Litecoin: Why investors should keep a close eye on whale activity

- Litecoin was down by over 3% in the last seven days.

- Metrics and market indicators looked bearish on LTC.

Whales have always played a major role in shaping the market for most cryptos, including Litecoin [LTC]. Recently, an interesting correlation has been etched between whale activity and LTC’s price, which could help gauge what the future of the coin holds.

Whales’ influence on Litecoin is interesting

The last week was not the best for Litecoin investors, as the coin’s price dropped. According to CoinMarketCap, LTC was down by more than 3% over the last seven days. At the time of writing, it was trading at $69.81 with a market capitalization of over $5 billion.

While the coin’s price dropped, Ali, a popular crypto analyst, pointed out an intriguing relationship between LTC’s price and whale holdings in a tweet.

#Litecoin | There's a fascinating correlation to observe – the link between $LTC whale holdings and its price movements.

If this trend continues, a rise in #LTC whale holdings might just be the signal of the next price upswing. pic.twitter.com/vSJmNx4kFa

— Ali (@ali_charts) November 20, 2023

As per the tweet, whenever whale holdings increase, the coin’s price follows. Therefore, an assessment of whale holdings can be a key indicator of which direction LTC’s price might head.

AMBCrypto then checked LTC’s press time supply distribution and found that during the latest price drop, the whale holdings also declined. This was evident from the fact that addresses holding 1 to 100,000 LTC dropped somewhat over the last few days.

The shrimp and fish holdings also followed a similar trend of decline.

What to expect from Litecoin?

Even as whale holdings declined, Shan Belew remained confident in the coin. As per his latest tweet, if historical trends are to be considered, LTC will soon kickstart its bull rally. In fact, Belew believed that LTC’s price could increase 100-fold over the coming year.

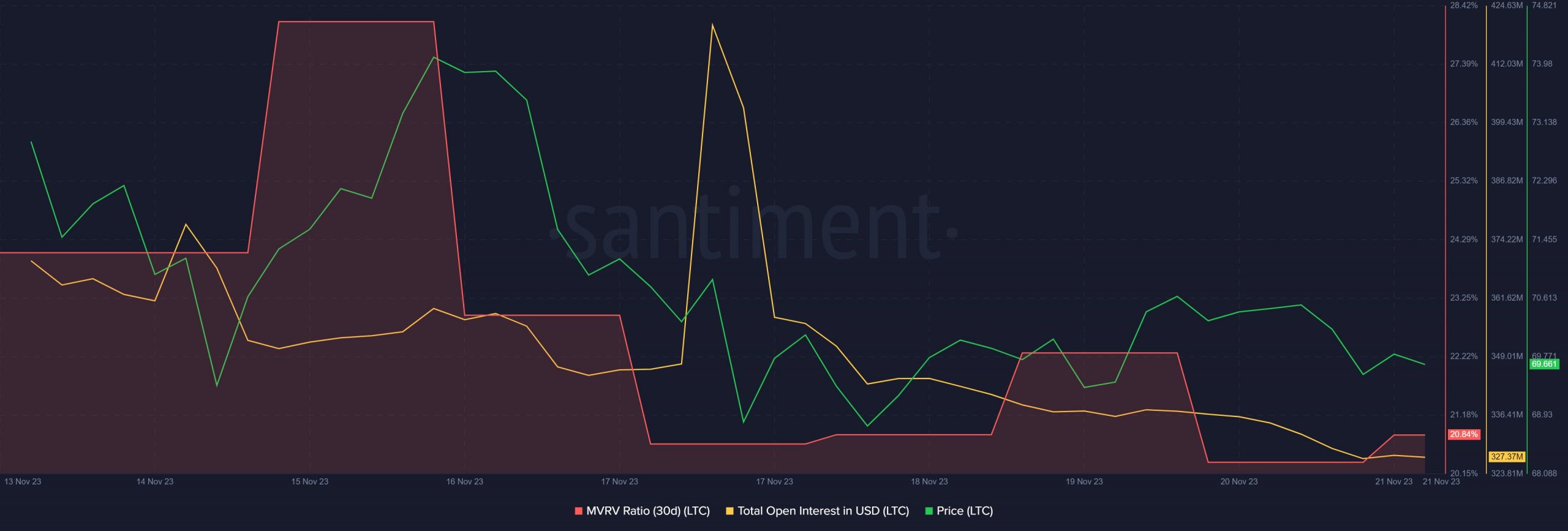

Since the target looked quite ambitious, AMBCrypto analyzed Santiment’s data to find out what to expect from LTC in the short term. As per the analysis, the coin’s Open Interest declined along with its price, increasing the chances of a trend reversal in the coming days.

