460k Ethereum options expire: how will it affect the price?

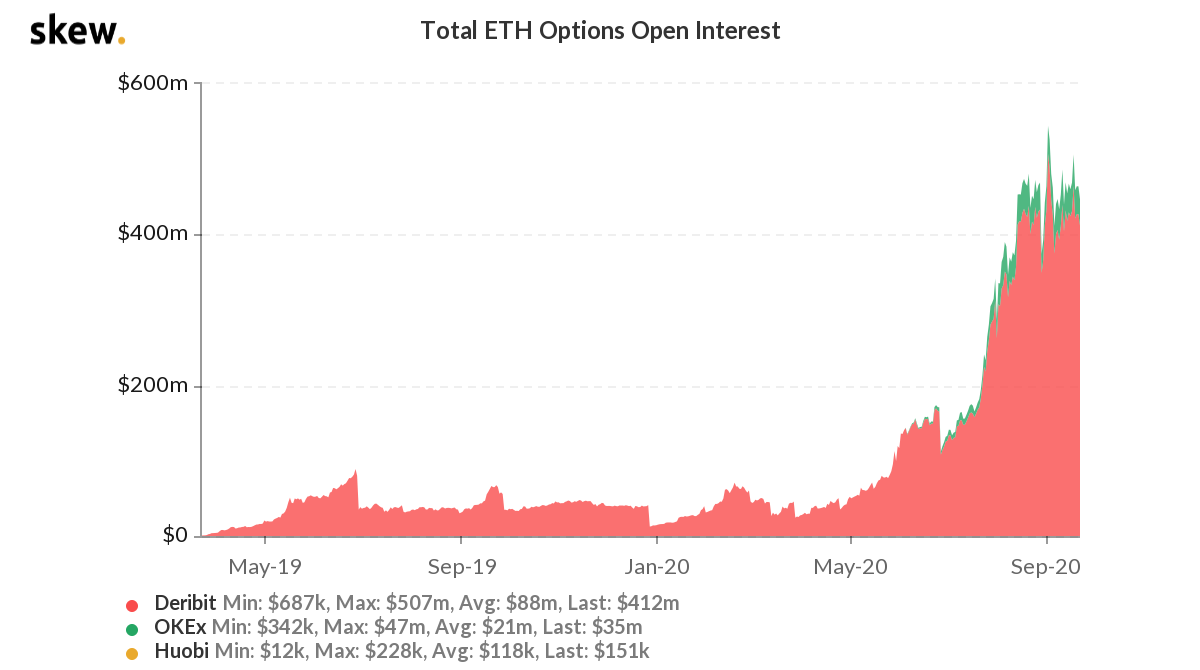

This week saw increased volatility in the crypto market, not only due to the expiry of Bitcoin contracts but also because of the expiry of Ethereum contracts. Nearly 460,000 ETH options are set to expire on Friday that made up for almost $450 million in open interest.

Source: Skew

This will be the largest expiration date for Ethereum and the options exchange Deribit, which is currently the largest venue offering ETH options contract. Deribit accounts for nearly 90% [414k ETH] of the total ETH contract set to expire of 25 September, followed by almost 77% [67k BTC] of BTC contracts held for expiration on the same day.

The expiration of this large sum will likely add to the existing volatility in the market. According to CoinMetrics’ research, the surge in volatility is expected to spark price swings throughout the week, as traders look to “hedge exposure on these positions, work out of them, or possibly take action in the spot market in anticipation.”

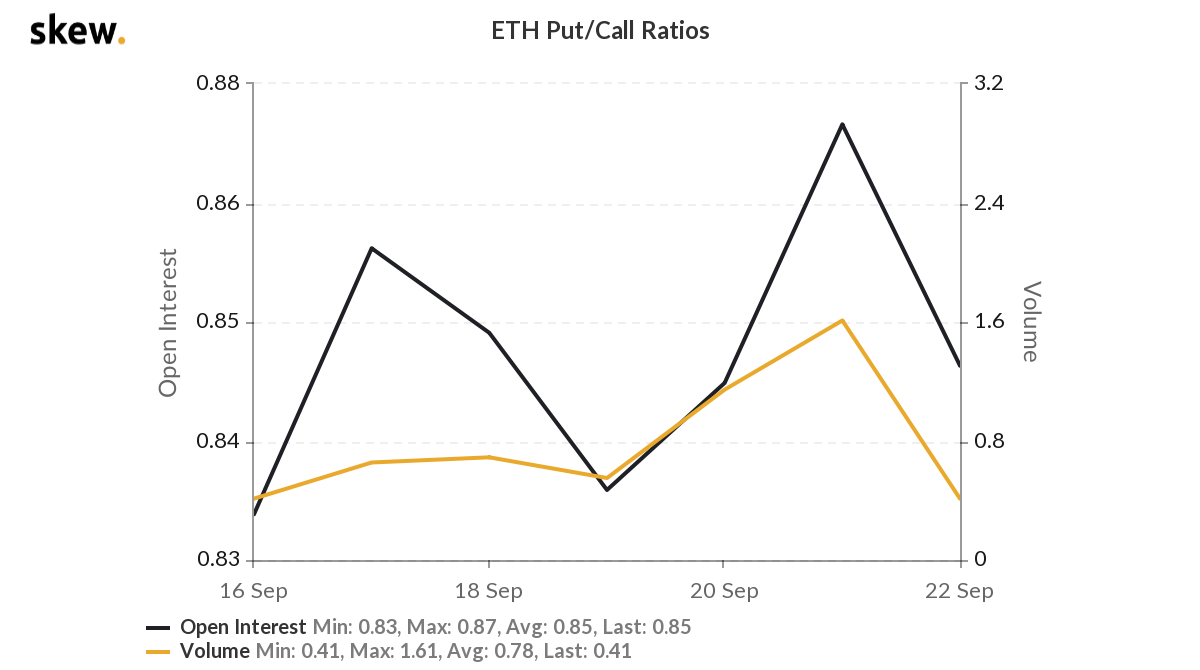

Interestingly, traders were actively buying more puts than calls, which was a bearish sign for the market. Investors were speculating a hit to the ETH price and were trying to hedge their portfolio in case of a sell-off.

