Stablecoins’ ties to traditional finance – A problem for transparency?

Stablecoins have seen their importance in the crypto-market grow rather dramatically over the past year. For Tether, the world’s most popular stablecoin, the past few months have seen it surge past XRP to occupy the third position in terms of market capitalization. Tether’s growth since its launch in 2014 has enabled even greater adoption for the crypto-market. Used commonly as an on-ramp, accessibility to Tether and other stablecoins have greatly helped cryptocurrencies like Bitcoin have a more diversified userbase.

During a recent episode of the On the Brink podcast, Nate Maddrey, Senior Research Analyst at Coin Metrics, discussed issues surrounding stablecoins like Tether, the challenges associated with transparency, and whether on-chain data can help address this issue. Highlighting that the biggest accusation leveled against the likes of USDT pertains to the fact that it is not transparent when it comes to the quality of the collateral, Maddrey argued,

“In a way that’s kind of a holdover from the legacy systems, especially the transparent parts of Tether. It’s not the parts that are trackable on-chain it’s kind of the parts that are off-chain. It’s the reserves that are being held by Tether and the traditional banking system that are not as transparent.”

Source: Rise of Stablecoins, CoinMetrics/Bitstamp

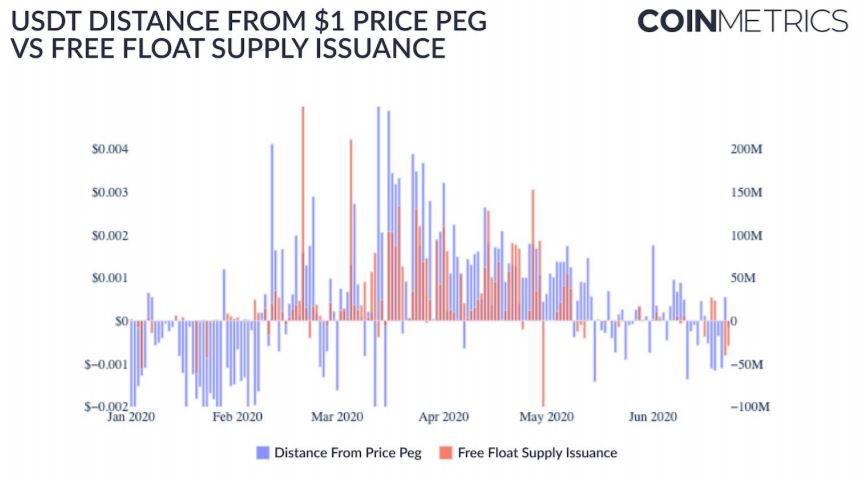

While this may be a concern associated with stablecoins for a while now, the past few years have registered tremendous growth for the stablecoin market within the larger cryptocurrency ecosystem. A recent report published by CoinMetrics highlighted this growth and surge in stablecoin supply. Maddrey noted that in the case of Tether’s free float supply,

“We can see exactly how many stablecoins are being printed. We have a new metric called free float supply….we can look at not only how many stablecoins have been issued, but how many stable clients are out and the open supply basically being held by the treasury.”

According to the report, the free float supply measures “the amount of supply freely available to the market, but excludes illiquid supply like supply held in escrow by a foundation. In the context of stablecoins, free float supply excludes coins that have been printed but not issued.”

However, despite such metrics coming to the aid and providing greater clarity, there still are challenges when it comes to making the ecosystem even more transparent, which is also of great benefit when it comes to audit-related purposes.

Maddrey went on to say that Tether being printed on several blockchains does help in its decentralization to a certain degree, adding that it also gives a layer of complexity against regulations that are designed to audit it. He noted,

“It’s spread out across a lot of different blockchains, which is really interesting. I think it’s the first major application that we’ve seen like this that really has its roots in multiple different blockchains which is good and bad.”