Litecoin records low figures of active addresses in light of volatility speculations

After a significant drop in Litecoin’s hash rate and price after the halving, the crypto was widely speculated to have exhibited signs of volatility. Additionally, the number of active addresses on the network also dropped to an almost two-year low.

While Litecoin and by extension, the cryptocurrency space, is no stranger to FUD and FOMO, even after a decade now, these two factors continue to manipulate coin’s valuation and other metrics. Despite Charlie Lee’s warning predicting a sense of “shock” within the community and a phase of volatility, speculations regarding the same have not died down.

Volatility

I disagree with folks who say that cryptocurrency volatility will fall as size & adoption increase.

Litecoin—one of the first coins—grew from $30m in market cap to $10b. But its price is just as frenetic as ever. Volatility isn’t a passing stage, it is endemic to crypto. pic.twitter.com/TuRb7h2sm6

— John Paul Koning (@jp_koning) September 2, 2019

Litecoin has indeed hit monthly lows, after failing to recover and breach the $70-key level. At press time, it was trading at $65.48. And while volatility was seen as a foe for the nascent market, whose valuations were mostly driven by speculations arising due to its unregulated nature. Taking a deeper glance, the Bollinger Band indicator’s daily chart predicted a moderate volatility rate in Litecoin’s price for the near future.

Source: TradingView

Active Address

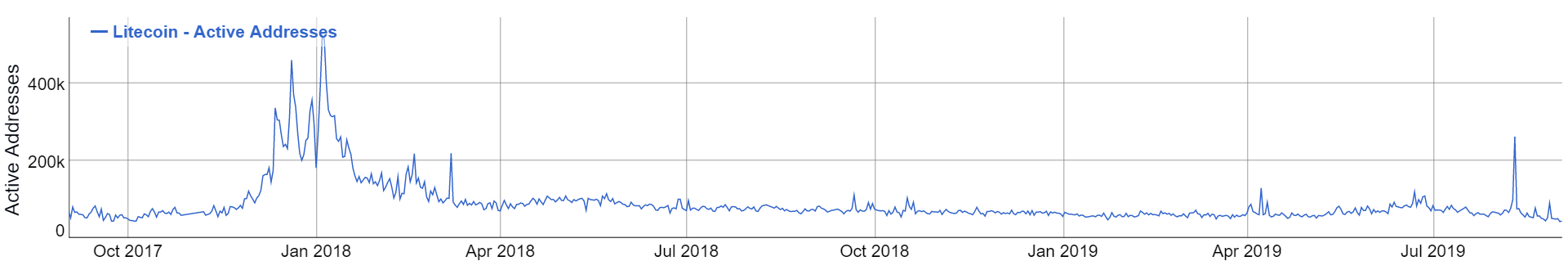

Source: BitInfoCharts | Litecoin Active Address

According to data published by BitInfoCharts, the number of active addresses on the Litecoin network dropped to 44.086 k on September 2nd. This suggests a significantly low volume of engagement in cryptocurrency transactions during the past 24-hours. The last time, the figures recorded such a low was on 4th October 2017 with 44.016 k number of active addresses.

Right after the halving , the numbers did show a sign of recovery. On 10th August, the number of active addresses on Litecoin shot up to 262.573 k, a 16-months since January 2018. However, the numbers soon fell. While other network fundamentals were also low, the above chart for the number of active addresses depicted declining popularity of the coin.