Source: Skew

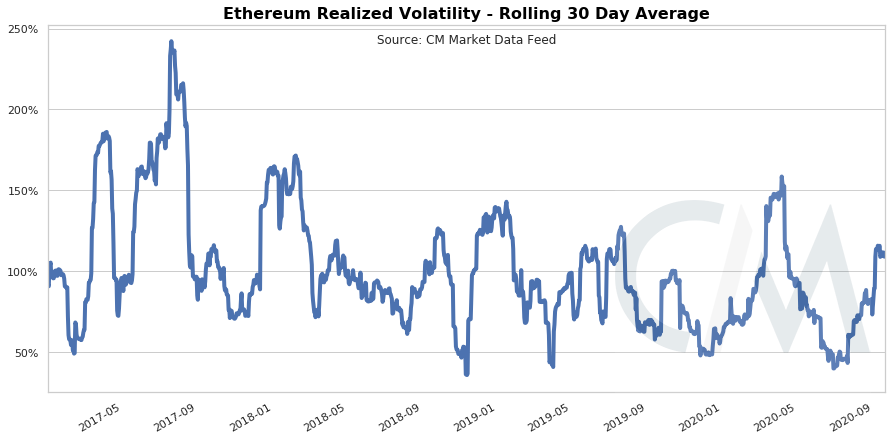

Volatility

The expiration of ETH and BTC options contracts on Monday re-introduced volatility. The Ethereum market was quicker to witness changes due to volatility as soon as UNI, Uniswap’s governance token, made its debut. This return of volatility was significant as it followed a period of sustained levels of low volatility not seen since mid-2019.

Source: CoinMetrics

With a sizeable number of contracts expiring this Friday, the volatility may increase further.

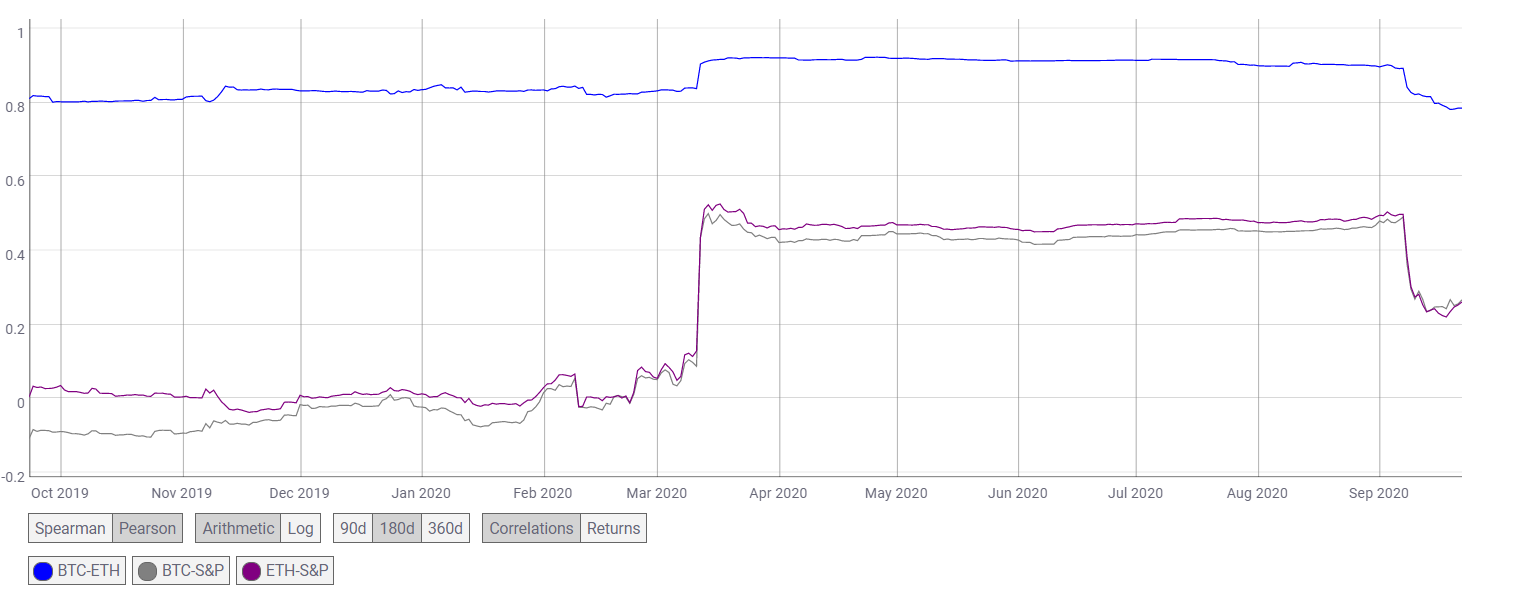

This volatility may bear a negative impact given the correlation shared between Ethereum and the stock market. Although Bitcoin shares the highest correlation with the stock market and Ethereum, this was the case of, mathematically speaking, transitive law.

Source: CoinMetricsThe correlation between BTC-ETH might be dropping, but has not dropped enough to make the asset independent. With the stock market still experiencing pull backs, traders may want to tread carefully.