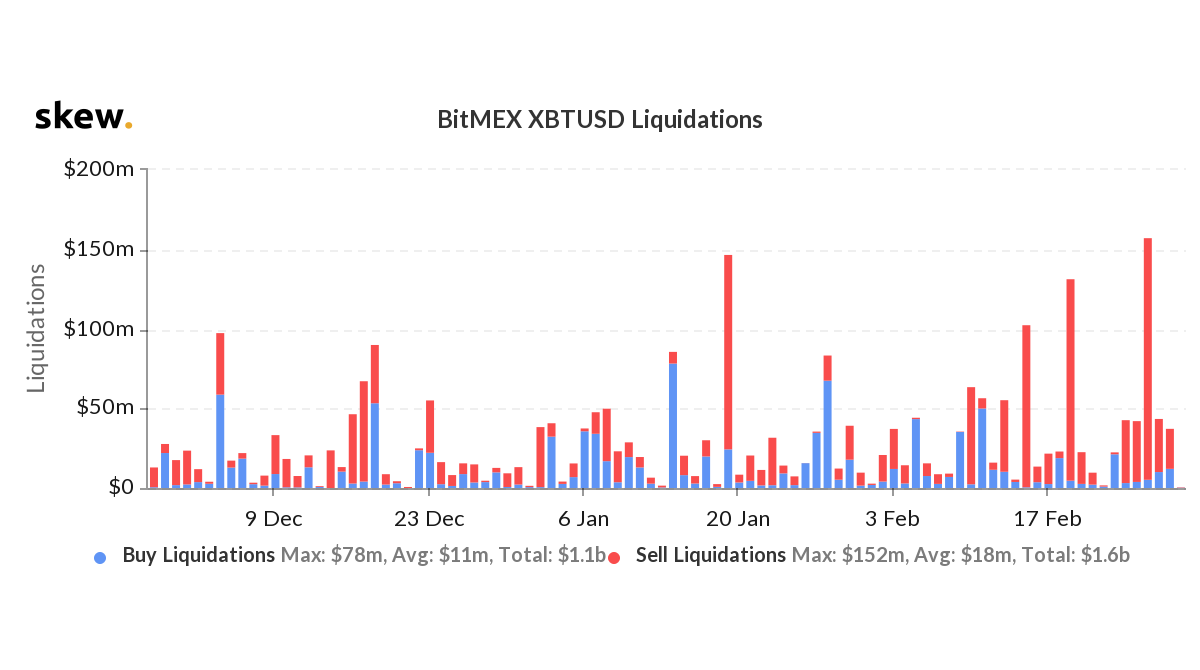

Bitcoin longs worth $769M liquidated on BitMEX in February

As February 2020 ends, it can be observed that Bitcoin’s performance in the market has been a tumultuous ride. The largest cryptocurrency in terms of market cap was, at press time, reporting a YTD return of 22.99%, a figure which was much higher before the drastic fall a few days ago. The coin began its journey in 2020 valued at $7,237.35 and managed to push through the resistances and reach $10k, an important psychological level. However, the selling pressure has been immense and the coin is back under $9k, with its value at press time being $8,760.71.

Source: BTC/USD on TradingView

This drastic fall in Bitcoin’s price triggered massive liquidations. Longs worth nearly $769 million were liquidated in February 2020 on BitMEX. This drastic rise in sales can be visible in the chart provided by a data analytics firm, Skew.

