Tether’s dominance may be getting undercut by crypto-collateralized stablecoins

Behind the rollercoaster-like price fluctuations of cryptocurrencies, there exists another class of coins that promises to offer price stability. Stablecoins attempt to bring in the best of both fiat, as well crypto, and over the past few years, they have gained massive traction, primarily because it is a major source of liquidity in the cryptocurrency market.

Unlike cryptocurrencies, the value of a stablecoin is pegged to a stable real-world asset that can range from commodities to fiat, held in reserve by the stablecoin issuer, bringing in centralization factor to the game. Meaning, there has to be a central authority holding and monitoring the backing of such crypto-assets.

This goes against the very ethos of cryptocurrencies. Along the same lines, Wiess Crypto Ratings’ latest tweet read,

“There’s a big problem with the 1st generation of #stablecoins: Users have to trust a central authority to hold sufficient dollar balances to back the coins they issued.”

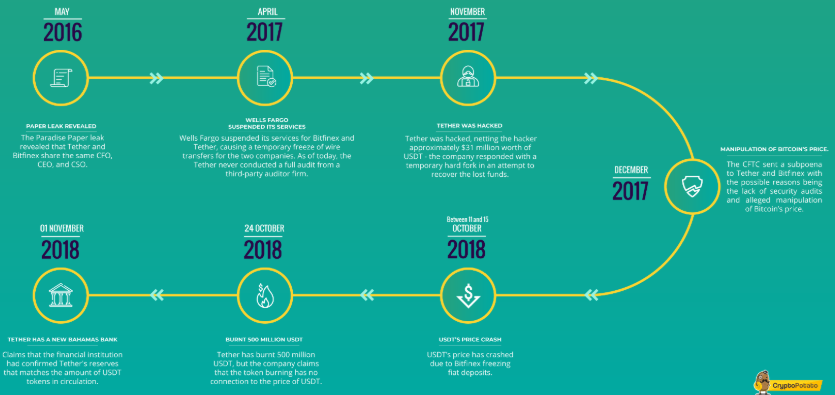

Tether is unarguably the biggest stablecoin in the realm. Tether, with a market cap of $4.46 billion, holds a dominance of 11.7% over the entire cryptocurrency market. But in less than four years of its inception, USDT has garnered significant bad press. with numerous scandals and issues under its name.

Speculations alleging Tether manipulated Bitcoin’s price were the most damaging for the space. To top that, last years’ Bitfinex-Tether fiasco has only added to the woes.

Source: CryptoPotato | Tether’s History of scandals

Even policymakers are not a big fan of stablecoins, with numerous papers published on how this sector can threaten the monetary systems. Grant Baker, Chief Innovation Officer at STAE and author of the 2019 Blockchain Compliance Paper, was quoted as saying,

“While stablecoins provide shelter for cryptocurrency investors during times of turbulence, they haven’t seen much usage elsewhere. We anticipate this will change when Singapore begins issuing licenses and regulating stablecoin issuers this year. Decentralized stablecoins will likely be a very practical application of blockchain and that’s what we’re focusing on.”

However, even as the crypto-space continues to evolve, dethroning the largest stablecoin by market cap is be a tough job. Nevertheless, there is a growing breed of stablecoins that has made its presence known over the last couple of months.

The rise of crypto-collateralized stablecoins

The most appealing factor is the decentralized notion of this breed. While most popular stablecoins like USDT, USDC, PAX, Gemini Dollar are all fiat collateralized stablecoins, ie., backed by legal tender, crypto-collateralized stablecoins are trustless in nature. They are linked to the reserves of other cryptocurrencies.

Without a central authority, the most prominent decentralized stablecoin is DAI. This stablecoin uses smart contracts on the Ethereum blockchain to manage the collateral and maintain order. Another token that has gained traction is Synthetix [$sUSD] and it allows the creation of on-chain synthetic assets on the Ethereum blockchain.

Its advantages include transparency, accountability, and efficiency [in using due to the quick process of liquidation into other cryptos],

But, everything has its own pros and cons. A recent blog by DeFi Rate explained the drawback of this emerging class of stablecoins,

“Where fiat-backed stablecoins only need to hold 1:1 reserves in legal tender, this subset of stablecoins often require over-collateralization to account for price volatility. Most commonly, this ratio is set at 150%, meaning that in order to issue $100 worth of $DAI, you will need to post AT LEAST $150 worth of $ETH as collateral.”

There is also a high volatility factor. Additionally, there also may be chances of instant liquidation, meaning, the underlying crypto can be instantaneously liquidated if its price falls below a certain threshold, which is a risky affair for investors.

That being said, the growing trend depicts a more mature crypto-space, despite mounting regulatory threats from agencies across the world.