Is Bitcoin’s uncorrelated status aided by its reliance on regulation, tech?

The financial crisis associated with the COVID-19 pandemic has overwhelmed economies across the planet. In fact, for the longest time, cryptocurrencies like Bitcoin were projected to be assets with low correlations, allowing them to behave akin to safe-haven assets like gold. Alas, recent events have tested the strength of such narratives.

On the latest episode of The Wolf of All Streets podcast, Mark Yusko, CEO of Morgan Creek Digital, explained why he believes Bitcoin is a hedge during times like these for investors and the significance of Bitcoin’s uncorrelated asset status. Highlighting Bitcoin’s low correlation to other financial assets, Yusko pointed out,

“In the last six years, the [Bitcoin’s] correlation to traditional assets, stocks, bonds, cash, commodities, real estate, etc. it’s been 0.15. It varies from 0.2 to 0.1 but it’s 0.15 and that is an awesome lack of correlation and there’s a reason for that.”

He went to argue that this low correlation is the resulting end product of a variety of reasons unique to assets like Bitcoin.

“All of the traditional investments, stocks, bonds, currencies, commodities derive their value from the same inputs – interest rates, corporate profits, GDP growth, and multiple financial engineering. If you look at cryptocurrencies, particularly Bitcoin, it derives its value from none of those other things.”

For Bitcoin, apart from the scalability issue, another key challenge it faces is with regard to its unpredictable and volatile nature. During the 12 March crash, the role of whale accounts moving around 1000 BTC that belonged to an old mining wallet from 2010 to 55 different exchanges was suspected to have played a part. Yusko highlighted that market manipulation in the case of Bitcoin does happen occasionally, leaving a last effect in the short-term, adding that the same can be overcome.

According to Yusko, “It is possible for a large owner of Bitcoin to manipulate the price short term. 100% right and that’s always been true of every nascent young market.” he went on to add that, “when they become large and dominated by lots of different players, that ability to manipulate goes away. ”

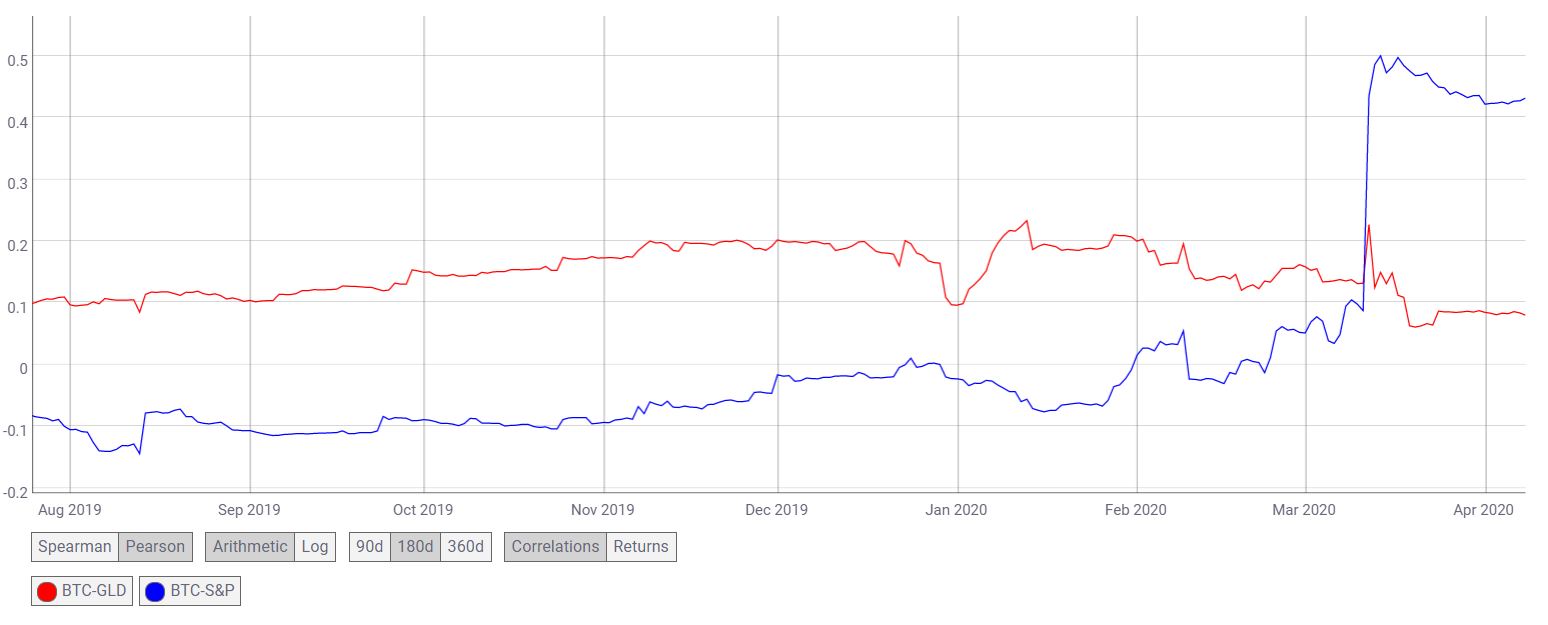

Source: coinmetrics.io

Interestingly, in recent times, Bitcoin has seen a rather drastic spike in terms of its correlation with the S&P 500 index and a decreasing correlation with gold. The BTC-S&P correlation since March had risen from 0.0871 to 0.43, at press time.

During the course of the conversation, Yusko also acknowledged that Bitcoin has seen increasing correlation with equities lately, noting that this was primarily because of the presence of speculators in the ecosystem. However, he remains optimistic with regard to Bitcoin’s uncorrelated status.

“Bitcoin is truly uncorrelated. It’s uncorrelated because it relies on different things like technology and regulatory changes etc. to get value.”