MakerDAO’s Spark Protocol moves ahead, but is it enough for MKR?

- MakerDAO’s Spark Protocol saw a lot of progress.

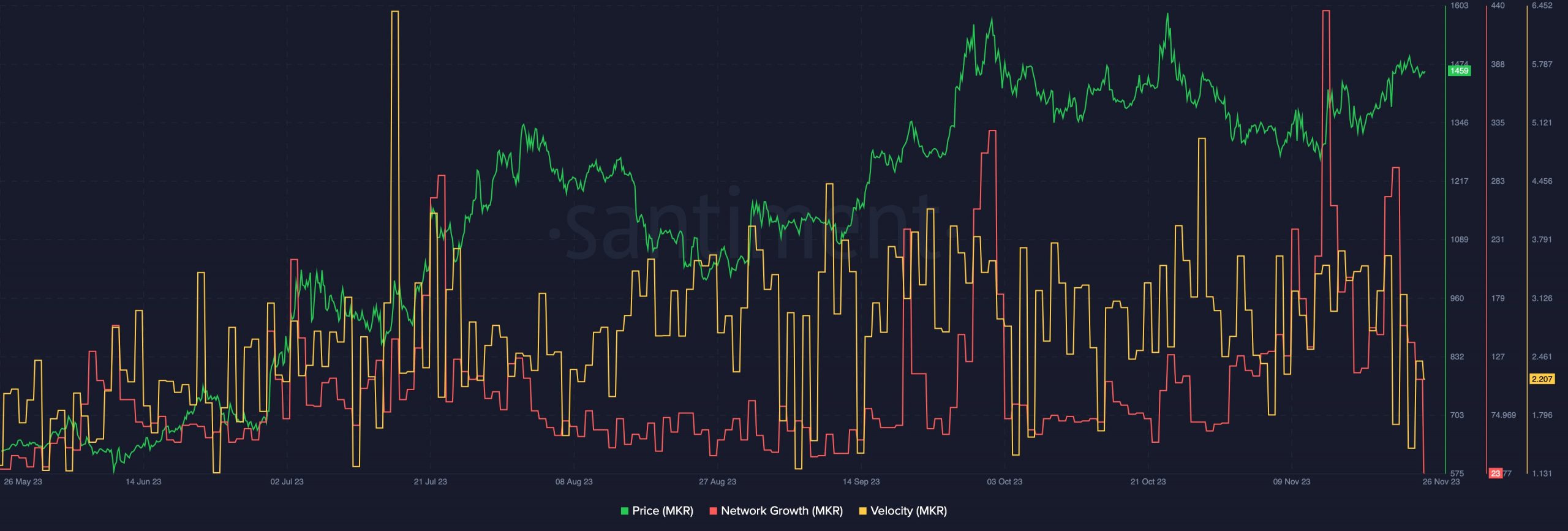

- The overall DAI supplied declined as MKR’s price fell.

Despite market uncertainty, the MakerDAO [MKR] protocol has continued to see growth. One of the many reasons for the growth of the protocol has been the success of its money market protocol.

Spark plays a key role

Spark Protocol is a money market protocol focused on DAI. It brings together liquidity from MakerDAO and integrates vertically with a leading DeFi protocol.

Recent data showed Spark Protocol leading the lending market, with over $629 million in active loans, making up about 10% of the lending market.

.@spark_protocol_ has been dominating the lending market over the past month.

Over $629M in active loans and ~10% of the lending market. ? pic.twitter.com/pU6z0LDBfi

— Emperor Osmo? (@Flowslikeosmo) November 26, 2023

Spark Protocol’s recent dominance in the lending market, especially with a focus on DAI, is likely to impact MakerDAO and DAI in notable ways.

With so many active loans, Spark commands about 10% of the lending market, potentially shifting dynamics in favor of alternative lending platforms. Users seeking diverse options may find Spark Protocol appealing due to its unique combination of liquidity sources.