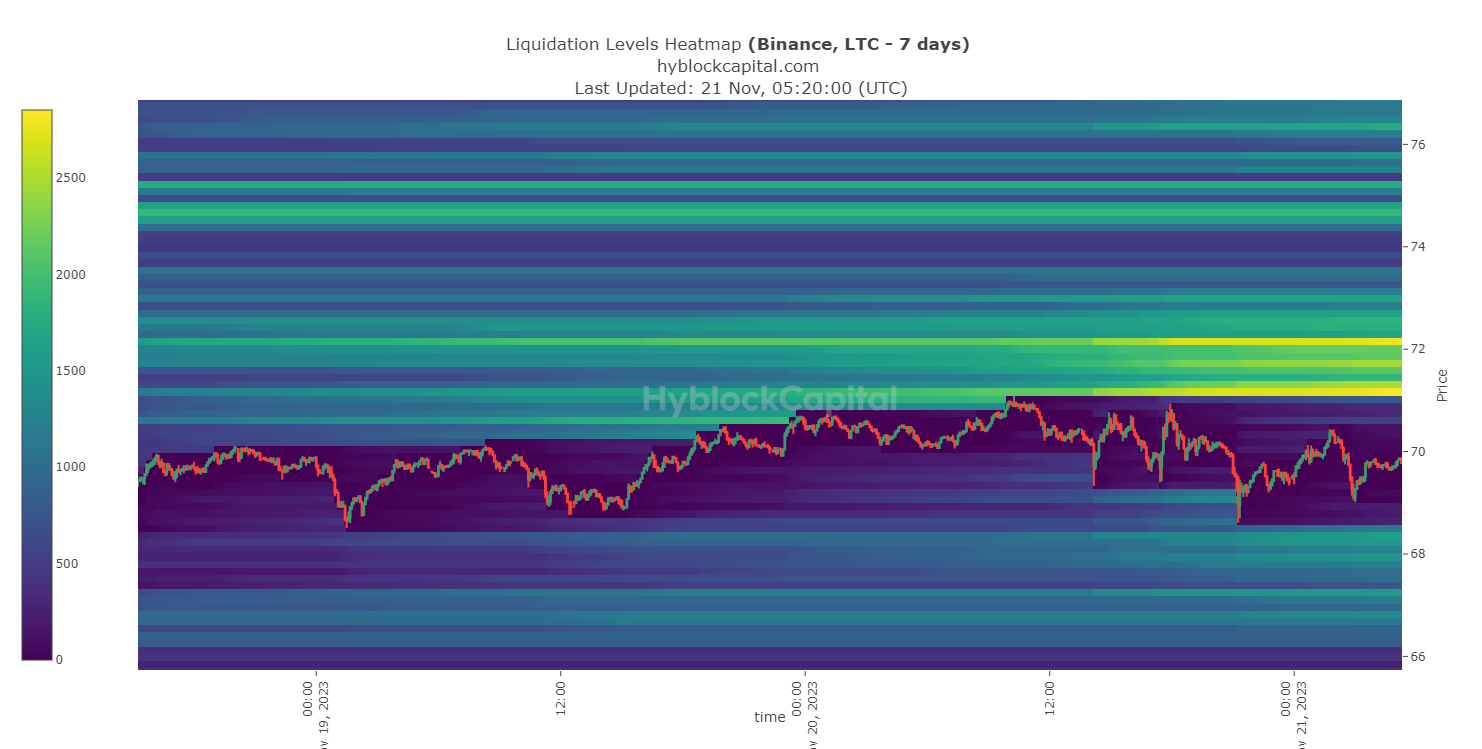

However, a bearish signal was that LTC’s MVRV ratio dropped sharply over the last week. Upon checking LTC’s liquidation level, AMBCrypto found that liquidation increased when LTC’s price reached the $71 mark, restricting it from moving up twice this week.

Is your portfolio green? Check out the LTC Profit Calculator

Additionally, most market indicators also looked bearish on LTC. The MACD displayed a bearish crossover. Litecoin’s Chaikin Money Flow (CMF) registered a downtick in the recent past.

The Relative Strength Index (RSI) was also resting under the neutral mark, increasing the chances of a continued price decline.

![Reasons why Litecoin [LTC] investors should be concerned](https://engamb.b-cdn.net/wp-content/uploads/2023/12/ambcrypto_A_Litecoin-themed_scen-400x240.png.webp)