Why Ethereum’s time to shine may be here

- ETH may hit $2,100 if buying pressure continues.

- Many transactions ended in profit in the last 24 hours.

Unlike other altcoins, Ethereum’s [ETH] price action failed to break out for a while. During that time, as recently as the 18th of November, ETH was swinging between $1,915 and $2,000. But in a swift move on the 22nd of November, the coin tapped $,2,083.

However, technical indications revealed that ETH could be ready for more upside. JA Maartunn, an author at CryptoQuant, looked at ETH’s price action and observed that there has been some Time-Weighted Average Price (TWAP) buying in the derivative market.

Someone(s) are TWAP-buying on Ethereum futures

This linear growth in open interest indicates systematic buying over a certain period. There is $700 million added so far. pic.twitter.com/GCXK8u5yLL

— Maartunn (@JA_Maartun) November 22, 2023

Little by little, ETH moons

From the post above, Maartunn noted that over $700 million had entered the Ethereum market through TWAP. The TWAP strategy is used to minimize the impact of a large order on a cryptocurrency’s value.

So, to reduce the impact, the order is broken down into smaller quantities. So, it is likely that some buy orders played a part in ETH’s resurgence.

Another indicator AMBCrypto considered while assessing ETH’s potential is the Open Interest. The Open Interest shows the number of outstanding futures contracts at the end of a trading day.

According to data derived by AMBCrypto via Coinglass, ETH’s Open Interest had increased. When this indicator increases at a time when the price is also increasing, it means there is a strong case for a further hike.

More gains on the way for holders?

Should Open Interest resist a decline, ETH could be on its way to reclaiming $2,100. In the interim, holders of the altcoin seem satisfied with its recent performance.

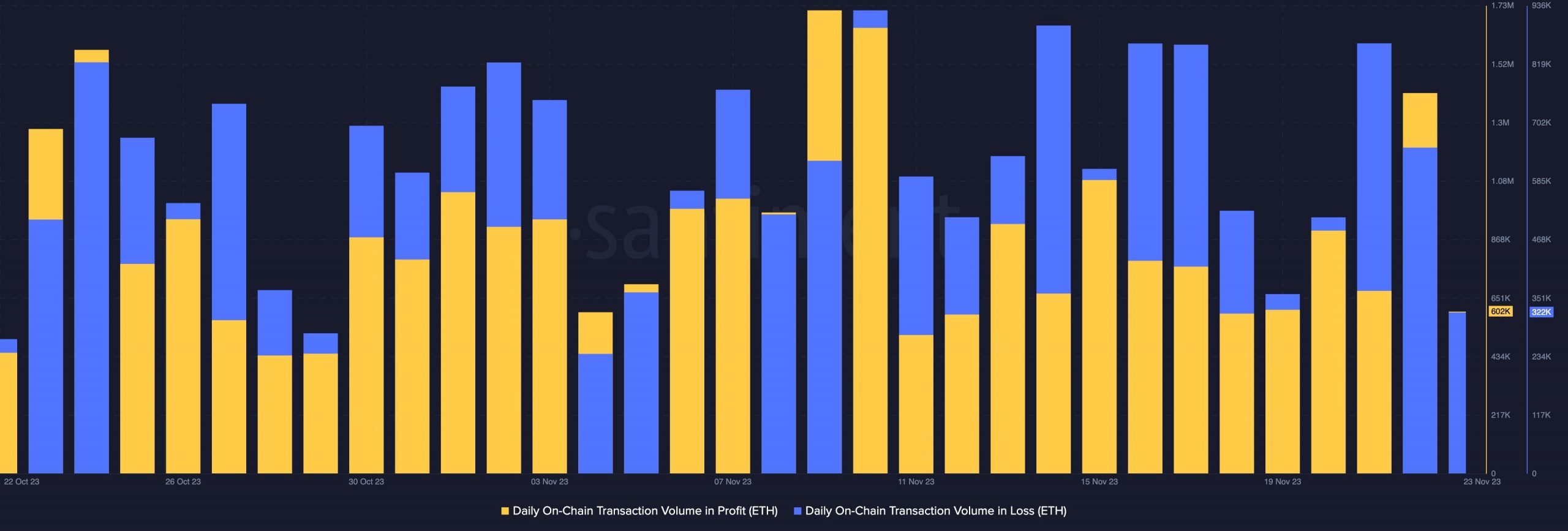

This was shown by the daily on-chain transaction in profit, and compared with those in the red.

At the time of writing, the daily on-chain transaction volume in profit on the Ethereum network was 602,000. Those transactions in losses were 322,000.

This difference is a sign that most market players have received gains.

The Exponential Moving Average (EMA) backed the notion that ETH’s upward momentum was alive. At press time, the 20 EMA (blue) had crossed over the 50 EMA (yellow). This crossover indicates that the trend is bullish.

How much are 1,10,100 ETHs worth today?

So, traders may be looking to long/buy Ethereum for the intermediate term. The Moving Average Convergence Divergence (MACD) also supported the bullish bias. This was because the MACD had a positive value of 6.74.

This value can be used to signal an increasing upward moment. Therefore, traders looking to short ETH should take a break or watch the price action till the movement changes.

![Ethereum [ETH] Open Interest](https://engamb.b-cdn.net/wp-content/uploads/2023/11/Screenshot-2023-11-23-at-12.29.40.png)