Here are 7 factors that can derail a Bitcoin bull run

The ongoing Bitcoin price rally is lucrative to traders on spot and derivatives exchanges, however, there are several factors that may influence the trajectory of the coin. This article takes a deep dive into the red flags to look out for. Looking at Bitcoin’s 24-hour change, the change is less than 0.50 percent, and weekly change is 1.8 percent. A sudden drop in volatility may change the direction of Bitcoin’s price movement. Senior Commodity Strategist at Bloomberg Intelligence, Mike McGlone tweeted

He revealed a fairly bullish stance on Bitcoin. Demand and adoption metrics have been in favor of the cryptocurrency for the past quarter. The forecast is bullish and Bitcoin may continue its rally until it hits a new high above $12400. There have been modest setbacks this week, however, overall the asset has retained its positive momentum and the trajectory continues to rise. The question is, what could possibly go wrong?

Demand and Adoption metrics

Currently, the demand for Bitcoin on fiat-crypto exchanges is being driven by new buyers and stock day traders. The metrics may remain favorable only as long as there is enough liquidity from crypto to crypto exchanges and if it is matched with the demand to absorb it.

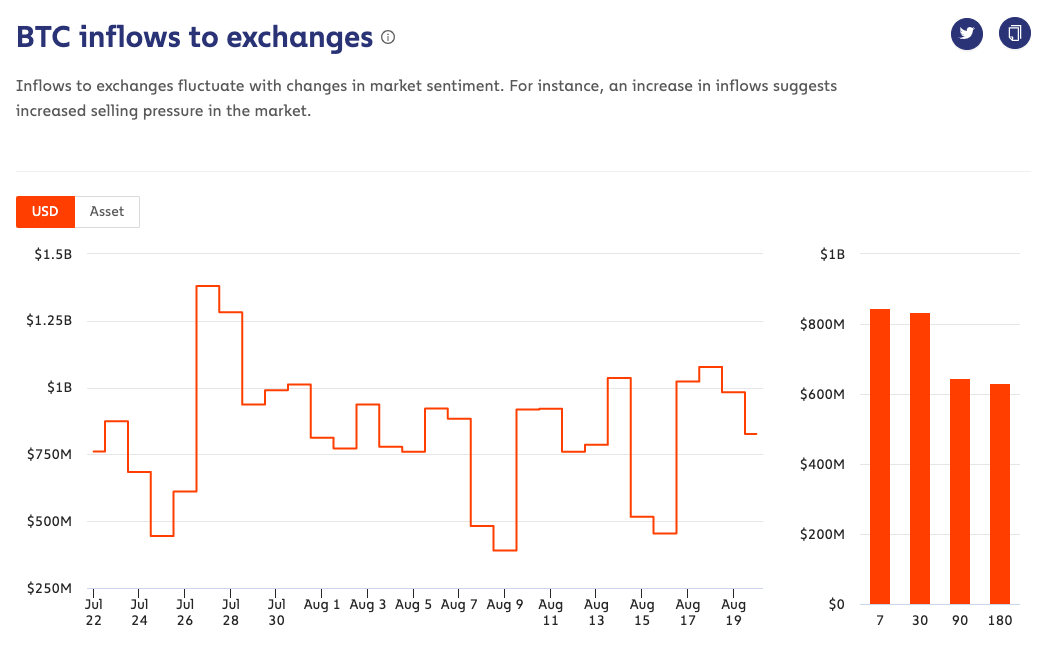

According to this chart from Chainalysis, BTC inflow to exchanges has changed almost every day in a row from July 22, 2020, to date. The high point being $1.25 B on July 27, 2020, and the below $500 M on August 9, 2020. With a highly fluctuating inflow, the demand may not absorb the supply and in turn, lead to a drop in volatility.

