Uniswap to expand DEX accessibility? What you should know

- Uniswap has announced the final launch of the Android version of its mobile wallet app.

- UNI continued to enjoy market-wide accumulation.

Leading decentralized exchange (DEX) Uniswap [UNI] has launched its Android mobile wallet app, bringing its built-in swap capability to Android users worldwide.

Say hello to Uniswap on Android. pic.twitter.com/AmybYVhZWa

— Uniswap Labs ? (@Uniswap) November 14, 2023

This release comes a few months after the platform announced a closed beta for the same and the release of an iOS version.

In the beta announcement made in April, Uniswap noted that the wallet app would allow its users to swap tokens on multiple chains without switching networks. This included Ethereum [ETH], Polygon [MATIC], Optimism [OP], Arbitrum [ARB], Base, and BNBChain [BNB].

Also, the wallet app can automatically detect which network a coin is on and switch to that network without the user prompting it.

Uniswap since the mobile wallet app went live

Uniswap users completed the majority of their transactions through a web-based application prior to the launch of the iOS version of the mobile wallet in April.

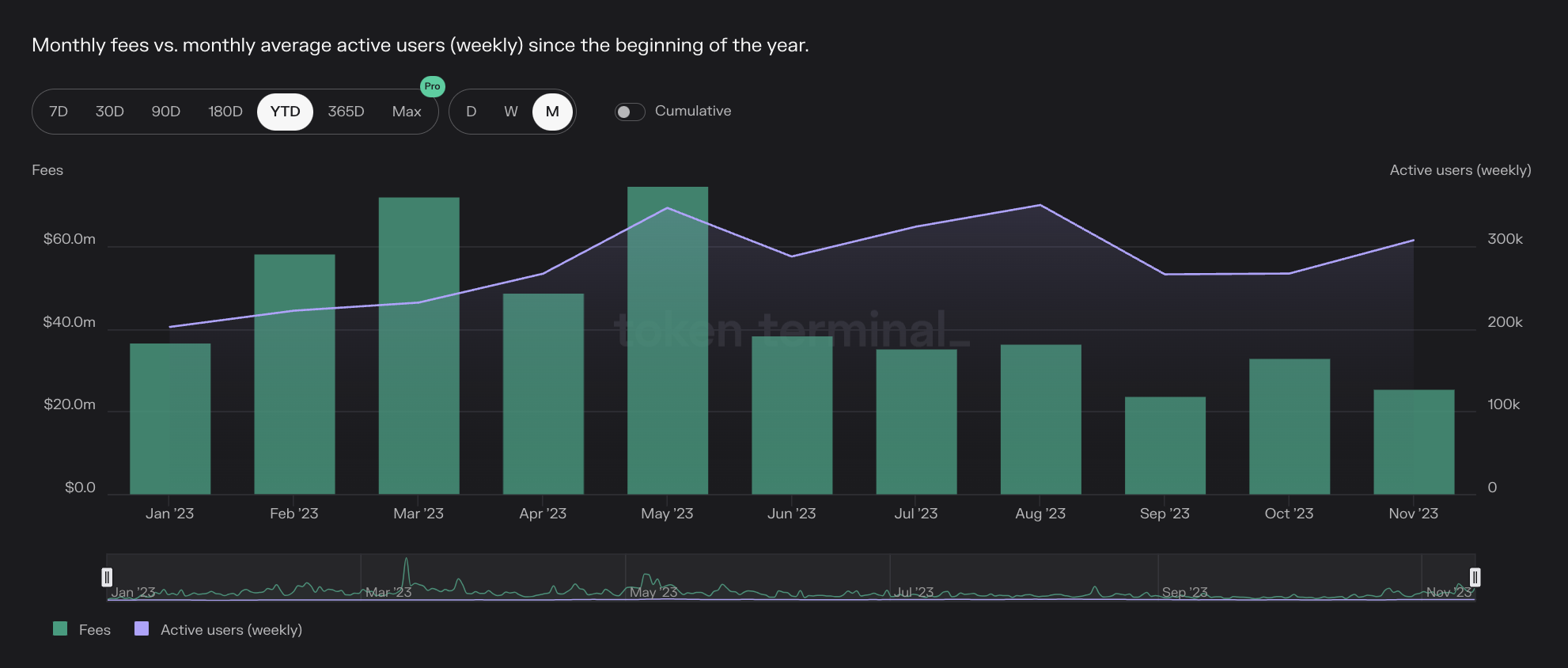

Following this release in April, Uniswap witnessed a notable surge in demand. According to data obtained from Token Terminal, the DEX saw its monthly active user count rally by 31% between April and August.

However, this demand lost momentum in September, when Uniswap recorded a 24% month-over-month decline in active user count. Even after the closed beta for the Android version of the mobile wallet app was announced in October, Uniswap saw a mere 0.377% in monthly demand.

So far this month, Token Terminal data reveals that DEX has amassed a total of 307,000 active users, signifying a 15% increase from October’s count—a growth achieved within a mere two weeks.

Regarding Uniswap’s transaction fees, AMBCrypto noted that following a brief rally in May, it has since trended downward. The protocol’s network fees totaled $33 million in October, registering a 55% decline from the $74 million recorded in transaction fees in May.

Realistic or not, here’s UNI’s market cap in ETH’s terms

The bulls have kept UNI bears at bay

AMBCrypto further found that at press time, UNI exchanged hands at $5.22, according to data from CoinMarketCap. An assessment of the token’s price performance on a 24-hour chart confirmed that the bulls have continued to sustain the buying momentum.

Moreover, UNI’s Relative Strength Index (RSI) was 62.92, while its Money Flow Index (MFI) was 63.70. Likewise, its Chaikin Money Flow (CMF) at 0.27 reflected the steady inflow of liquidity into the UNI spot market.