Here’s a look at the Binance ecosystem following its indictment

- BNB’s trading activity levelled off, indicating a wait-and-watch approach.

- Binance’s current situation was far from what FTX experienced last year.

The legal resolution between Binance [BNB] and the U.S. Department of Justice (DOJ) may have paved way for a risk-free and more assured future for the ecosystem but it came at the cost of its star CEO and one of the most successful Web3 entrepreneurs – Changpeng Zhao (CZ).

As part of the deal, CZ pleaded guilty to anti-money laundering charges, which required him to step down from his position.

Being the world’s largest crypto trading platform and an important barometer of the broader industry’s health, the development sparked a degree of FUD among market participants.

How did BNB react?

The whole episode resulted in intriguing shifts in the native token’s movements over the past week. As per AMBCrypto’s analysis using CoinMarketCap data, BNB jumped 6% during the start of the week when news of the resolution was first reported by Bloomberg.

Crypto market data provider CCData linked the positive reaction to the end in uncertainties that had bogged down the crypto behemoth.

It stated that the trading volume for BNB spiked to $13.8 million in the first hour after the story broke from just $1.3 million in the previous hour.

However, when the news of CZ’s resignation and his pleading guilty to charges arrived, the confidence of BNB holders was shaken. Sell-offs ensued and BNB collapsed to $227 on 22nd November, losing 14% of its value.

Since then, BNB has stabilized somewhat, exchanging hands at $235 at press time. Trading activity has also levelled off, indicating that investors were taking a wait-and-watch approach.

BNB’s derivatives market reacts

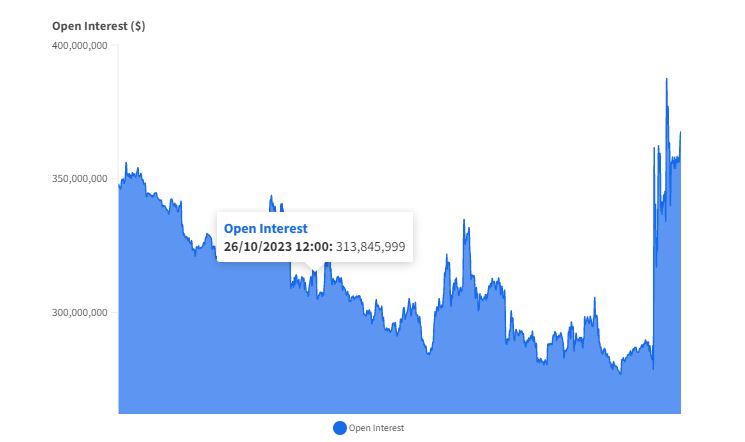

The developments of the past week also impacted BNB’s speculative market. The money invested in BNB derivatives increased sharply over the past week, as indicated below.

More than $100 million in Open Interest (OI) was added within a day, CCData noted.

With the OI at press time remaining close to its highs, the speculative bets on BNB were predicted to rise further.

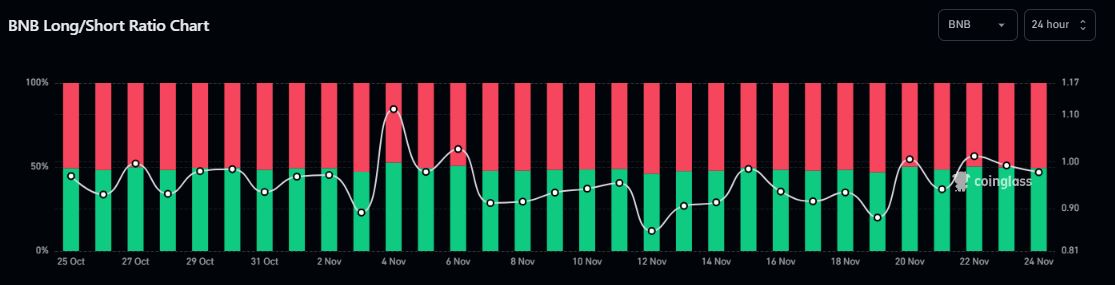

Much like the price fluctuations, the nature of bets also swung rapidly over the week. When BNB rose initially, the number of traders holding long positions exceeded those holding shorts.