A decrease in correlation with gold

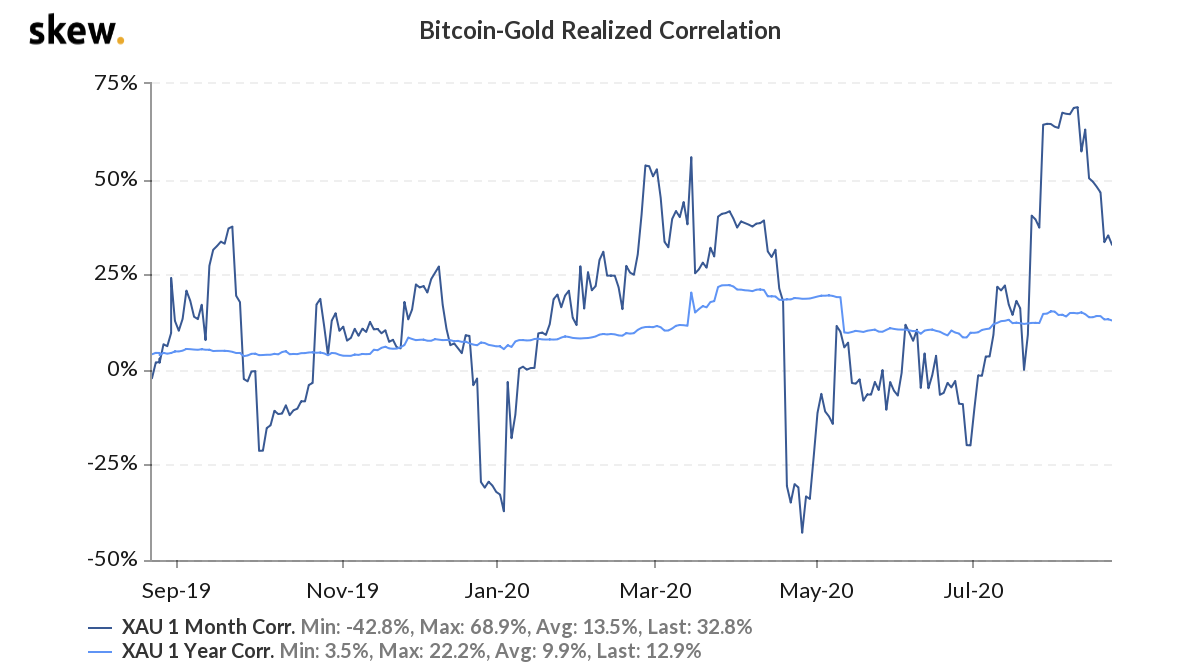

Gold price has the volatility that causes cycles of price hike and drops, however, Bitcoin’s volatility is higher. Owing to this, there is a weak correlation between the two assets over a one year period. Currently, the correlation is high, above 50% for the past few weeks; the price of both assets is rising steadily. However, gold prices may be stable and can get corrected, and this may lead to a drop in the correlation between the two.

Additionally, the current correlation could be a response of traders to the turmoil and uncertainty in global markets and the decline of USD, however over a longer period of time, can push the correlation to drop to zero, or negative. Once that happens, Bitcoin’s price may not rise in response to the infamous ‘digital gold’ narrative.

Increasing market capitalization and Defi

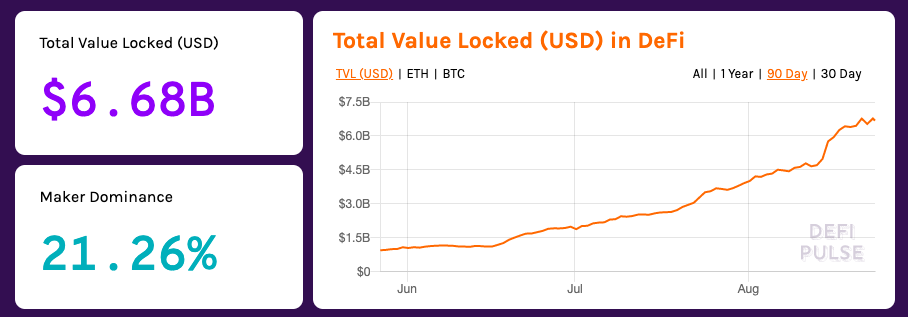

Defi’s market capitalization has been on a steady rise in the past 90 days and it is currently at 21.26%.

The popularity and rise of Defi are increasing its market dominance steadily and though trader interest is high in Defi and Ethereum, many Bitcoin day traders may disinvest from Bitcoin in the short run in hopes of making a quick buck in DeFi’s highly liquid and volatile market.

