Bitcoin derivatives: evolution of appetite for trading digital assets

During the early days of Bitcoin, the community saw an overwhelming portion of retail dominance. It was not until 2020 when the change in this dynamic was observed via the derivatives market. The flow of institutional capital into the space via this derivatives market has been the spotlight of 2020, slowly taking over the spot market’s dominance.

From the ICO boom to the 2018 Bitcoin crash and several scandals from Silk Route to Quadriga and Cryptopia, the space has seen it all. The need of the hour, however, according to BitFinex CTO Paolo Ardoino, was “better infrastructure and tools” to bring institutional money flowing in.

In a recent interview, Ardoino spoke about the transformation with respect to the appetite for trading digital assets.

“This phase taught the crypto market a good lesson – better infrastructure and tools need to be built to bring institutional money flowing in and while many crypto companies have come and gone, what is left is robust and provides the tools and services to support institutional take up.”

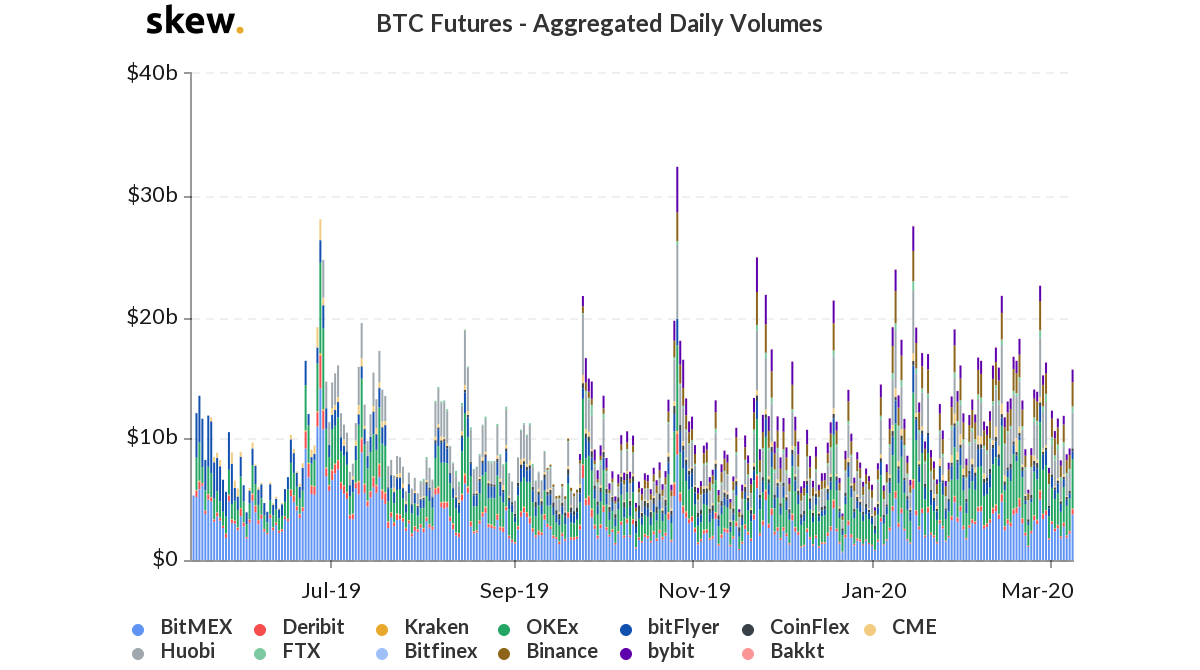

Skew market charts depicted an upward trajectory maintained by both Bitcoin futures and options trading.

On Bitcoin futures side, the volume has been in the overall positive territory. With respect to BTC futures’ aggregated daily volume, the first milestone was seen on June 27th last year when the volume reached a whopping $28 billion. The number was dominated by BitMEX with a $14 billion volume. Interestingly, 2020 saw the charts intensifying as platforms recorded high trading activity.

Source: Skew | BTC Futures Aggregated Daily Volumes

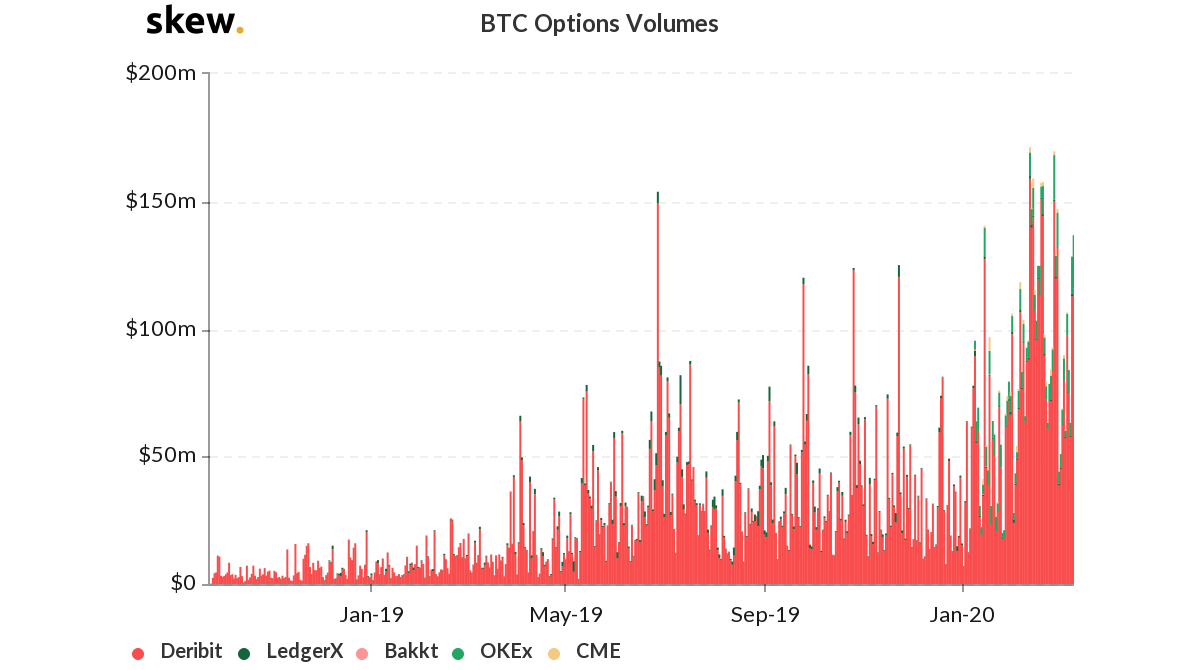

Bitcoin options trading, on the other hand, started gaining traction in April 2019, when the volume spiked close to $33 million, with Deribit dominating the chart. Bitcoin option volume hit another milestone on June 26th when it surged to $153.4 million.

BTC volume in options was mostly dominated by Deribit and Ledger X. However, as more players such as CME, Bakkt, OKEx launched support for derivatives on its platform during late-2019 and early 2020, the numbers increased.

Source: Skew | Bitcoin Options Volume