DAI supply declines

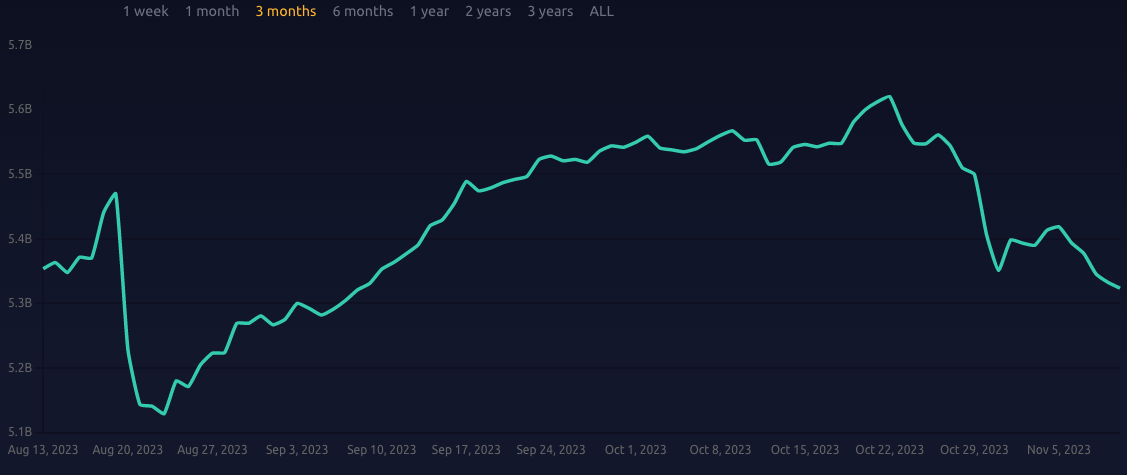

The DAI supply, which was around 5.6 billion in late October, dropped to about 5.3 billion as of press time. People seem to be moving away from holding balances in the DSR, possibly looking for better yields in other stablecoins.

What is the current state of legacy finance and crypto markets?

What @MakerDAO exposures are important to monitor?

This thread highlights key findings from the November edition @BlockAnalitica’s “Market Conditions and Competition Analysis” research product.

1/19

?⬇️ pic.twitter.com/oqTKCr9DUd

— Block Analitica (@BlockAnalitica) November 21, 2023

Some options include lending markets with higher rates and positions in perp and futures basis.

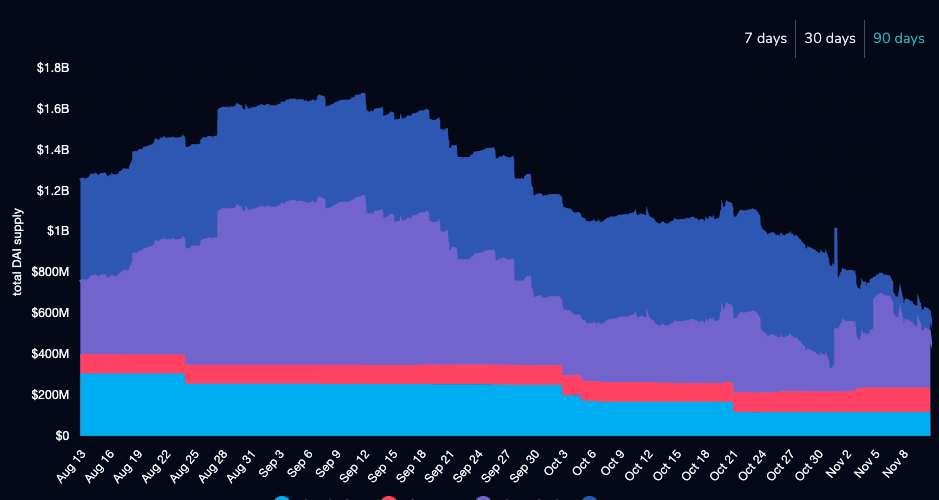

While ETH and wstETH vaults have been used steadily, there’s been an increase in total ETH debt due to more borrowing at Spark. WBTC core vaults have also grown from 76 million to 86 million in total DAI exposure.

With DAI supply decreasing and more people moving to volatile assets, the liquidity ratios for stablecoins are going down. PSM and Coinbase Custody balances now make up 11.4% of circulating DAI, down from 18.8% last month.

Is your portfolio green? Check out the MKR Profit Calculator

This could be a concern, and Maker might need to take action like adjusting borrowing rates or recalling funds if liquidity levels fall further.