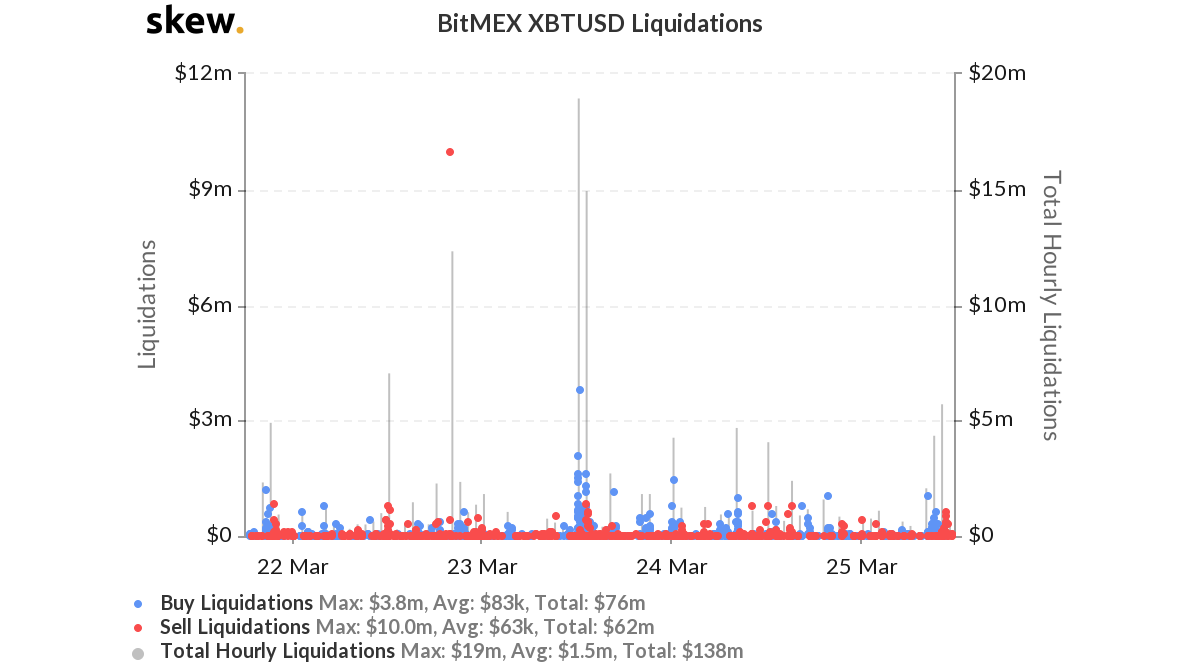

In what appears to be a revival of confidence and faith in the market, buy liquidations worth $76 million in total were registered on BitMEX, at press time, with the highest single transaction liquidation found to be $648k. The latest data from Skew markets revealed that this figure dominated sell liquidations which amounted to $62 million.

These figures brought it to a total of around $138 million worth of Bitcoin long and short positions.

However, the crypto-market has continued to sustain market corrections, something that was evident in the rise in sell liquidations, after the fall of Bitcoin’s spot price from $6,900-level to the current price on 25 March, despite the fact that this number is still lower than that of buy liquidations for BTC Futures on BitMEX.

Source: Skew

The massive drop and sell-offs crypto’s spot price to 2020-lows affected the derivatives space as well. However, the latest trend is indicative of a renewed interest in the market, with buyers stepping up as Bitcoin’s price gradually recovered, even as minor corrections continued.

Besides, thanks to Bitcoin’s high correlation with the other crypto-assets, this sentiment was not just limited to the king coin’s derivatives market. The second-largest cryptocurrency, Ethereum, has closely mimicked Bitcoin’s price, and its correlation remains one of the strongest with a coefficient of 0.88, according to data charted by CoinMetrics.

Ethereum has also surged significantly after the crash, even as it remained trapped in the $135-level, at the time of writing.

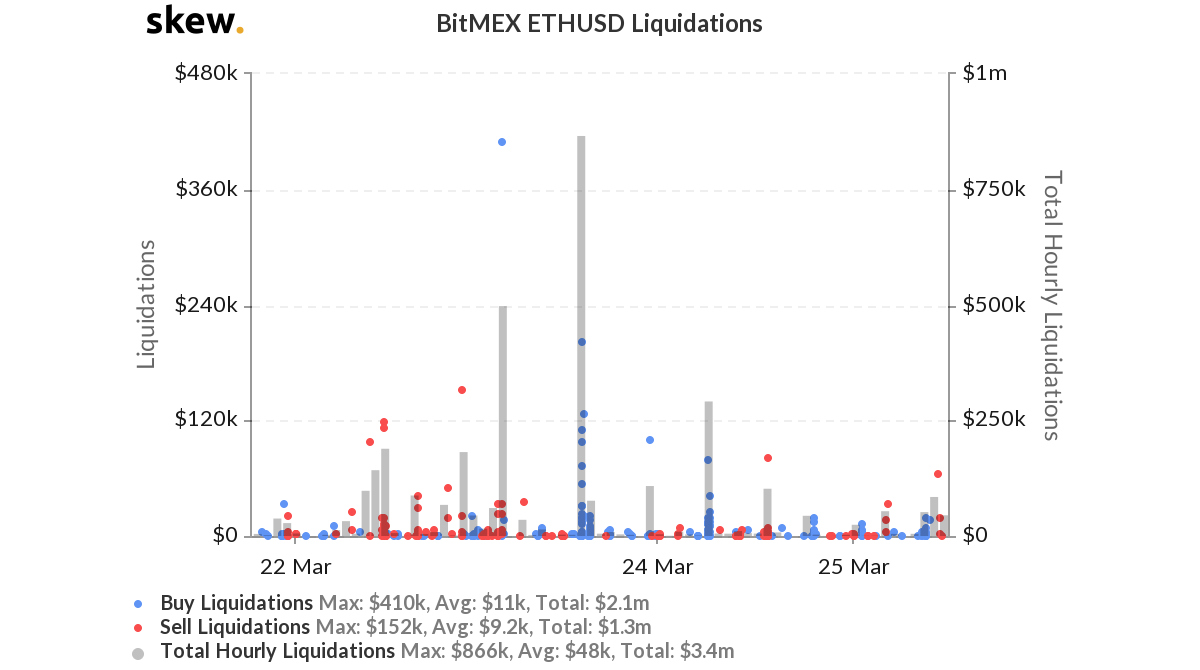

Source: Skew

Liquidations rose in ETH Futures on the crypto-derivatives platform BitMEX following the surge in its spot price. A total of $3.4 million liquidations took place, at press time, which accounted for $2.1 million of buy liquidations and $1.3 million of sell liquidations.