Bitcoin whales lead the way as market dynamics shift

- Bitcoin whale wallet addresses have been seeing a decline in numbers.

- The price of BTC has declined by over 4% in the past few days.

The rise in Bitcoin’s [BTC] prices brought varying levels of enthusiasm for holders. For large investors, the excitement manifested in selling off their holdings.

Bitcoin whales commence sell-offs

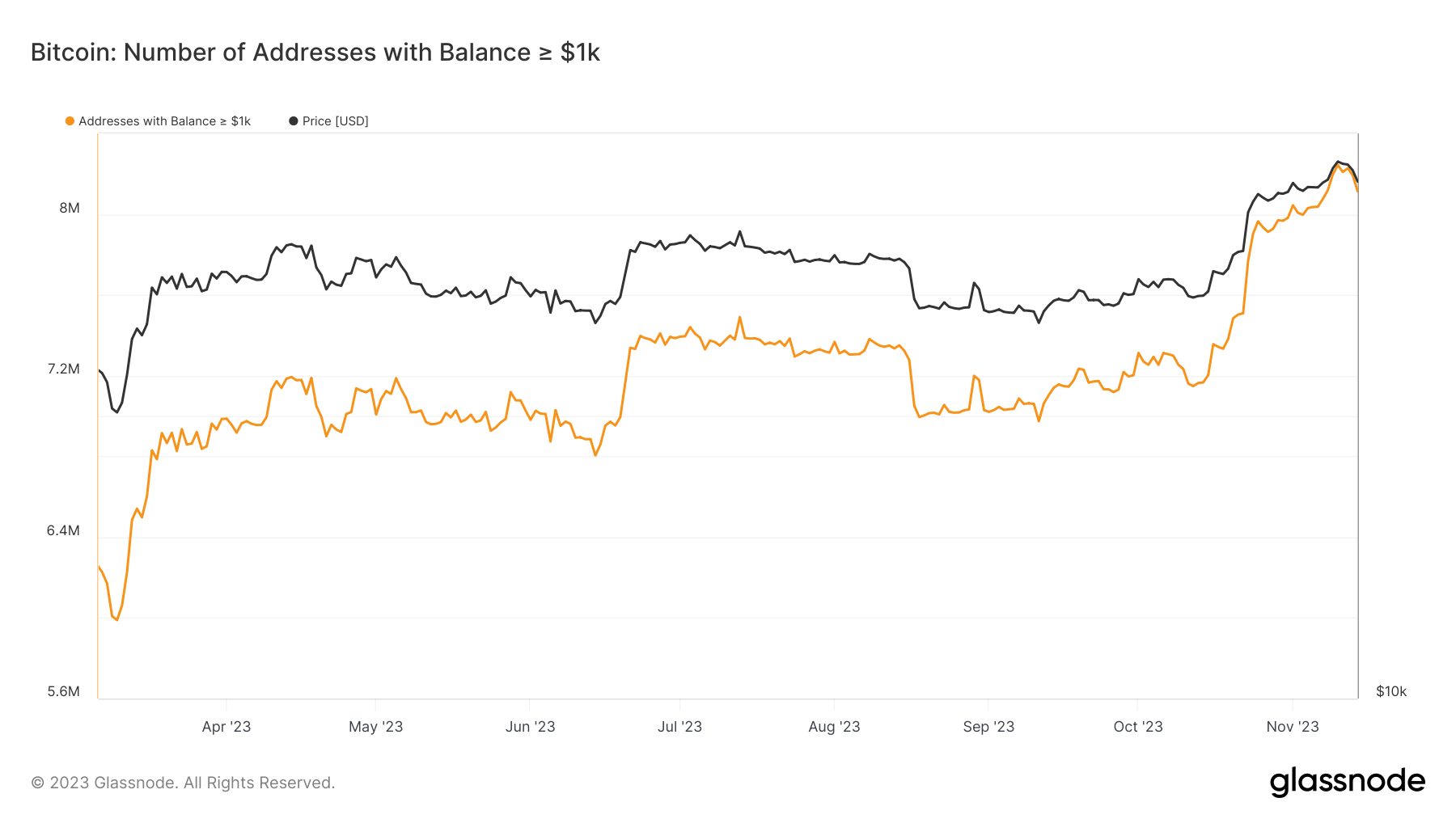

AMBCrypto’s examination of Bitcoin wallet addresses on Glassnode revealed a notable decline. Notably, the analysis of wallet addresses holding 100, 1,000, and 10,000 BTCs indicated a decrease.

For wallets holding 100 BTCs or more, there was an upward trend until around the 9th of November, with around 16,194 wallets. Subsequently, a decline commenced, and at the time of this report, the number stood at around 16,125.