Source: Skew

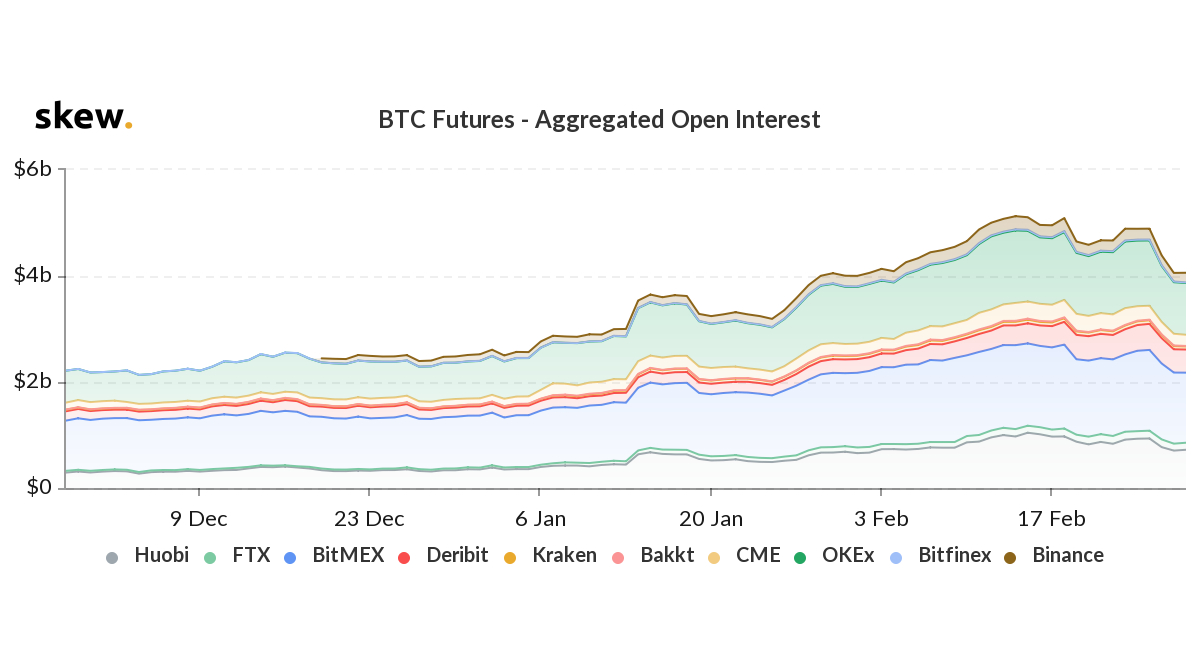

Despite the sell-offs, however, the Bitcoin market still kept investors intrigued. The Open Interest has been on the rise since the beginning of January 2020, and it peaked this year on 18 February with an aggregated interest marked over exchanges at $5.13 billion. However, the fall that followed on 19 February, along with the expiration of contracts, was resultant of falling Open Interest.

