Bitcoin

Institutional investors have a crypto-custody problem: Bitwise

It seems that crypto-custody has been kept a secret from institutional investors.

Few things have improved in 2019 as much as the custody of cryptocurrency, and the regulators’ attitude towards it. While a Bitcoin Exchange Traded Fund still waits on the doorsteps of the SEC, institutional companies entering the cryptocurrency custody market has grown.

Coinbase snapped up custody provider Xapo, Fidelity entered the crypto-storage space, and the Intercontinental Exchange’s digital assets platform Bakkt launched offering both trading and custody. Yet, investors have been kept in the dark.

According to a survey by Bitcoin ETF hopeful Bitwise Asset Management, institutional investors have a crypto-custody problem. The problem, however, is a lack of information, not a lack of solutions.

ETF trends 2020 Benchmark survey by the asset management company rounded up 415 responses from independent broker-dealers, financial planners and wirehouse reps. The respondents’ AUM averaged $50 million to $100 million, emphasizing the class of investors and the nature of their investment.

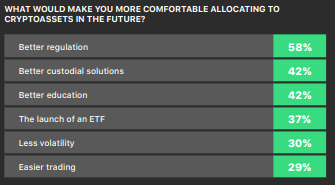

On asked what would elicit a greater cryptocurrency-dedication in investors’ portfolio, the respondents cited better regulation and custody as their main concerns. While digital asset regulation within the United States has been largely a hit-and-miss, custody has been straightforward, and investors have been slacking.

Source: ETF Trends 2020 Benchmark survey, Bitwise

In their note following the concerns breakdown, the report stated that investment advisors are not keeping up with the developments of the cryptocurrency industry. Bitwise evidenced this lack of information dissemination, by highlighting that only a quarter of respondents were aware that Fidelity, one of the largest investment banks in the world launched a custody service for Bitcoin.

The report read,

“In addition, generalist advisors often do not follow the day-to-day evolution of the market as closely as crypto advocates do. For instance, 75% of financial advisors surveyed this year were not aware that Fidelity Digital Assets offers custody services for bitcoin.”

Not just a concern, the custody issue was even preventing investment in digital assets. Over a third of advisors stated that “Custody concerns/fear of hacks” was an obstacle to increasing investment in cryptocurrencies and making the first allotment.