When BNB fell subsequently, market dominance shifted towards bearish traders.

Outflows increase but situation not like FTX

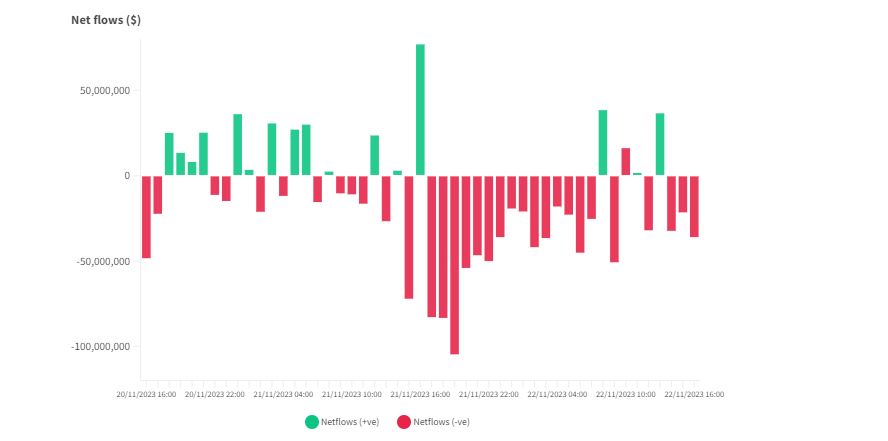

The FUD over CZ’s exit led many investors to withdraw their crypto assets from Binance. Since the DOJ’s official indictment, outflows worth $800 million were recorded.

AMBCrypto confirmed the above observation with DeFiLlama and found $1.31 billion in net outflows from Binance over the past week. This meant that more assets were withdrawn than deposited on the exchange.

Customers’ willingness to move their assets out signaled a trust deficit with the exchange. Aside from concerns about stability, the stigma of violating government regulations weighed strongly on public opinion.

Having said that, it was important not to equate Binance’s current situation with the collapse of FTX [FTT] exchange last fall.

CCData recalled that during the FTX crisis, approximately $1 billion in Bitcoin outflows were observed in under an hour on Binance alone.

The marked difference underlined the market’s growing confidence in the security of their funds. Strict compliance standards, along with transparency in reserve reporting, avoided a knee-jerk reaction.

Liquidity monitoring would be crucial

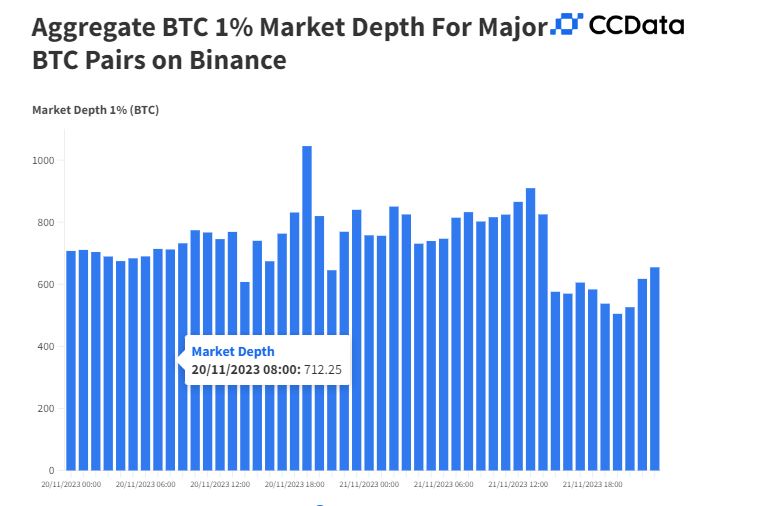

Last but not least, the liquidity on the exchange was examined to understand the impact. As is well known, liquidity makes the market more stable and protects traders and cryptocurrency exchanges from the effects of price swings.

How much are 1,10,100 BNBs worth today?

CCData’s research showed that market makers withdrew liquidity on 21st November, fearing price volatility. However, the largest drop of nearly 30% after DOJ’s official indictment.

CCData mentioned in the report,

“Monitoring liquidity flows over the coming weeks will be vital to understand whether market participants continue to have faith in Binance with its new leadership and compliance requirements.”