How far away is Ethereum’s scalability boost?

Ethereum continues to dominate the altcoin market, after having cemented its position as Bitcoin’s most notable rival. The last few weeks have been particularly exciting for the community since it saw the much-awaited launch of ETH 2.0, with the beacon chain going live on 01 December. However, on the question of Ethereum’s scalability, how many changes are users in the space likely to see in the coming months?

Speaking on the latest episode of the Unchained podcast, Ryan Watkins and Wilson Withiam, senior research analysts at Messari, elaborated on the significance of Ethereum 2.0, its effect on the overall scalability, and whether or not the DeFi ecosystem will end up being a threat to staking.

On the question of a scalability boost for Ethereum, Withiam argued that a substantial hike may still be a year away before a drastic impact is seen. He went on to add,

“Scalability is a need now and frankly what Ethereum 2.0 can bring from a scalability perspective is years away, maybe a year, maybe a little bit over that. So in the short-term, the solution that a lot like Vitalik and some of the other teams have been working on for years is transitioning over to a layer two solution.”

Elaborating on layer two solutions like rollups, Withiam also noted that with ETH 2.0, the plan is to take a lot of the transactions that DeFi is handling today and move them to a layer that’s above Ethereum right now. He pointed out,

“Essentially, all it is, is taking a lot of the transactions that DeFi is handling today, moving them to a layer that’s above Ethereum right now, so kind of taking them off-chain but having security ties back into the chain.”

Since the start of the year, the crypto-community has anticipated the transition from PoW to PoS thanks to ETH 2.0. However, in the months leading up to December, Ethereum saw the rapid rise of Defi. This has also led to questions pertaining to whether DeFi is going to threaten staking on ETH 2.0. In response to the same, Watkins claimed that such a possibility is fairly unlikely. He elaborated,

“I think the biggest thing between staking and DeFi just boils down to how validator returns are designed. So, if there was this event where, say, yields in DeFi were very high and then some people who were staking, this is actually significantly more important in phase 1.5 and beyond when you can actually withdraw your ETH and use it in DeFi.”

While the fruits of ETH 2.0 may still take time to realize, ETH’s price action post-Dec 01 seems to be rather promising. While ETH’s price did drop in the hours right after the beacon chain went live, the cryptocurrency bounced back and remained above the key $600-price level, at press time.

