XRP active addresses surge by 178% as alts lead the market

Bitcoin finally pushed past its $9k resistance this past week and the world’s largest cryptocurrency was trading at $9,277, at press time. However, there is growing evidence that Bitcoin is reacting to geopolitical events, according to the Coin Metrics’ latest report. The report added,

“Adjusted transfer value increased by at least 20% for all five cryptoassets in our sample, outpacing the increases in market cap. Bitcoin Cash’s (BCH) adjusted transfer value is relatively even with Ethereum’s (ETH) — over the past week, BCH had a daily average of $217M adjusted transfer value while ETH had $234M.”

Further, Bitcoin‘s transfer value dwarfed Ethereum and Bitcoin Cash’s with a daily average of $11.9 billion.

The market ended the week on a strong note, however, the growth of the CMBI Bitcoin Index was the weakest of all other indexes. According to the aforementioned report, the Bitcoin index reported returns of 9%. However, small-cap assets are leading to the growth of the entire market.

The report also noted that Bletchley 40 assets noted a 16% surge, while MonaCoin, ZCoin, and BitShares posted returns of over 50%. Additionally, Siacoin, Zilliqa, and Nano registered returns of 20% to its users too.

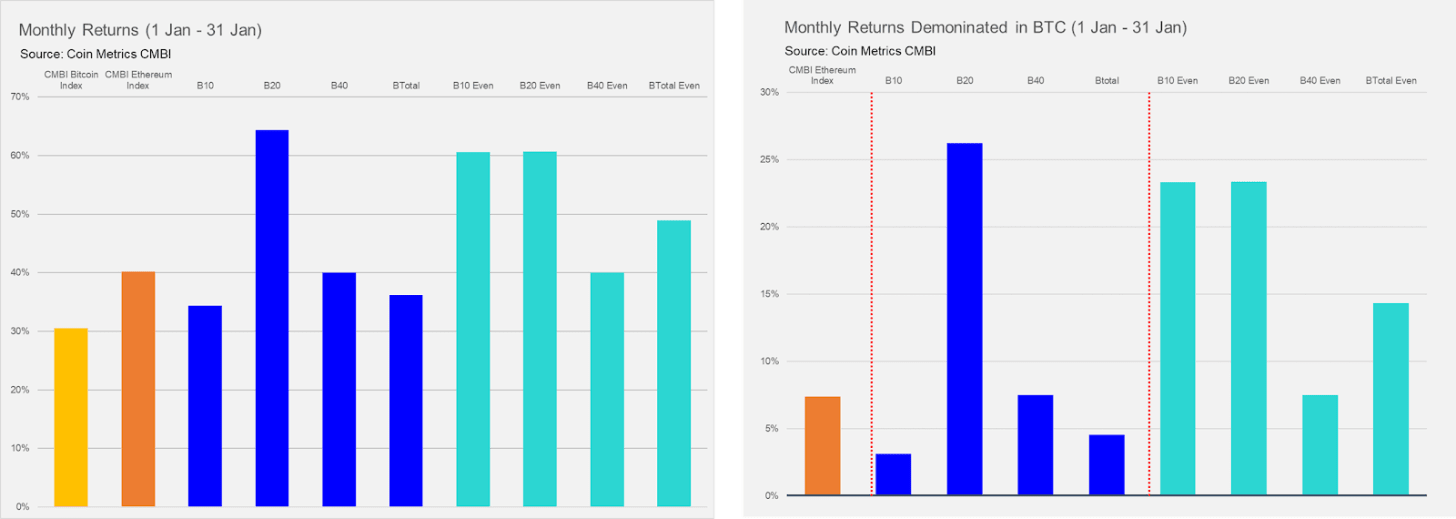

The week was, in fact, an extension of an eventful month the crypto-market has had. Crypto-assets have been largely positive and the Bletchley 20 [mid-cap assets] were reported to be the best performers. The mid-cap assets returned 70% in a month, while large-cap and small-cap assets were tied with ~35% returns over the month.

Source: Coin Metrics

XRP’s active addresses noted a whopping rise of 178.2% over the week, followed by Litecoin’s minuscule 15.4%. XRP transfers also saw a 32.6% surge, with Bitcoin cash [BCH] noting a 13.8% increase.