Crypto News

Crypto spot vs derivatives: Exchanges shift their focus

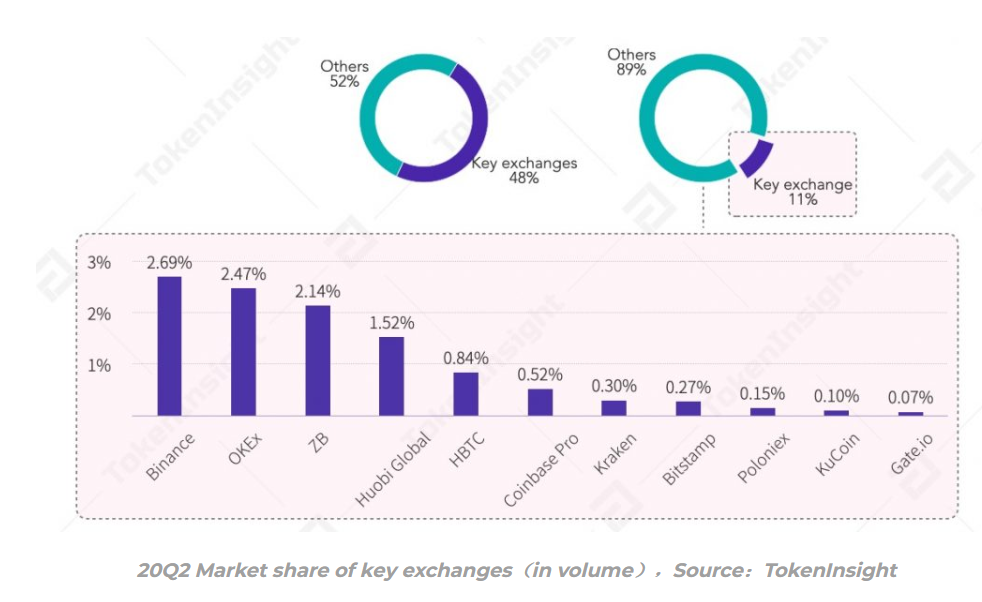

Even though the second quarter of 2020 did not manage to register tremendous growth due to the consolidation in the spot market, the derivatives market kept the pace up for the crypto assets. The spot exchanges accounted for only 11% of the transactions in the industry, whereas the crypto derivatives exchanges accounted for almost 50%.

For instance, the market share of Binance, the single spot exchange with the highest volume was 2.69%, which was minuscule compared to the market share of the single derivative exchange with the highest volume, Huobi Futures with 19.98%.

Source: TokenInsight

According to data provided by TokenInsight, since 2020 the focus of exchanges has largely shifted to derivatives trading. This was visible in the derivative/spot ratio of Huobi Global/Huobi Futures, which increased by 3.7 times this quarter to 7.26 times. While the turnover of the contract was reportedly 0.53 times more than that of the spot.

Source: TokenInsight

The consolidation phase that stretched the entire month of June made the crypto spot far less fierce than the derivatives market. Exchanges can use various tactics to shift many traders from derivatives and accumulate a strong user base in spot trading. As the exchanges plan strategically, centralized spot exchanges reported a turnover of $5.25 trillion, which was 18.9% less from the previous quarter.

The total spot market transaction volume sunk by 18% compared to the last quarter as well, but the centralized spot exchange fee income was close to $472 million, which remained the profit center of the industry. Whereas the trading volume of the derivatives market in Q2 was $2.159 trillion, which was a rise of 2.57% from the previous quarter and a year-on-year increase of 165.56% from Q2 2019. The total transaction volume of cryptocurrency derivatives in Q2 was about 27.4% of the total spot transaction volume.

Source: TokenInsight

Despite an active derivatives market, the volatility on the crypto derivatives market in Q2 was less than Q1, which caused a decrease in investors’ trading decisions and lead to market weakness.