How can Bitcoin investors take advantage of present market conditions?

The Bitcoin market seemed to be consolidating again, following the trend it last witnessed back in June-July 2020. Generally, long-term investors consider the interpretation of the market as noise, but for derivatives traders, this could be the time to pay attention as contracts roll and Options expire.

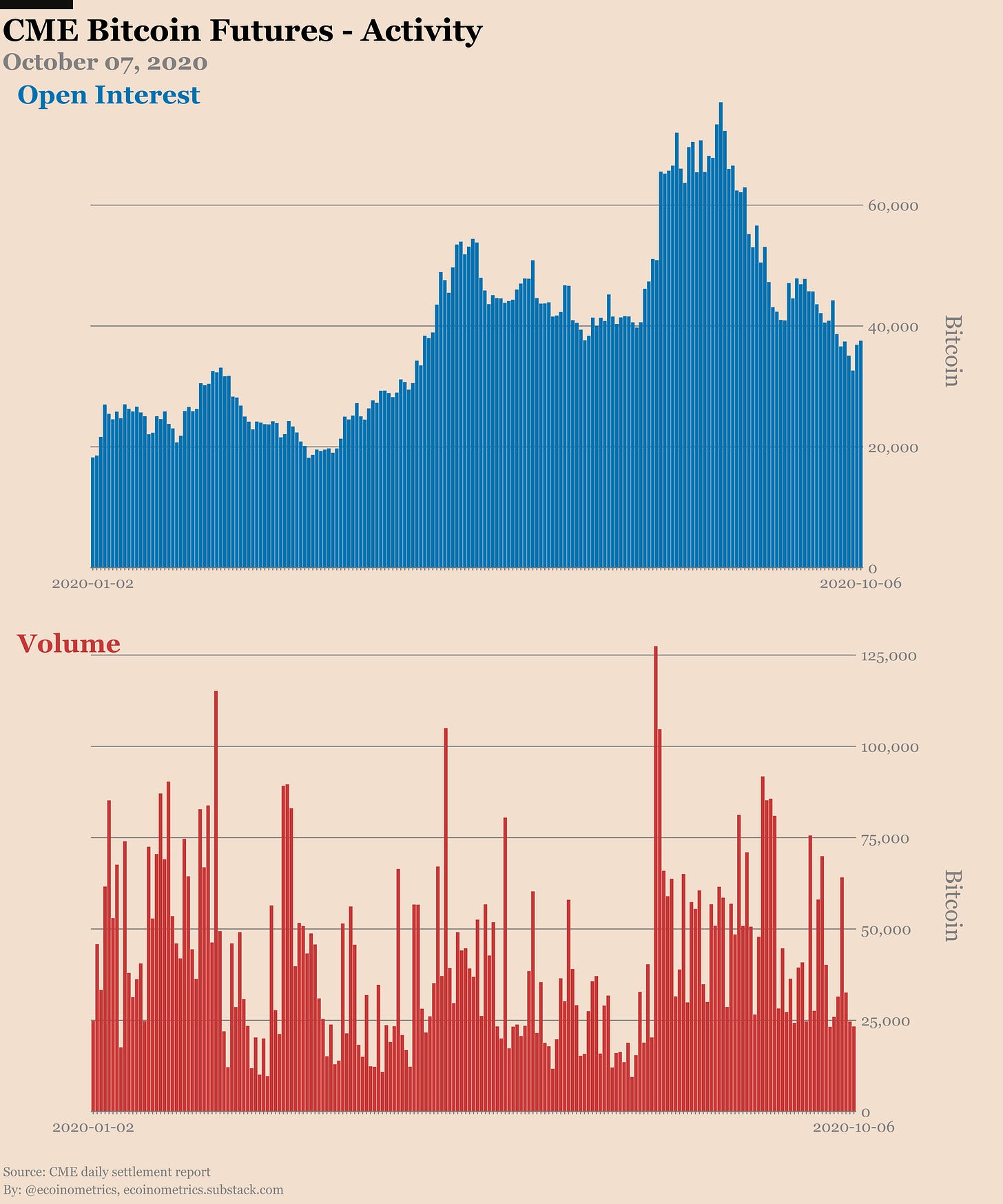

The Chicago Mercantile Exchange was in the news recently after the Open Interest climbed to an ATH of more than 70,000 BTC on CME BTC Futures. However, since the same, the said OI has been moving lower and lower, with the same soon noting a value of under 40,000 BTC.

