VanEck exec suggests avoiding large orders due to ‘evaporating BTC liquidity’

Volatility in the crypto-industry is at its peak, at the moment. The collective industry is witnessing turbulent price swings, with the market continuing to suffer from a bearish outbreak. In fact, Bitcoin registered its 6-month low after the coin plunged down to $6600 following the market’s recent crash.

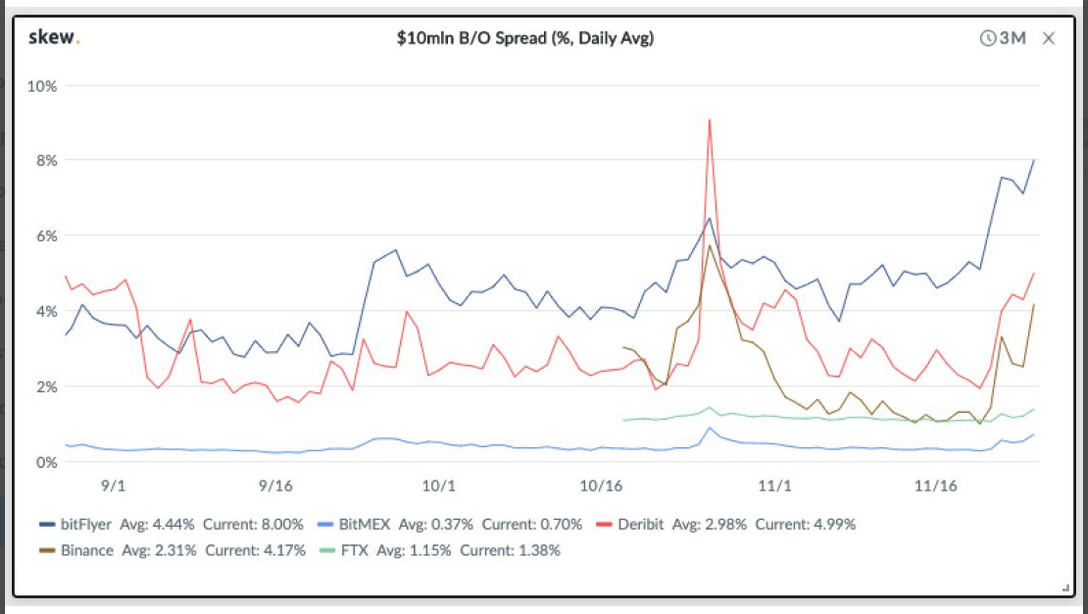

According to skew markets, due to the price slump, Bitcoin’s liquidity is drying up in the industry.

Source: Twitter

Gabor Gurbacs, a digital asset strategist at VanEck, suggested that Bitcoin’s liquidity is evaporating in the industry due to the sharp widening of the bid-offer spread on the $10 million market trade. The chart suggested that the spread has been the most significant over the past 3 months, which again, indicated the presence of extreme volatility.

Gurbacs also opined that under the current circumstances, the market can flip either way, which is a concern for investors buying into larger market orders. Hence, he suggested that it is better to avoid a larger buy/sell order in the industry.

Speaking about the $10 million Bid-Offer spread, the VanEck executive stated that certain market makers and OTC desks usually buy into such high orders since $10 million gets added up fast in terms of repetitive small trades, which would have a similar effect to a higher buy/sell order.

Additionally, Gurbacs mentioned that such wide B/O spreads were rare in the early days of crypto since liquidity was extremely low in the past. Before 2017, the Bitcoin market was also relatively smaller, which translated to lower liquidity.

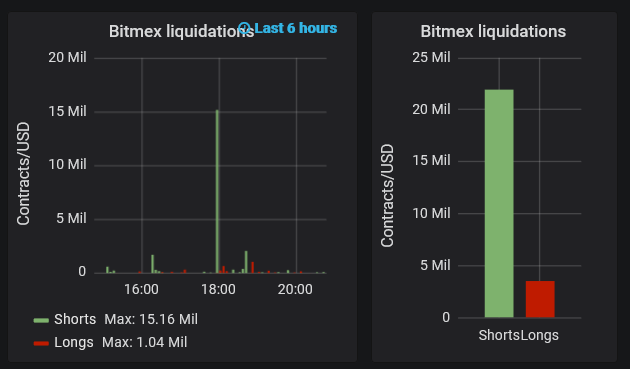

Source: datamish

With respect to liquidation, BitMEX registered 21.93 million in Bitcoin shorts, which suggested that traders are exiting the market to re-enter at lower price point. However, volatility was extremely high at press time, and this could turn the market either way in the near future.