Source: Skew

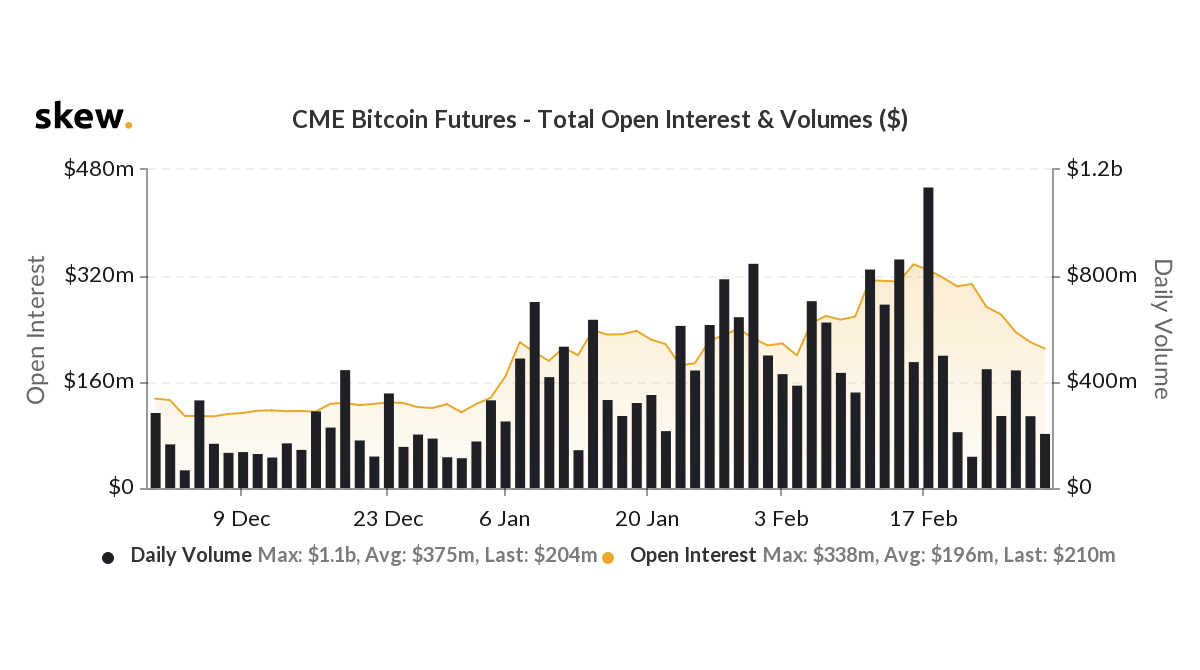

The CME Bitcoin Futures chart was a better indicator of the 9% fall in Bitcoin’s price. The Bitcoin Futures volume peaked on CME at $1.1 billion on 18 February, however, the misstep caused a drastic fall in CME volume on 19 February and it was reported to be $449 million. Despite the low volume, however, the OI remained high until 21 February, after which even the interest went on a decline. The CME market closed on Friday with a volume of $204 million, while the OI stood at $210 million.

Source: Skew

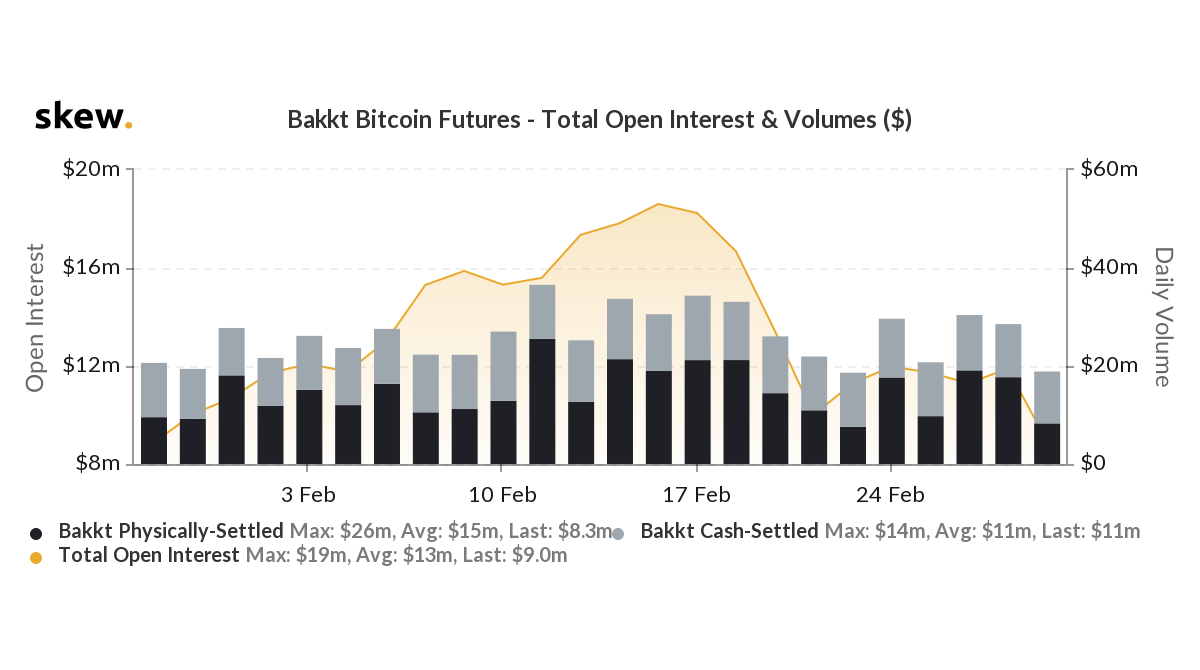

Bakkt BTC Futures were reporting a similar story, with less volume throughout the month. Bakkt OI peaked on 14 February and was reported to be $19 million, a figure much lower than that of the CME’s. However, it went into a nosedive on 19 February. Bakkt’s OI was at $9 million while the volume remained low at $19.3 million on 28 February.

Source: Skew

On the other hand, the Ethereum Futures market reported growth, despite the bear’s presence, as its volume shot up close to its all-time high on 26 February. The Open Interest reflected a dip too, at press time, but that could also be due to the contract expiry.