Source: Ecoinometrics

Even though a similar trading sequence was seen in the Bitcoin market back in June-July, there seemed to be fewer open positions than before the breakout above $10,000. With trading activities dropping, derivatives traders seem to be exiting the game as they have been unable to gain profit in a dull market.

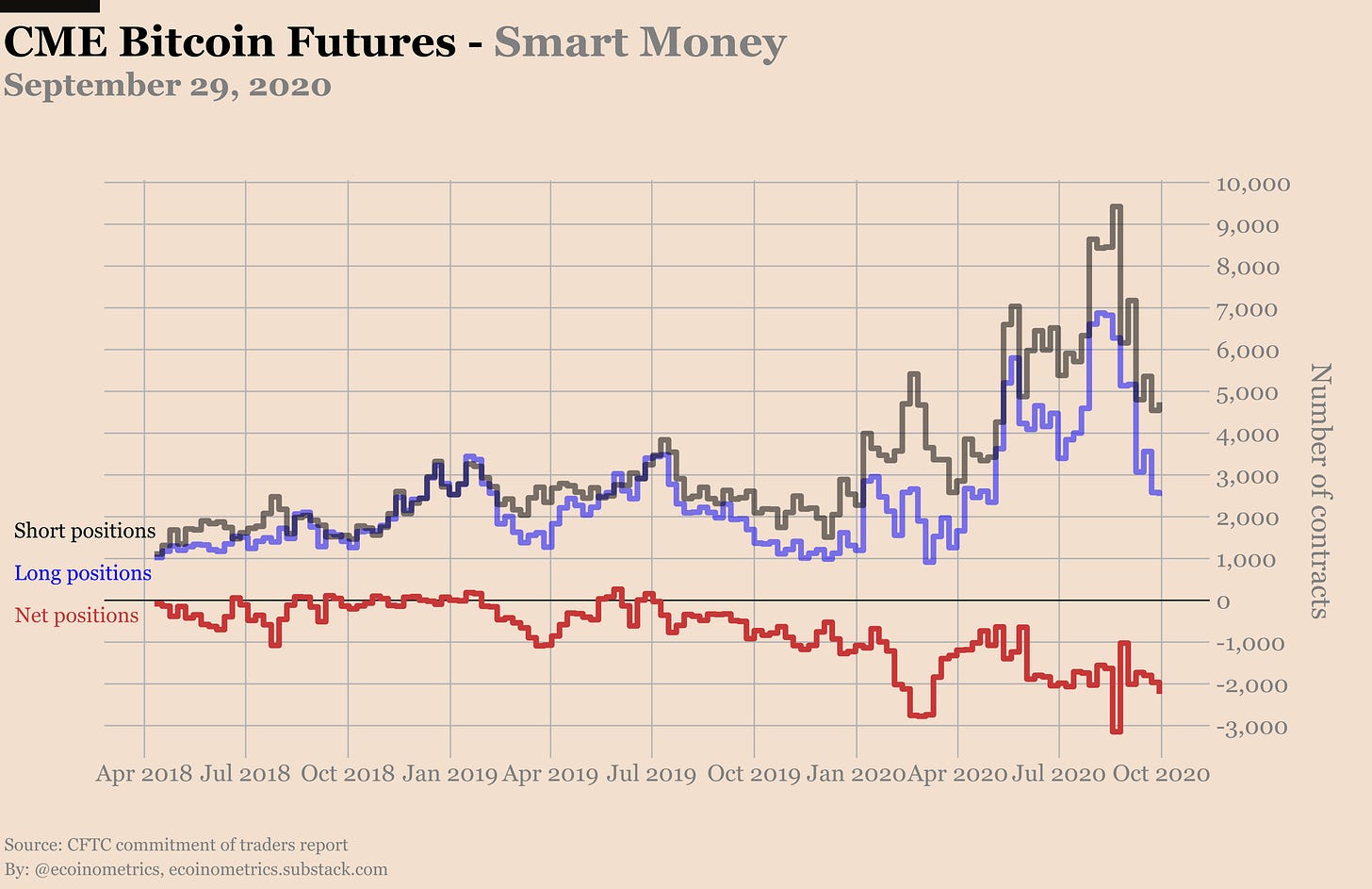

Although there are various tricks and trades in a market, depending on the expectations of the participants, the present-day market has cooled down and arbitrage opportunities have only gotten smaller, contributing to premium farmers de-leveraging. According to Ecoinometrics’ insight on the latest Commitment of Traders report, the traders who un-ironically shorted Bitcoin Futures at $12,000 are now closing positions to take profit as $10,000 has been established as a strong support level on the charts.