Increasing open positions in Bitcoin

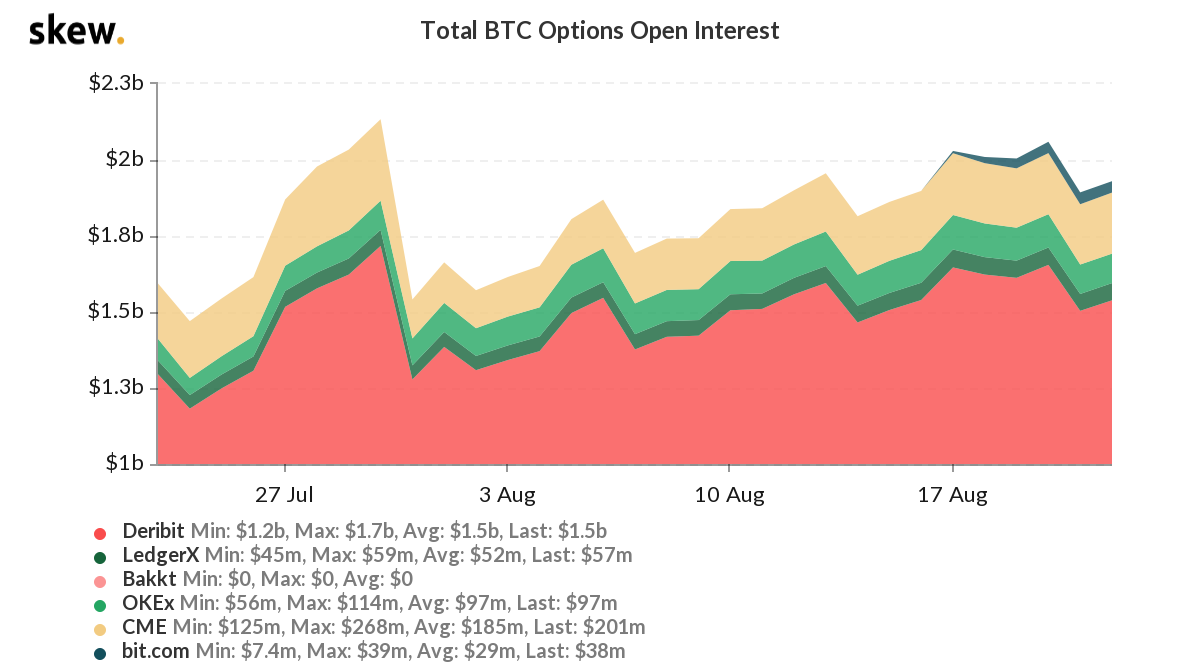

Open positions in Bitcoin options are hitting record-high levels, according to this chart from skew. This may be conducive for the short term, however, in the long-run, this may be counterproductive to the price growth.

The total number of outstanding Bitcoin options contracts with open interest crossing $2 B three times in a row since July 27, 2020. A high number of open positions indicated anticipation and interest, however, traders are free to close their long calls ahead of the expiration date. Therefore a drop in the volume of open positions may raise a red flag.

