XRP takes the top spot in current ‘Emerging Trends’

The last couple of weeks have been a case of ebb and flow for XRP. After the flagship token of Ripple lost its plot as the third-largest asset, the response from the asset lacked intent. The asset continued to ponder under its long-term resistance at $0.21 and recently a reputed analyst in the space noted its performance with respect to Bitcoin and Ethereum.

However, times are fickle at the moment and according to Santiment’s insight, XRP holders may have something to look forward in the near future.

Source: Twitter

According to the analysis platform, XRP is currently rising as an Emerging Trend as the asset has seen massive social and volume spikes over the past week.

The above data can also be verified from LunarCrush’s dataset as it appeared that the average sentiment score received by XRP had risen significantly over the past few days.

Ripple’s growing network

Social volume is usually triggered in the market when the price undergoes massive swings but that hasn’t been the case off late for XRP. It can be speculated that the developments facilitated by Ripple may have helped network adoption and as a result, XRP’s social volume has improved.

Ripple has been working towards boosting its worldwide presence and as previously reported, the organization is looking forward to dabbling in the lending industry. There were speculations that Ripple was considering the use of XRP for loans. Even though nothing is set in stone, for the time being, this potential use case of XRP could be used to create market asymmetry.

Additionally, last week Ripple’s ODL in Australia also recorded a new all-time high for the liquidity index of XRP on various corridors. It was stated that the liquidity index for BTC Markets for the pair XRP/AUD surged up to $15.4 million on 29th May.

Is XRP primed for an upcoming decoupling from BTC?

Santiment’s insight had indicated in the same thread that indicators such as social volume and market sentiment may allow XRP to conduct a decoupling from Bitcoin in the current market scenario.

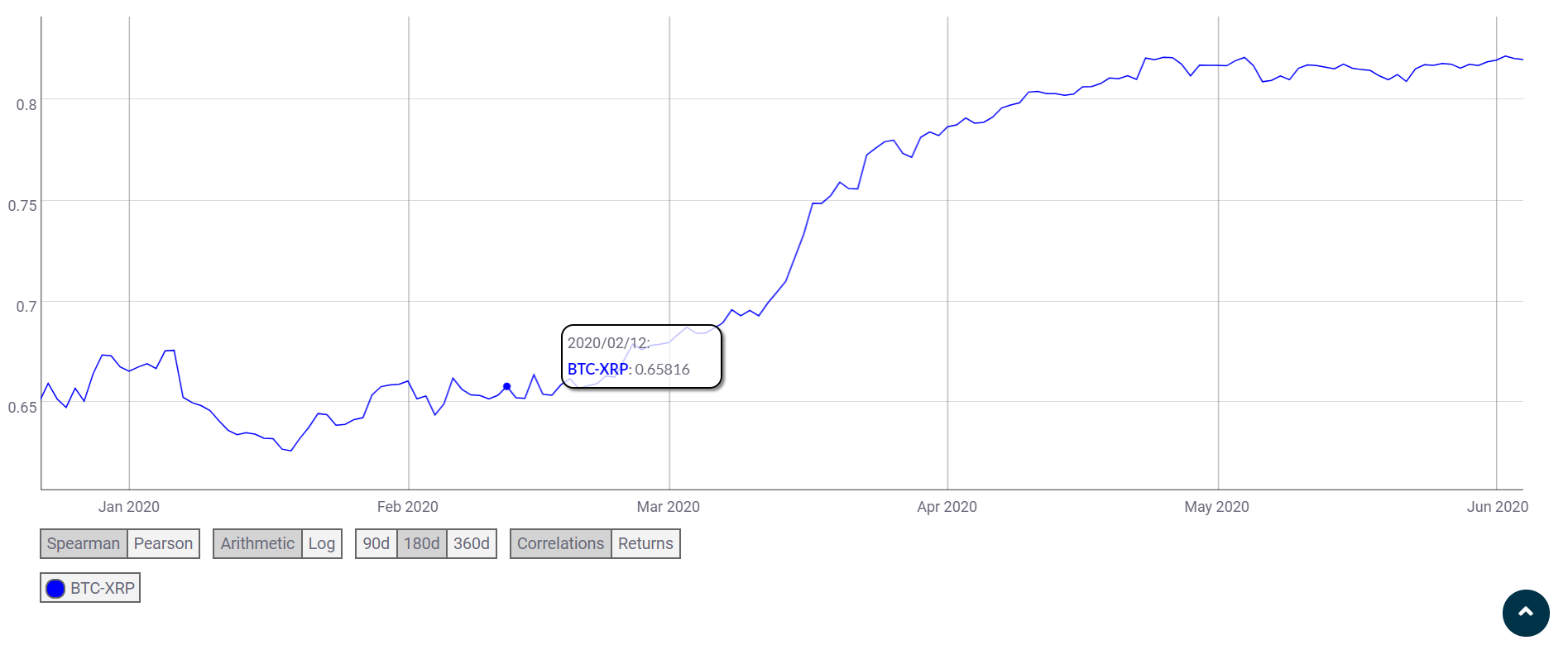

Source: Coinmetrics

However, it may not be that straightforward.

Coinmetrics’ correlation index between XRP and Bitcoin has rarely changed since April 10, 2020, and at the time of writing this article, the correlation index was 0.82.

For XRP to break away from Bitcoin, it would need to facilitate a steady price pump and not undergo strong corrections when the largest digital asset makes its move. Ethereum has managed well since the start of May, outperforming Bitcoin at certain intervals.

Now, it is important to note that XRP and Ether’s functionality and general utilization are drastically different, hence it is more difficult for XRP to break away. Hence, it will be interesting to observe XRP’s movement over the next few weeks to witness whether the social volume fizzles or whether the asset is able to take advantage.