Source: Ecoinometrics

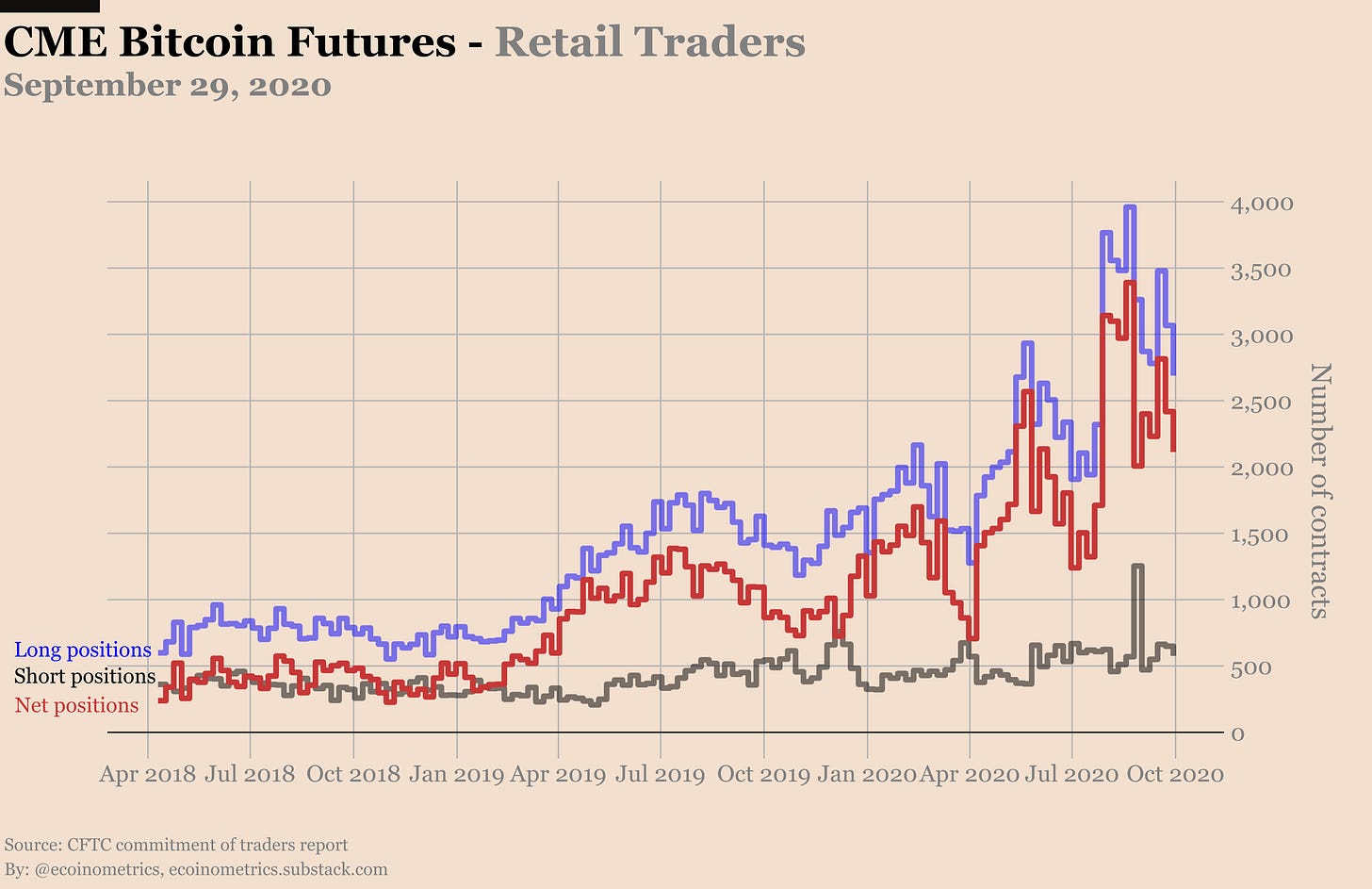

In fact, Smart Money seems to be de-leveraging on the long and short side, while retail investors are also following the trend.

