Crypto inflows cross $1 billion amidst week 7 of growth

- The price surge experienced in the crypto market over the last few weeks has led to a steady flow of funds.

- Last week, Ethereum recorded its highest weekly inflows since August 2022.

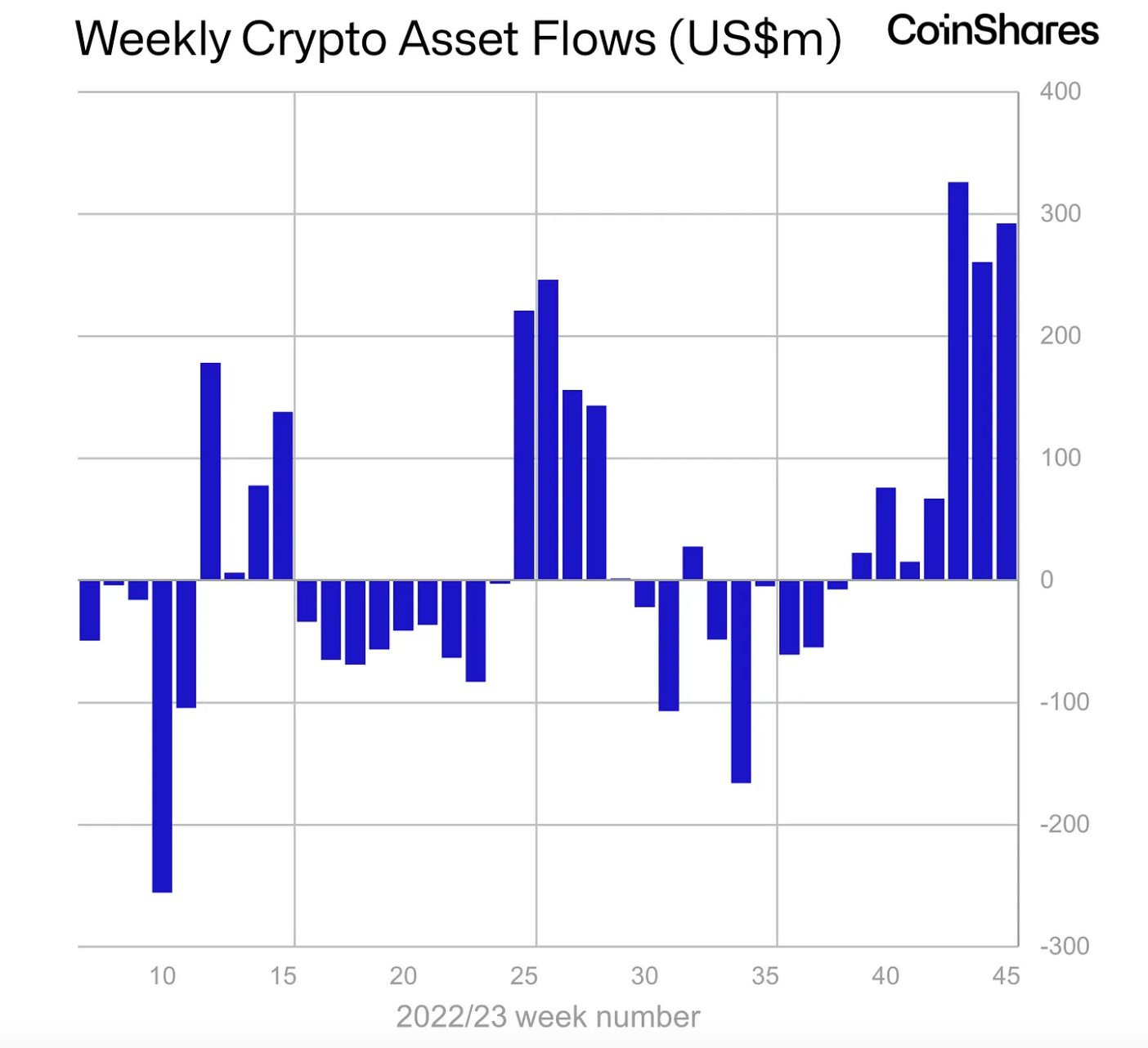

Digital asset investment products recorded inflows totaling $293 million last week. This marked the seventh consecutive week of inflows, digital asset investment firm CoinShares found in a new report.

According to the report, the seven-week run of inflows crossed the $1 billion mark, causing the year-to-date (YTD) to reach $1.14 billion, the third-highest yearly inflow ever recorded.

Further, the general market growth and the steady liquidity inflow into crypto funds witnessed in the past few weeks resulted in an uptick in total assets under management (AuM).

CoinShares reported:

“Total assets under management (AuM), as a result of these inflows and recent price appreciation, total assets under management have risen 9.6% over the last week and 99% since the beginning of the year.”

At the end of the period observed by CoinShares, the total AUM for crypto-related investment products was above $40 billion.

On a regional level, most of last week’s flows into crypto funds came from Canada, the United States, Germany, and Switzerland, with inflows of $106 million, $81 million, $53 million, and $50 million, respectively.

Bitcoin’s YTD inflows sit above $1 billion

Last week, Bitcoin-backed investment products recorded inflows of $240 million, representing 82% of all inflows seen during that period. This pushed the leading coin’s YTD inflows to $1.08 billion, a 19% uptick from the previous week’s YTD inflow of $842 million.

CoinShares found further that during the week under review, the trading volumes for BTC Exchange-traded products (ETP) accounted for 19.5% of the overall BTC trading volumes on reputable exchanges. The research firm acknowledged:

“This has rarely happened and suggests ETP investors are participating much more in this rally compared to 2020/21.”

Regarding short-Bitcoin products, they recorded outflows of $7 million last week. This caused their month-to-date net flow to a deficit of $4.8 million.

Ethereum continues to excel

In the previous week, leading altcoin Ethereum [ETH] recorded an inflow of $18 million, which CoinShares had reported as the coin’s “largest inflows since August 2022.”

However, its inflows totaled $49 million last week, marking a new high since August 2022 and representing a 172% increase from the previous week’s inflows.

According to CoinShares, this is:

“Likely related to the recent spot-based ETF listing request in the US. Solana also saw further inflows totaling US$12m.”