Altcoins

XRP, ETH, and other altcoins show surprising deviation from Metcalfe’s law

Popular altcoins like ETH, XRP, and TRX were seen following the footsteps of BTC as they mirrored BTC’s surge and drop. Bitcoin, with a market cap of $207 billion, is the largest cryptocurrency and the on-chain activities of the coin like transaction volume, active addresses, number of transactions, etc. have been influencing the growth of the coin’s market capitalization.

Market cap of altcoins is fairly lower than that of Bitcoin and crypto company Messari shared a cross-sectional study in an attempt to examine the correlation between the market cap of altcoins and its on-chain metrics.

Contrary to the time series analysis (which studies the advancements of one asset over different intervals of time), Messari used cross-sectional studies to determine the required data with multiple assets, at one point in time.

The research considered three on-chain activities to determine if there was a positive correlation between the market cap of altcoins and the latter.

Source: Messari

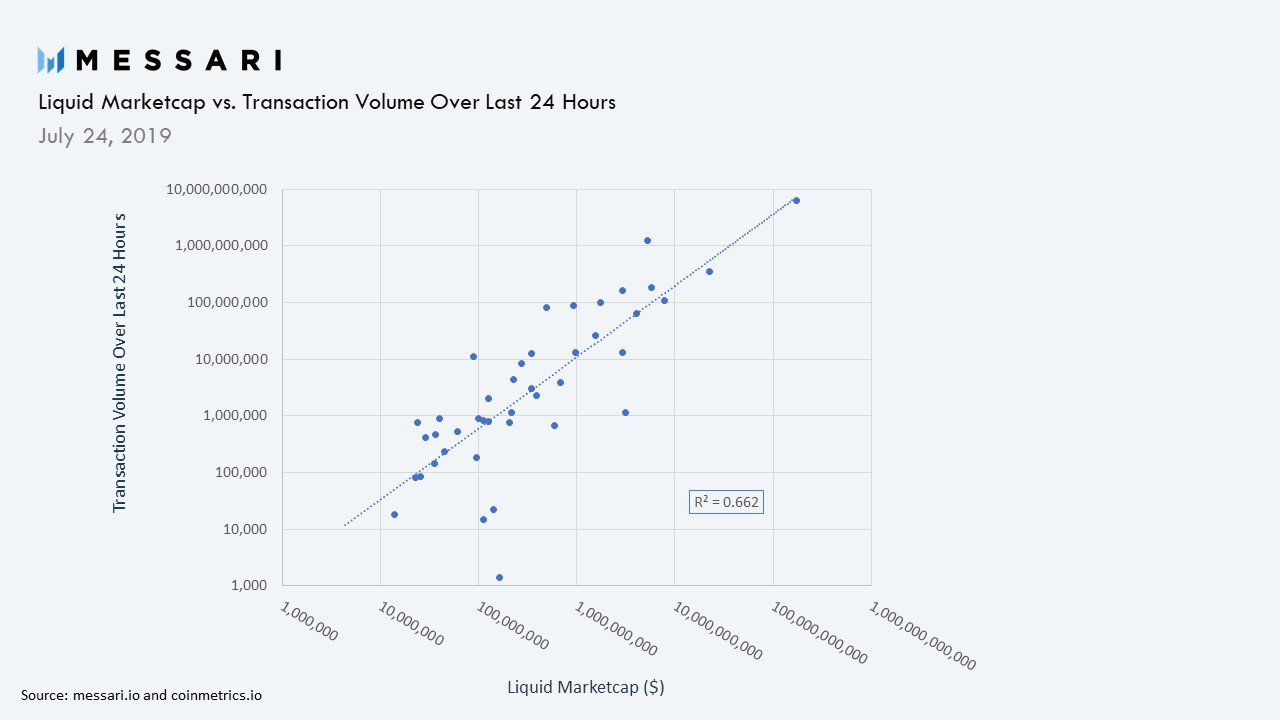

The above image displays the best fit line between transaction volume and liquid market cap where each dot in the graph represents crypto assets. Moreover, the graph also paints a brief picture of transaction volume in the last 24 hours in relation to its liquid market cap. Simply put, it can be inferred from the graph that the altcoin with the highest market cap had the highest transaction volume, but this is not set in stone.

Additionally, the second graph depicts the relationship between the active addresses of the altcoins and liquid market cap in 24-hours. As expected, a trend similar to the first graph can be seen here.

Source: Messari

The last graph also revealed a similar trend as the liquid market cap of the altcoins was the highest when the number of transactions was the highest.

Source: Messari

While the findings were in line with the expected result, it defies the famous Metcalfe’s Law, which suggests that the strength of the network is proportional to the square of the users. In this case, the relationship between crypto-assets and market cap and on-chain metrics was found to be linear.