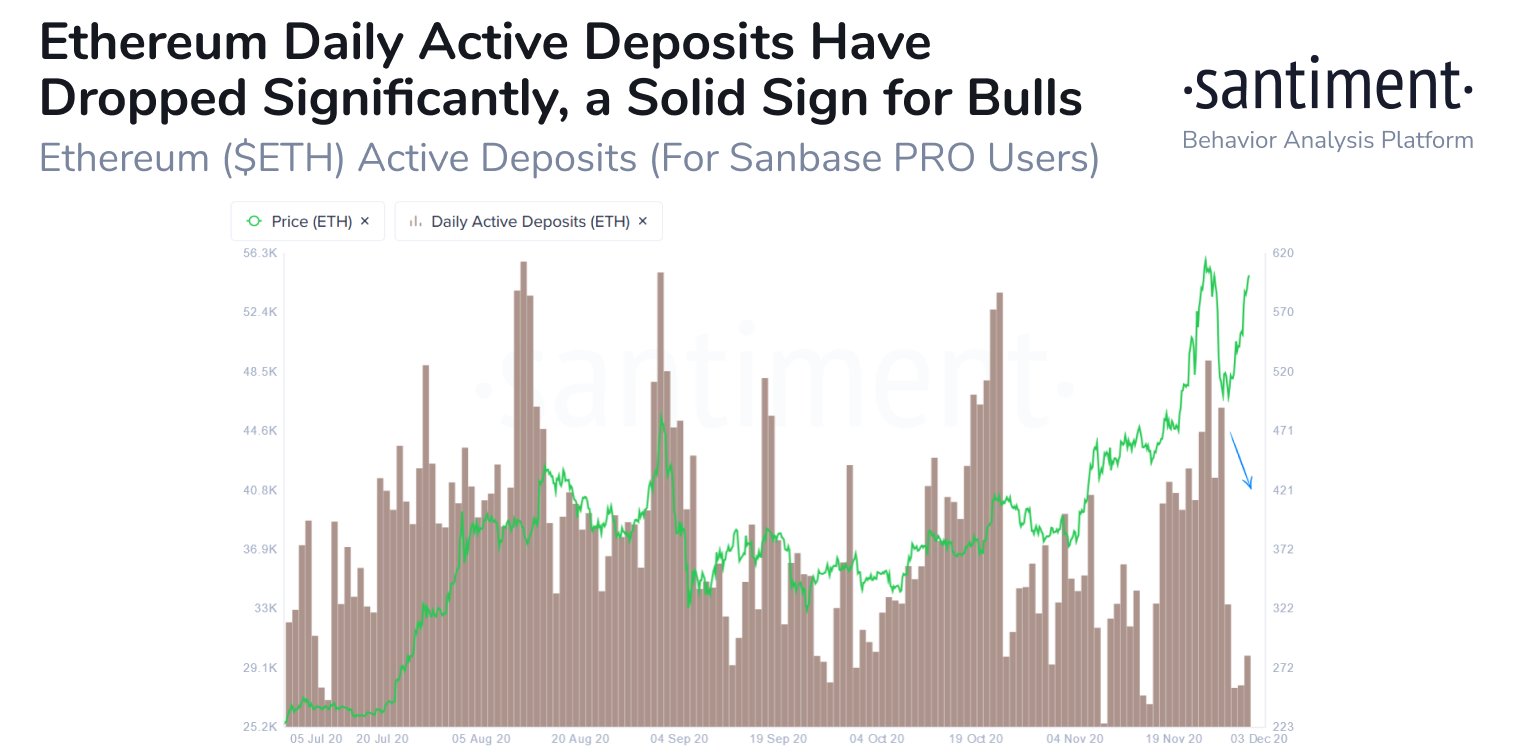

Source: Santiment

Interestingly, Santiment recently noted that as the market awaited the beacon chain event, there was a steady drop in daily active deposits, which, going by past precedents, have been considerably bullish for the coin’s price.

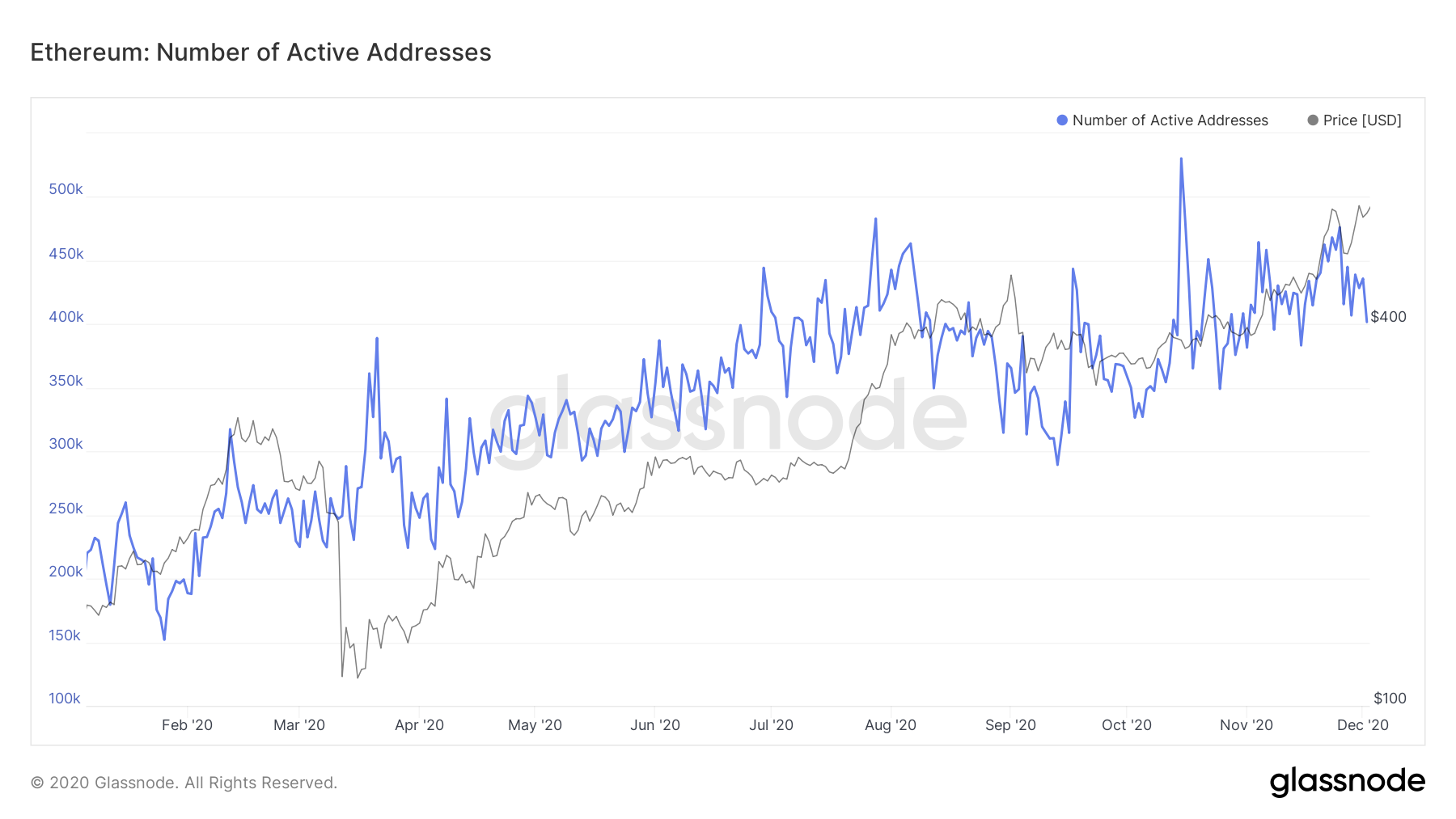

This, coupled with the steady increase in the number of active addresses, does confirm the market’s positive response to the transition. While ETH 2.0’s potential will take a bit more time to fully realize, its performance on trading charts seems to be already painting a promising picture.