How a Bitcoin ETF approval may spur BTC to $141K

- Demand for Bitcoin may increase once the SEC approves a spot ETF.

- It might take a while before corporate bodies begin to fuel the BTC hike.

For a large part of the year, there have been discussions surrounding a possible Bitcoin [BTC] spot ETF approval. But contrary to what many market players may have desired, the U.S. SEC has repeatedly excused itself from giving the go-ahead.

With respect to the development, James Butterfill, Head of Research at CoinShares released a report. In the report, Butterfill revealed that the Bitcoin price, after the potential approval, may hit $141,000.

If you are an avid follower of AMBCrypto’s updates, you’d admit that Butterfill has been vital in providing updates about investment fund flow linked to Bitcoin and other cryptocurrencies.

The time, it’s different

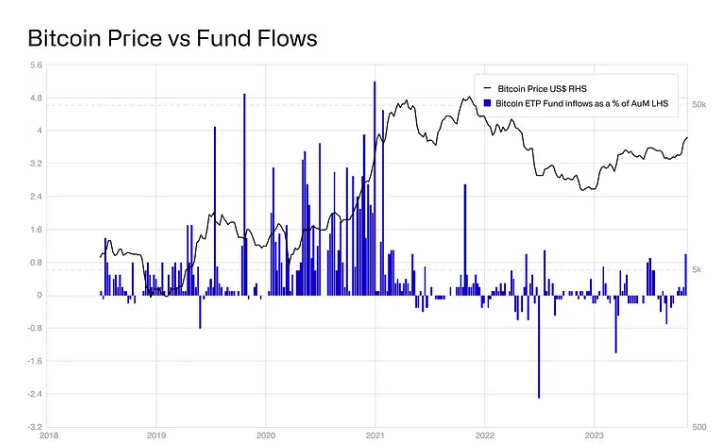

The interesting part is that, in the last few weeks, the analyst had repeatedly mentioned how Bitcoin inflows have been increasing. Interestingly, the CoinShares’ research head focused on the fund flow relationship with Bitcoin.

This model was also instrumental in the $141,000 conclusion. To arrive at the price, Butterfill analyzed the Assets under Management (AuM) from 2018 to 2023.

He observed that:

“This year is unusual in the fact that ETP volumes have proportionally risen, this is due to the dramatic fall in volumes from Binance rather than a rise in ETP volumes. Historically at least, as overall market volumes rise, so have ETP volumes, where there is a form of “sentiment matching.”

From the chart shared above, the report also highlighted how Exchange-Traded Products (ETPs) in other countries rarely impact the Bitcoin price action.

A Bitcoin ETP is a financial product that allows investors exposure to BTC without holding the coin.

Over $100,00 or nothing

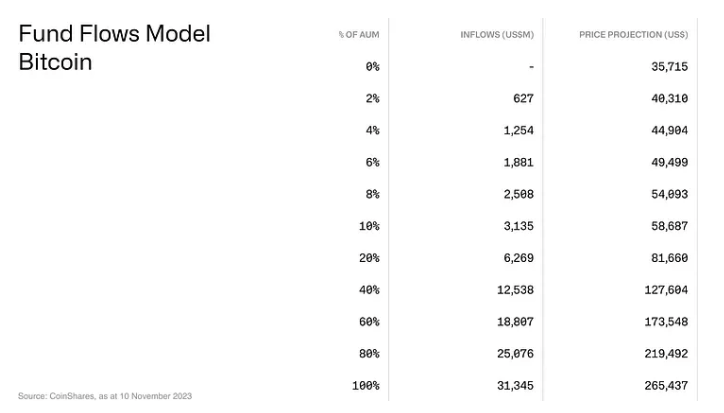

Regarding the change in the ETF effect on the price, the analyst looked at the weekly fund flows. According to him, about $14.4 billion worth of investments has flown into Bitcoin lately.

So, if the average allocation is put up against the Bitcoin price, then BTC may hit $141,000.

However, the report admitted that it was difficult to ascertain the exact value. It also added a projected ETF approval impact on BTC depending on the fund flow model.

On a Year-To-Date (YTD) basis, Bitcoin has increased by 119.27%. But profit-taking in the last seven days has pulled the price back to $36,440. This was the price at the time of writing.

In conclusion, the CoinShares report noted that it was uncertain about the level of Bitcoin demand once a spot ETF is launched. The report also added that it could take some time before the corporation decided to invest, highlighting that:

“Regulatory approval and corporate acceptance are slow burn issues due to Bitcoin’s perceived complexity. For this reason, it may well take some time for corporations and funds to build up their knowledge and confidence before they decide to invest.”

How much are 1,10,100 BTCs worth today?

Meanwhile, it seemed that the U.S. SEC was hell-bent on pushing its decision on the spot ETFs forward. As reported by AMBCrypto, another round of applications has been delayed.