Analysis

Litecoin, Stellar Lumens, Algorand Price Analysis: 14 October

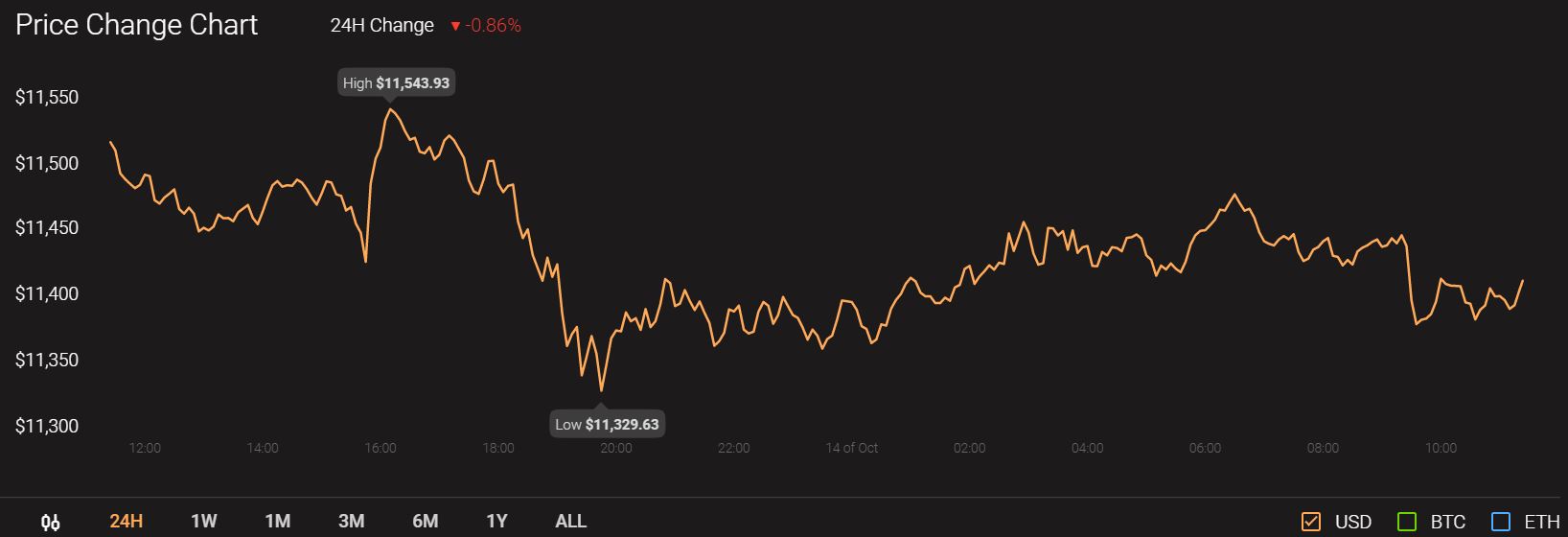

Bitcoin Dominance has slowly decreased in the past few days, from 59.99 to 59.69 at press time. Bitcoin surged from a low of $11,250 to a high of $11,750 in the past couple of days.

Source: CoinStats

The higher lows Bitcoin sets could see a bullish scenario develop for the altcoin market as well. Litecoin and Stellar Lumens faced an important level, and their reaction at the level would decide their short-term direction. Algorand could be set for a minor pullback.

Litecoin [LTC]

Source: LTC/USD on TradingView

Litecoin was moving within an ascending channel (yellow). There was a level of resistance at $50, right next to where LTC was trading at press time.

It is possible that LTC closed a trading session above its resistance, and continued moving above the channel’s midpoint. This would be bullish for the asset in the near term.

If LTC was rejected at resistance, it might be able to bounce off the channel’s lower boundary. The 100 period moving average (pink) was also moving in that region and could prove to be strong support.

Litecoin celebrated its 9th birthday the previous day.

Stellar Lumens [XLM]

Source: XLM/USD on TradingView

The 20 SMA (white) had crossed above the 50 SMA (yellow) a few days ago following a surge in price, but in the short-term, we might see some correction for XLM.

The asset was headed to support at $0.074. The MACD gave a weak sell signal. A loss of support at $0.074 would shift the outlook to bearish, as the MACD could move beneath the zero line.

The signal line and the MACD line’s spacing also showed that there was some downward momentum in the market. The next direction for the asset depended on whether the support level would hold.

Algorand [ALGO]

Source: ALGO/USD on TradingView

Algorand closed a trading session beneath the ascending channel (yellow) and was likely to head downward. The RSI also showed overbought market conditions recently.

Subsequently, a bearish divergence was spotted (white). This precipitated a drop, although the RSI stayed above 50. This was bullish for the asset.

A zone of support at $0.326 might be able to hold the descent, with the next level at $0.31.

![Reasons why Litecoin [LTC] investors should be concerned](https://engamb.b-cdn.net/wp-content/uploads/2023/12/ambcrypto_A_Litecoin-themed_scen-400x240.png)