MakerDAO: Weekly revenue exceeds 2021 bull market peak

- MakerDAO saw an uptick in weekly revenue.

- MKR continued to combat low demand.

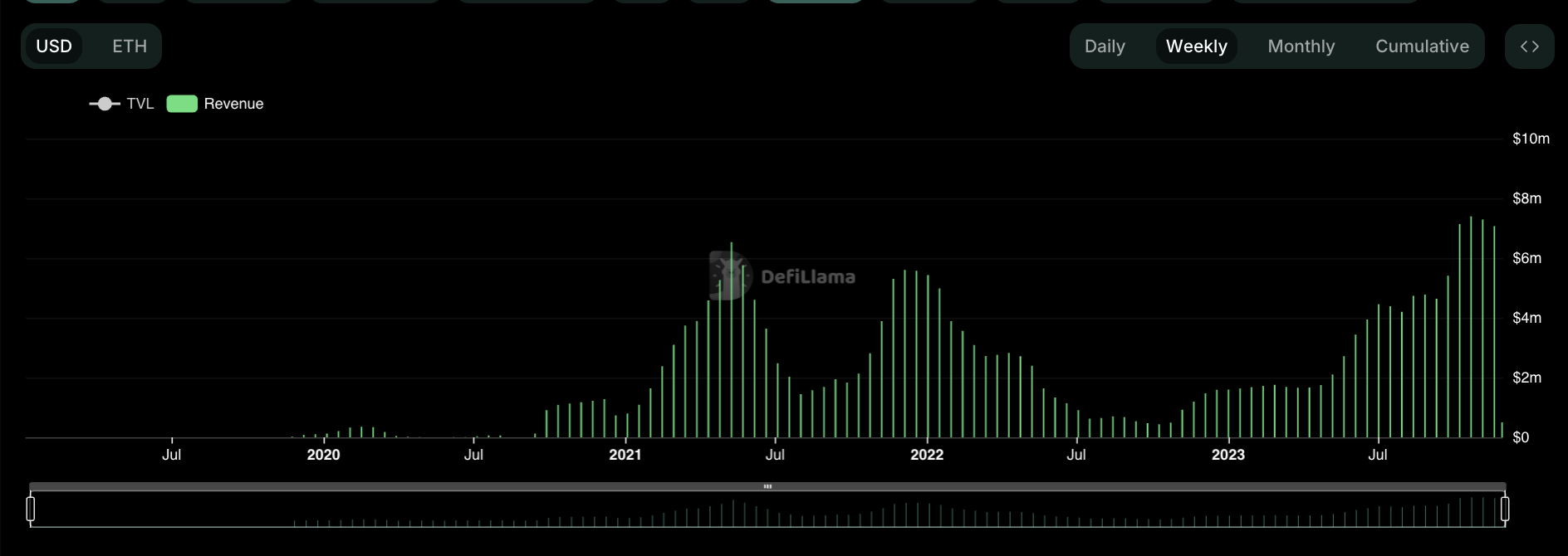

Stablecoin lender MakerDAO [MKR] has reached new heights in revenue generation. According to data from DefiLlama, MakerDAO now generates more revenue weekly than it did at the peak of the 2021 bull market.

This comes after the decentralized finance (DeFi) protocol set all-time highs in monthly fees and annualized revenue in October. In October, transaction fees paid to use the protocol totaled $16.12 million, recording over 400% increase in monthly fees since the year began.

The annualized revenue obtained from these transaction fees reached an all-time high of $213 million in October, rising by 450% since January.

