OKEx announces launch date for EOS/USDT Futures trading

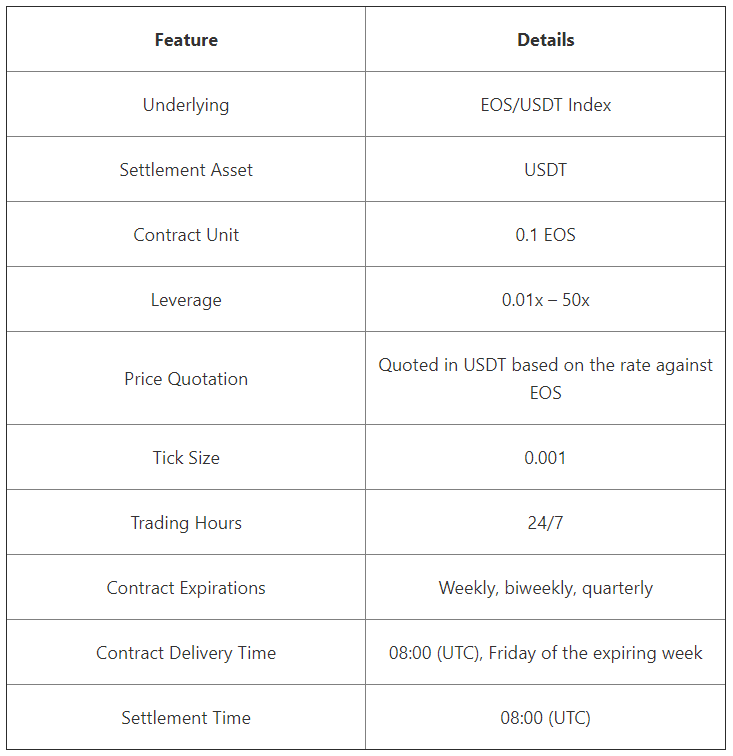

Cryptocurrency exchange OKEx has announced the launch of EOS/USDT Futures trading, a feature that is set to go live at 06:00 [UTC] on 2 December 2019. In an official blog post released by OKEx about the new offering, the Malta-based platform revealed leverage of 0.01x – 50x on the EOS/USDT Futures contracts on the OKEx Futures market. Other features include a contract unit of 0.1 EOS and a tick size of 0.001.

Source: OKEx | Support

OKEx launched Tether-margined Futures in the second week of November this year and after conducting a simulation that began on 5 November, the exchange listed the BTC/USDT offering on its trading platform.

Jay Hao, CEO of OKEx, had previously stated,

“The simulation of our USDT Futures Contract was very successful, and we received positive feedback from traders in the OKEx community. At OKEx, we’ve developed a safe, reliable, and stable environment for cryptocurrency trading, and strive to offer new services based on our customers’ interests. We’re excited to add USDT linear contract to our Futures market and next on the Perpetual Swap market to meet the interests of our growing international user base.”

Currently, USDT-margined Futures support the trading of Bitcoin [BTC] and Ethereum [ETH]. In addition to the aforementioned stablecoin-based derivatives contracts, the cryptocurrency exchange plans to launch other major cryptocurrencies such as Litecoin [LTC], Bitcoin Cash [BCH], Ripple [XRP], Ethereum Classic [ETC], Tron [TRX], and Bitcoin SV [BSV] on the USDT-margined Futures market soon.

Besides, Bitcoin’s high volatility has led to the Futures market picking up the pace. Intercontinental Exchange’s [ICE] Bakkt Bitcoin Futures trading has highlighted strong institutional interest in BTC. Additionally, leading crypto-exchange Binance’s Futures daily volume has also gained significant traction after it went live on 24 September, following its beta launch. In fact, Binance Futures’ trading volume soared over $1 billion for the first time.

According to Tokeninsight’s latest research on the cryptocurrency Futures industry, the trading volume of token Futures increased significantly from February to July 2019. Futures trading has increased since May, and the market-wide Futures trading volume increased from $104.5 billion in February to $412.7 billion in July, with a monthly average growth rate of 39% in half a year. The uptick in trading volume figures for crypto-futures was attributed to the positive market sentiment caused by the rapid surge in the value of Bitcoin since April 2019.