Source: Ecoinometrics

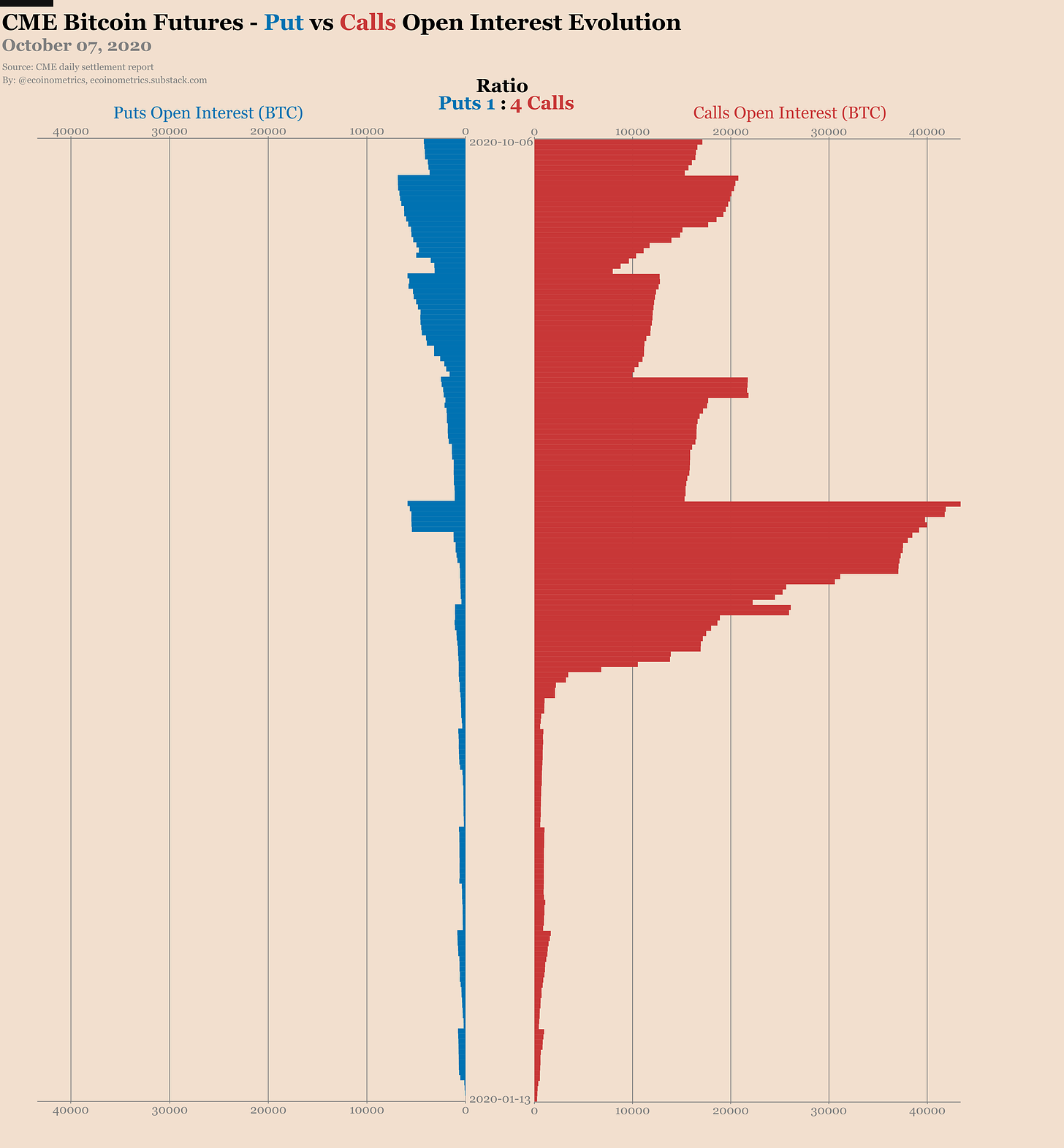

In fact, the CME Bitcoin Options market has been witnessing the end of large bull call spreads. These large bets involved hundreds of contracts with price targets 20% and 30% above the money. However, as the market lost its heat, big bets started leaving the market, without being paid off.

The aforementioned report by Ecoinometrics noted that,

“There are still 4 calls for every 1 put. You can’t call that bearish.”

Source: Ecoinometrics

While the overall sentiment of Options traders did not anticipate a market crash, these trends can change within minutes, especially since uncertainty has been the norm of the crypto-market for a while now. Ergo, the present market may be dull for long-term hodlers, but professional investors can take advantage of the CME Futures and Options market to make money, especially if a majority of the market follows the trend.