Real-world assets fall on hard times

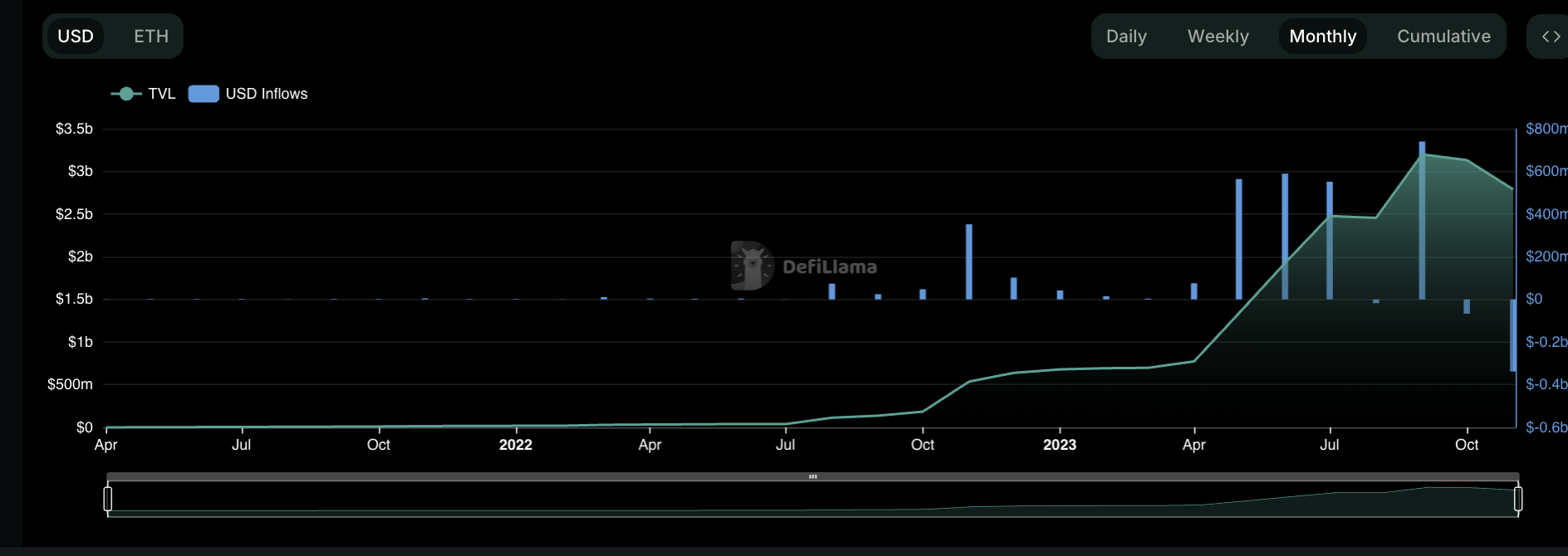

Described as on-chain variations of assets that exist in the physical world or in traditional finance, activity around real-world assets (RWAs) on MakerDAO prompted the significant growth recorded in October.

Data sourced from a Dune Analytics dashboard created by data analyst Steakhouse showed that 67% of Maker’s fee revenue came from its RWAs in October.

However, due to the low demand for the asset class since the beginning of November, its share of Maker’s fee revenue has declined significantly. As of the 24th of November, it had fallen below 10%.

The low demand for RWAs on MakerDAO this month has also manifested in the form of USD outflows from this asset class. So far this month, $300 million has been removed from RWAs on MakerDAO, marking its highest monthly value of outflows ever.

Due to these outflows, there has been a decline in the RWA makeup of MakerDAO’s entire total value locked (TVL). In October, RWAs enjoyed a 43% share of MakerDAO’s total TVL. As of this writing, it was less than 35%.

According to data from DefiLlama, there has been a steady decline in RWA TVL since 28 October. At press time, this was $2.71 billion.

MKR faces low demand

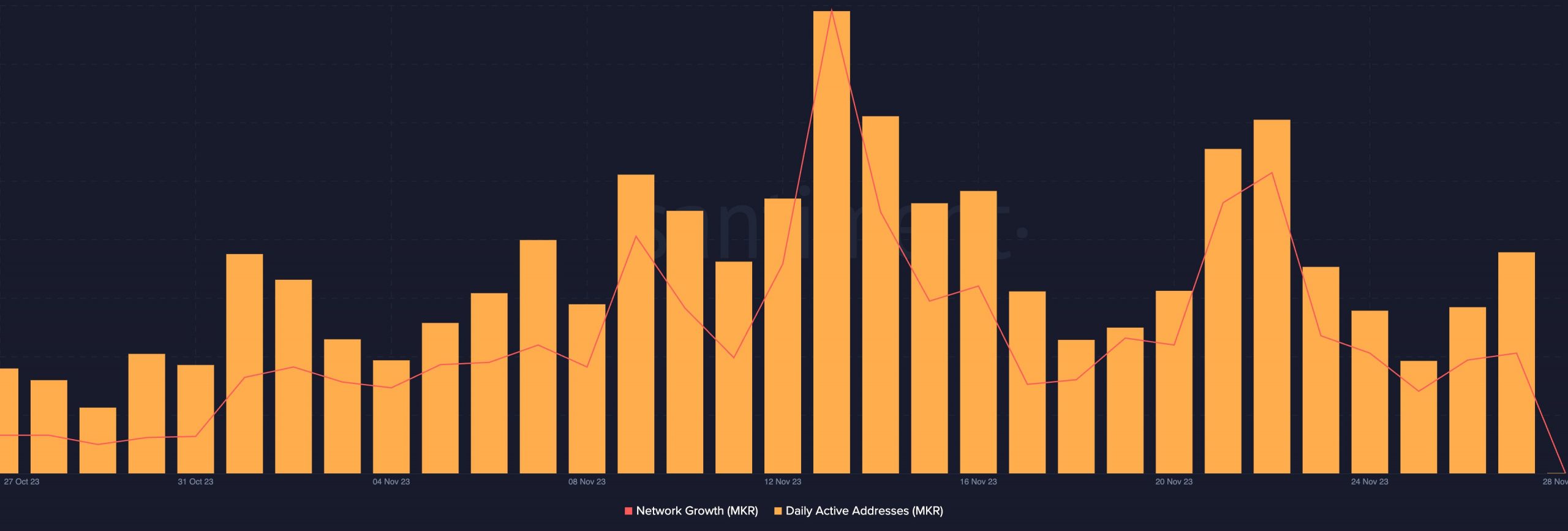

An on-chain assessment of MKR’s on-chain activity showed that the token recorded a two-month high in its daily new demand on 13 November. According to Santiment’s data, 436 new addresses were created to trade the altcoin.

Is your portfolio green? Check out the MKR Profit Calculator

However, MKR’s daily trading activity has trended downward since then. As of the 27th of November, only 140 new addresses traded the altcoin, representing a 70% fall from the 13 November high.

Likewise, the daily count of unique addresses executing MKR trades has dipped in the last two weeks. Since the 13th of November, MKR’s daily active address count has fallen by 44%.