XRP whales are busy keeping the buy tab open – Here’s how

- The rise in accumulation pushed XRP to $0.63.

- If buying pressure wanes, XRP may drop to $0.60 and also force some liquidation.

Ripple [XRP] addresses holding between 100,000 and 10 million tokens have accumulated over $6 million worth of the cryptocurrency in the last seven days, according to AMBCrypto’s analysis of Santiment’s data.

As a result, the supply owned by this cohort has increased. For example, the 100,000 to 1 million cohort accounted for 11.39% of the total XRP supply at press time, while the 1 million to 10 million group owned 6.31%.

XRP reacts

By reducing the number of tokens available to be purchased in the market, whales can put upward pressure on prices. Also, accumulating large quantities of cryptocurrency can result in high volatility.

In XRP’s case, there have been signs that the cryptocurrency is ready for a parabolic move. At press time, the value of the token was $0.63. This was after the price increased by 2.29% in the last 24 hours.

From the 25th of November to press time, as indicated by the H4 chart, XRP consolidated. During this period, the price moved between $0.61 and $0.62. However, a rise in the whale transactions seemed to have affected the volatility, as a sharp green candle suddenly appeared.

However, the Bollinger Bands (BB) showed that XRP’s volatility was not as extreme to cause significant price fluctuations. At press time, both the lower and upper bands of the indicator contracted.

But at the same time, the Relative Strength Index (RSI) reading increased to 63.09. Such an increase implied that buying momentum was picking up. So, the possibility of XRP’s upside in the short term could not be ruled out.

Careful! Retracement is an option

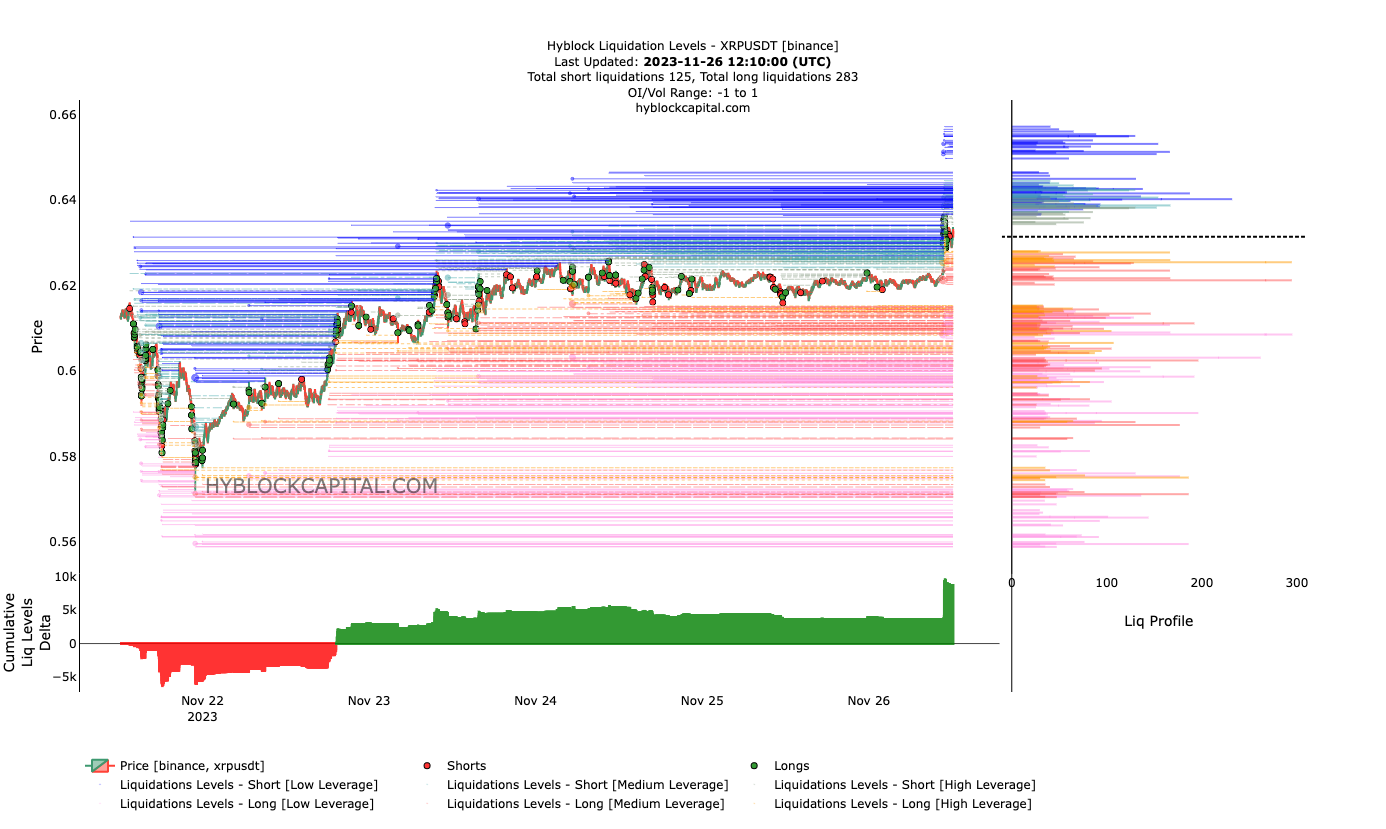

AMBCrypto also looked at XRP’s liquidation levels shown by HyblockCapital’s data. Liquidation levels are potential price levels where liquidation of a trader’s position may occur.

At press time, the Cumulative Liquidation Level Delta (CLLD) showed that there were more open long positions than shorts.

This implies that more traders are betting on an XRP price increase than a slide. However, there arose a possibility of full retracement, as indicated by the positive CLLD. Should a retracement happen, traders with entries around $0.60 could be liquidated.

Another indicator that could have an effect on XRP price action is Open Interest. Open Interest is the number of open contracts left at any given time. When the Open Interest increases, it means that there are more traders trying to capitalize on an asset’s movement for potential gains.

Is your portfolio green? Check out the XRP Profit Calculator

A decrease, however, suggests an increase in closed positions. As of this writing, XRP’s Open Interest had decreased. When compared with the price movement, Open Interest showed that the upward move was weak.

So, it is possible for XRP to fall back to $0.61. However, if the buying momentum continues, the token may defy the odds and possibly move to $0.65.