Stablecoins’ rising demand to attract increased regulation

Cryptocurrency markets have seen steady growth; increased regulatory clarity has enabled greater adoption. With growing uncertainty in the global markets, many have turned to crypto as a safe-haven asset for long-term investment. Along with these developments, it is also interesting to note 2020 has been a significant year for stablecoins in general. As adoption in crypto grows, demand for stablecoins has grown significantly.

Crypto investor and founder of crypto investing firm Three Arrows Capital – Su Zhu noted in a recent interview discussed the increased significance stablecoins such as Tether enjoy within the crypto ecosystem. Zhu highlighted USDT’s growing dominance in Asia and how it has cemented its position in comparison to other stablecoins.

Tether has played a very crucial role as an on-ramp for popular cryptocurrencies like Bitcoin. Interestingly as the price of Bitcoin crashed earlier in the year, demand for Tether skyrocketed with increasing premiums. Commenting on Tether’s growing significance within crypto and the regulatory response towards crypto, Zhu pointed out that,

“I think that’s because it’s doing a service to the whole world in sort of bridging the liquidity across all these exchanges and allowing on-ramp off-ramp, I think being in that position, it automatically attracts the attention of all regulators onto crypto itself.”

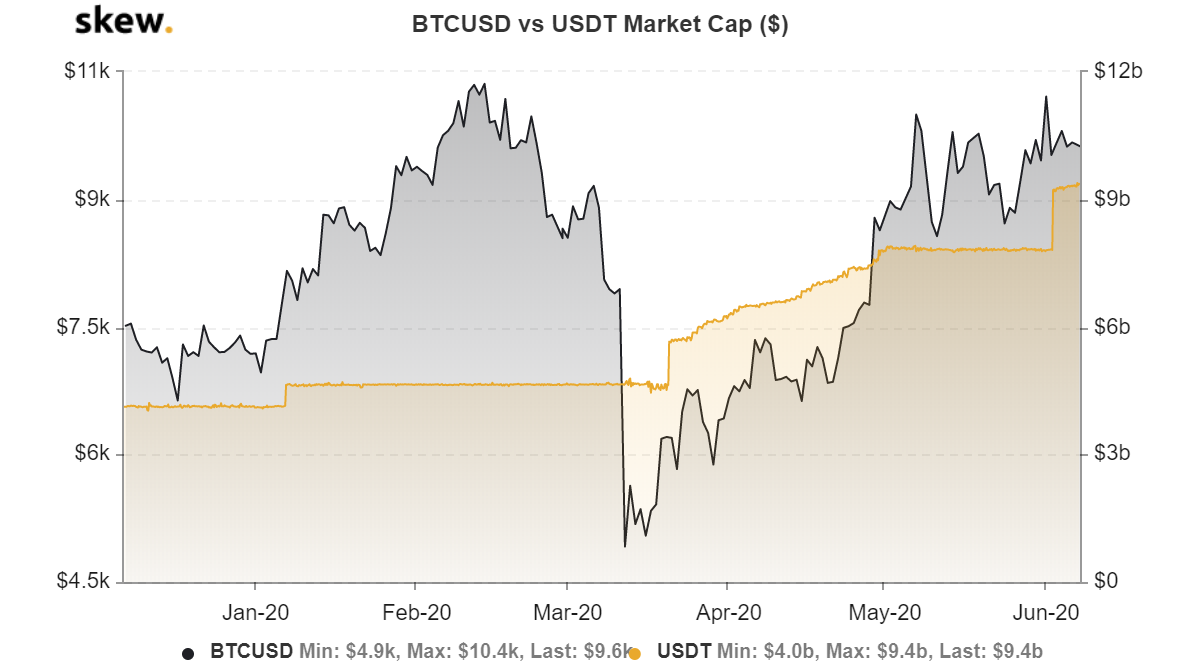

Source: skew

Market data from the past six months show how Tether’s market cap increased significantly and systematically in relation to Bitcoin’s price. Bitcoin’s crash on Black Thursday seems to have been added fuel to Tether’s increasing dominance.

Commenting on the growing demand for stablecoins, Zhu highlighted how stablecoins like USDT have a diverse portfolio of use cases in today’s economic environment, he noted,

“Its growth shows the global demand for stable coins. There is massive demand to start settling cross-border trades to start using it as money for a whole host of reasons…we use it to pay for things or to settle trades or for investments. Ultimately I think that kind of shows the power of that network effect.”

Co-founder of CoinMetrics – Nic Carter in a recently noted how the demand for stablecoins are not just a symptom of increased demand for assets like Bitcoin, instead, many users are looking at stablecoins as much more than an on-ramp and in many cases even as a store of value. He noted,

“Initially, I thought stablecoins were just for traders to move money around exchanges and retain them within the crypto industry. But it’s become clear to me in more recent months that stablecoins actually have a genuine usage here, even for non-traders, just for regular people.”