A similar pattern was observed in addresses holding 1,000 or more BTCs. Initially increasing to over 8.2 million, the number has now decreased to around 6.1 million. Additionally, wallets containing 10,000 or more BTCs peaked at over 2.4 million before experiencing a decline.

AMBCrypto’s analysis also revealed a reduction of over 62,000 wallets in this category. This decline suggested that whales had started to divest after a period of accumulation.

Gains for 30-day and 60-day holders

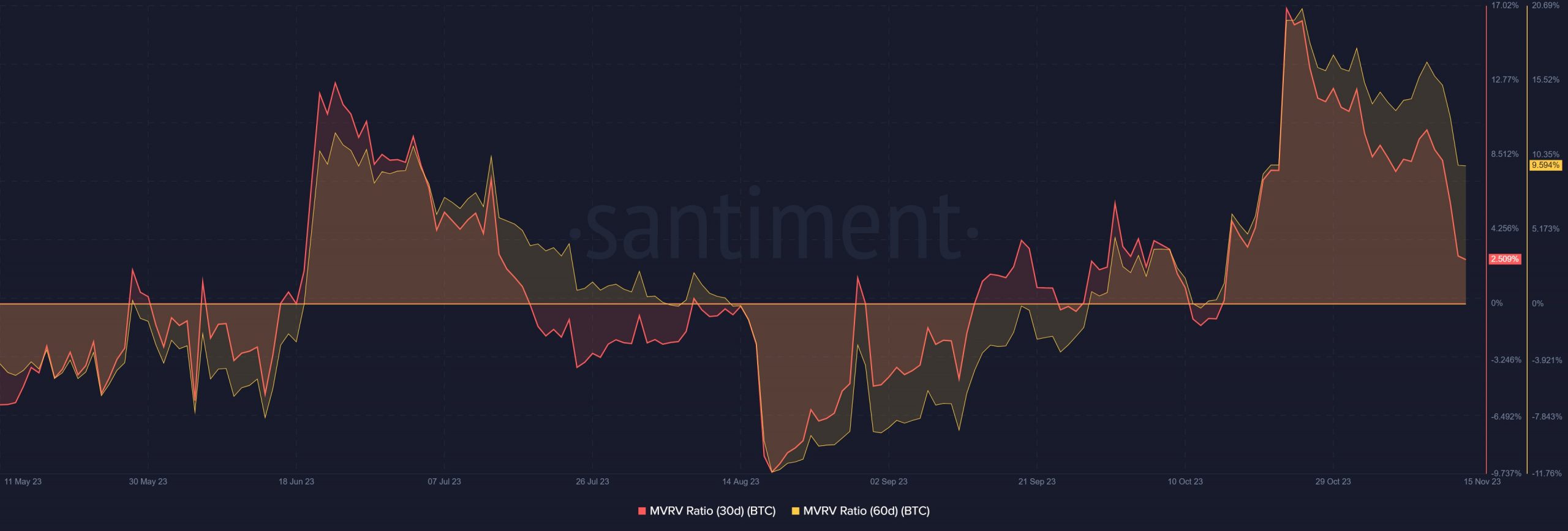

In addition, AMBCrypto’s assessment of the 30-day and 60-day Market Value to Realized Value Ratio (MVRV) for Bitcoin on Santiment indicated a downturn. The charts revealed that the peak of profitability for holders during these periods occurred in October.

Around the 23rd of October, the 30-day MVRV showcased a profit exceeding 16%, while the 60-day MVRV peaked at over 20% around the 25th of October. However, both MVRVs have witnessed declines in recent days.

Also, at the time of this analysis, the 30-day MVRV stood at approximately 2.4%, and the 60-day MVRV was around 9.5%. The shift in MVRV suggested a significant decrease in profits for holders.

This decline may offer an explanation for the observed trend of whales divesting their holdings and the reduction in the number of wallet addresses.

Bitcoin catches a slight break

AMBCrypto’s analysis of Bitcoin’s daily price trend indicated a recent downtrend. The chart revealed a loss exceeding 4% in the past few days, causing the price to fall below the recently achieved $36,000 range.

Is your portfolio green? Check out the BTC Profit Calculator

At press time, Bitcoin was trading at approximately $35,700, showing a less than 1% increase in price. The recent price decline has led to the Relative Strength Index (RSI) moving out of the oversold zone and standing at around 65 at the time of the report.

Additionally, considering the RSI trend, the ongoing decline may signify a price correction, potentially paving the way for another uptrend in the near future. If a price correction unfolds, there could be a resurgence in whale accumulation.