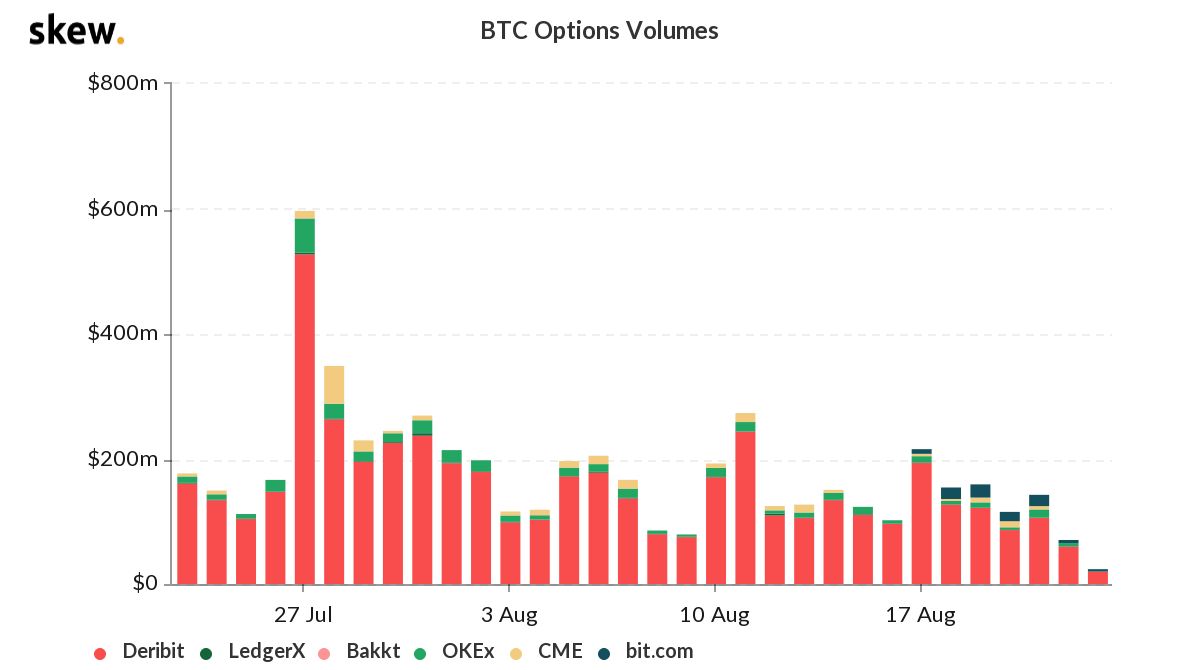

Decrease in BTC options volume

A high volume of BTC options indicated that there is a higher interest in BTC in the given period. A high volume indicates a high interest and in a similar manner, a decrease in BTC options volume is another red flag to watch for.

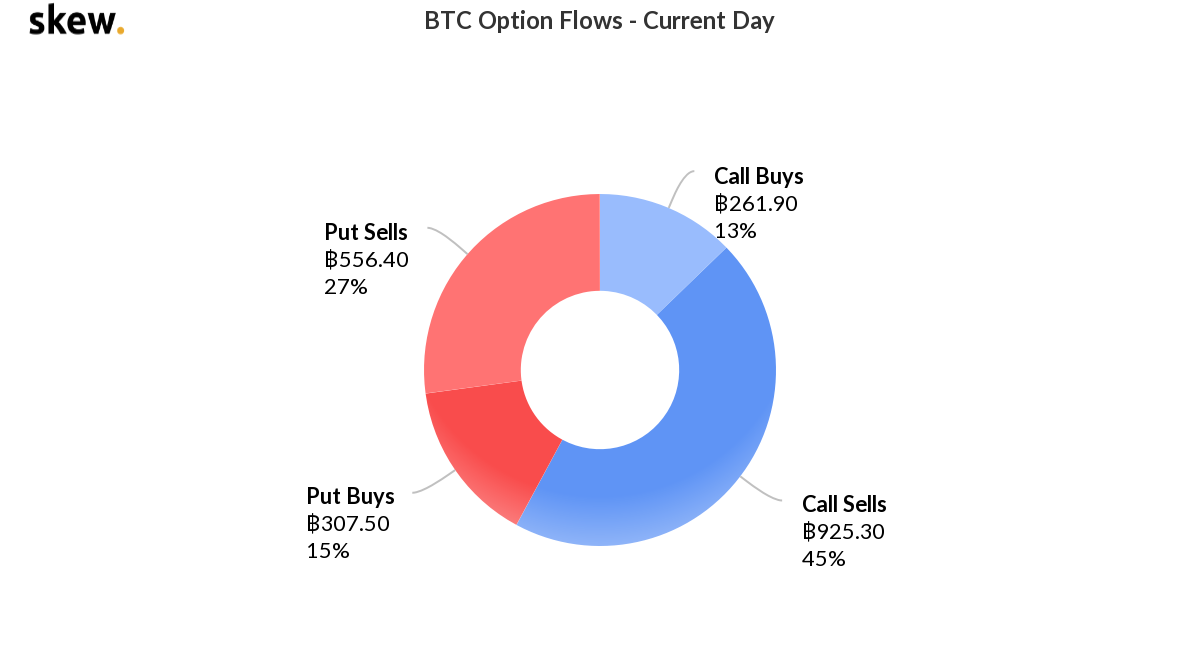

Offloading of calls could trigger a drop

Open positions in Bitcoin options have hit record levels and the total number of outstanding contracts increased, however, the trend may not be sustained. The number of bearish puts relative to bullish calls has recovered in the past week and traders are flooding the market with their call options.

45% call sells against 13% call buys is a bearish speculation of Bitcoin’s price and a bearish phase may follow if this continues for a longer period.

Pull back from institutional investors

Bitcoin’s demand is on the higher side consistently due to combined interest from institutional and retail investors. Coupled with aggressive retail buying and speculative interest, that has led the price rally to $11571. One popular contributor to institutional interest is the derivatives market that offers impressive gains and appeals to a spectrum of traders. This points to the source of the spot market’s liquidity and how it depends on Derivatives and other available investment products. The risk management potential is higher in the derivatives market, and if institutional interest drops here, there may be a pullback.

Financial uncertainty and a decline in USD is driving institutional investors to alternative investments and Bitcoin may continue on a growth trajectory, irrespective of the reasons shared here. However, it is always better to err on the side of caution.