Why a recovery for XRP looks imminent

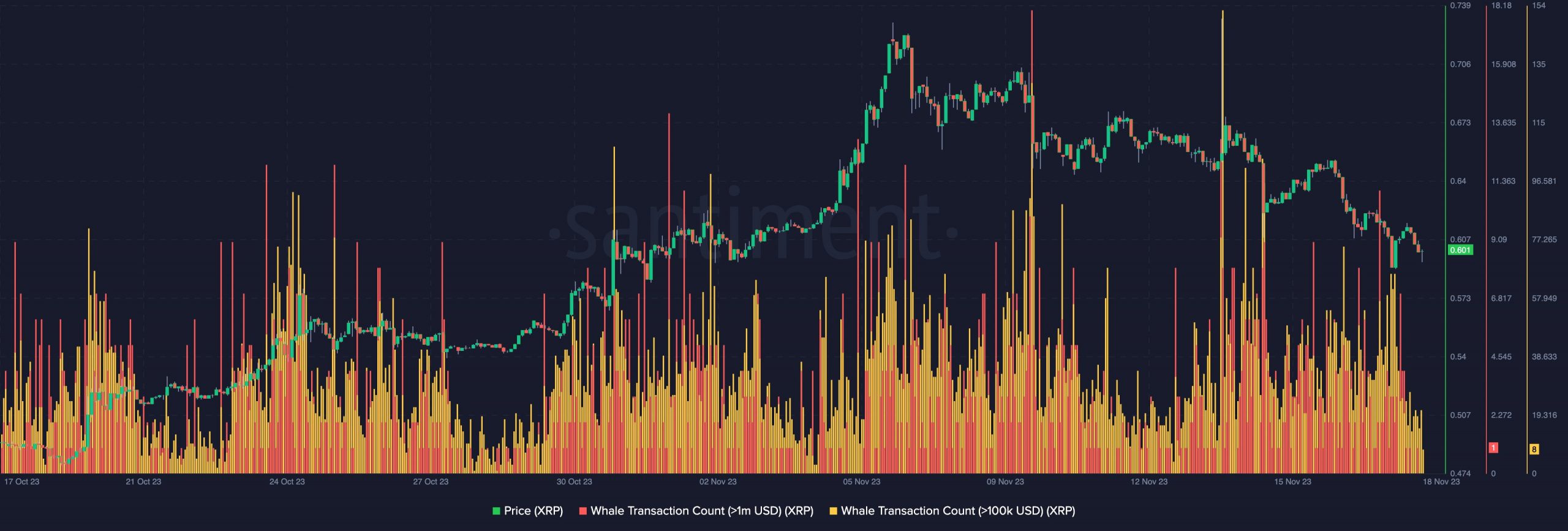

- XRP’s whale transactions have seen a spike in recent days.

- However, the token may fall below $0.60 before a jump.

Ripple’s [XRP] price decreased by 8.80% over the last seven days. However, the token could be on the verge of a recovery, if on-chain data is to be believed.

Notably, according to AMBCrypto’s analysis per Santiment, whale transactions between $100k – $1 million witnessed a rise over the past few days. Historically, whenever whale transactions have picked up at a time when XRP falls, prices have witnessed a rise.

Never a straight line to revival

Now could be the perfect time to watch out for the significant changes in XRP’s price. To do this, AMBCrypto decided to take a look at the metrics.

When we viewed TradingView’s XRP/USD 4-hour chart, we found that the 20-day EMA (blue) had a downward crossover below the 50 EMA (yellow). This crossover is a bearish sign. So, XRP could fall below the $0.60 threshold soon.

If the EMA position is accompanied by high trading volume, the drawdown may be faster. But at press time, Ripple’s trading volume decreased, indicating a drop in spot trading.

Another indicator we evaluated was the Money Flow Index (MFI). The MFI measures the selling and buying pressure by looking at the price and volume data. At the time of writing, the oscillator stood at 23.53.

Thus, evidence of XRP’s potential recovery could also be found in the MFI. For the uninitiated, an MFI value of above 80 is considered overbought. When the indicator is below 20, it is termed as oversold.

Should the MFI hit 20.00 or below, XRP might reverse its direction to the upside.

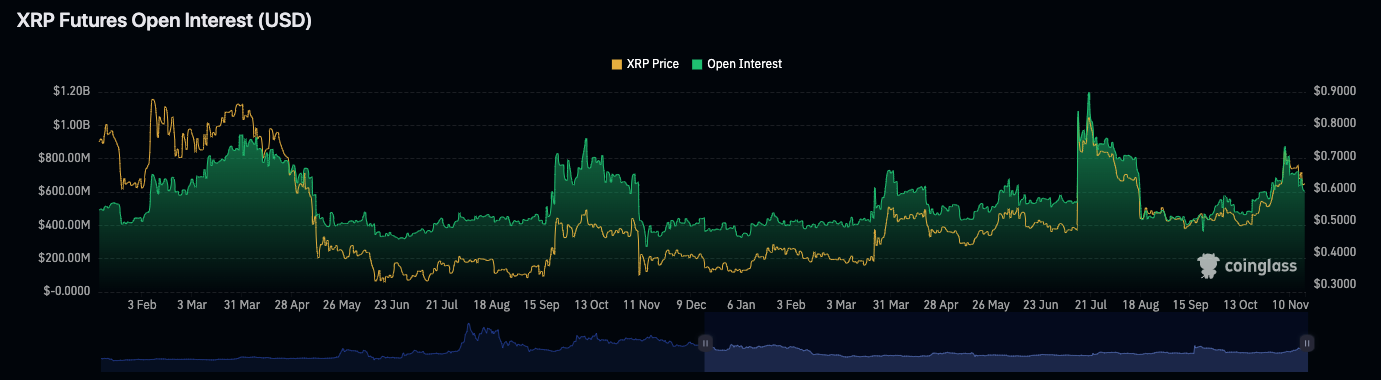

Open Interest declines

Correspondingly, the token’s Accumulation/Distribution (A/D) had flattened at the time of writing. For confirmation of XRP’s uptrend, the accumulation has to increase. If this happens, then XRP may be able to hit $0.65 in the short term.

Meanwhile, Open Interest around XRP had declined at press time, based on AMBCrypto’s evaluation of Coinglass’ data. At press time, the Open Interest was down to $605 million.

Open Interest is the amount of liquidity allocated to open positions in the Futures market. When the Open Interest increases, it implies a surge in market interest.

Read Ripple’s [XRP] Price Prediction 2023-2024

XRP’s waning Open Interest meant that traders were refraining from opening more positions at the time of the report. This lack of interest could be due to the current market uncertainty.

As matters stand, XRP continues to have the potential to rise, but investors may have to brace themselves for another decrease first.