Has the cypherpunk Bitcoin been relegated to history?

A decade ago when Bitcoin was introduced to the world the response it received was a testament to how radically different it was in comparison to other innovations in tech and finance. The polarising views that were immediately formed in reaction to Bitcoin exemplified its disruptive quality. In the decade since Bitcoin has worked with various avatars and explored different use-cases. However, as Bitcoin cements itself as a store of value asset, it also raises questions regarding whether it has strayed from its original vision.

In a recent episode of the What Bitcoin Did podcast, crypto commentator – Ragnar Lifthrasir discussed issues surrounding popular Bitcoin narratives and why spending Bitcoin is as important as hodling. In the past few years, Hodlers have emerged as a highly influential demographic within the Bitcoin ecosystem. With Bitcoin predictive models like the Stock to Flow developed by PlanB getting a lot of recognition, it is a lucrative time to hodl. However, does this compromise certain ideals that the cypherpunks had when envisioning Bitcoin as digital cash remains a relevant concern. Lifthrasir argued that,

“People say, don’t spend your Bitcoin only spend your dirty fiat. And say that because this money is hard money, then you’re not supposed to spend it. You’re supposed to save it… that’s a clear attack and violation of the cypherpunk goals of untraceable digital cash.”

Terming the act of hodling a ‘monomania’ Lifthrasir noted that it is dangerous for Bitcoiners to go into such extremes as it limiting what Bitcoin can do and is now becoming the crypto equivalent of a stock.

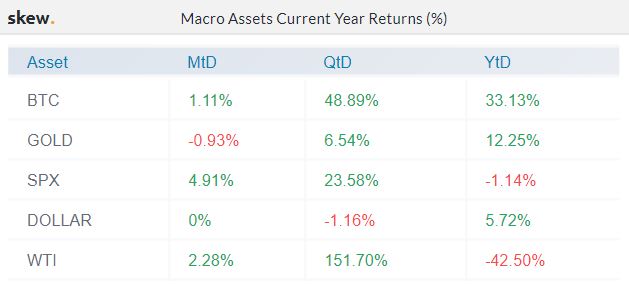

Source: skew

Bitcoin has been considered to be the best asset of the past decade in terms of its ROI. Market data from skew, regarding current-year returns percentage substantiate Bitcoin’s position as a long term investment vehicle. In 2020 alone, Bitcoin performed better than gold and the S&P in terms of its ROI, which in turn fuels the hodl culture and hurts Bitcoin’s potential claim of ever being used for transactions.

Interestingly, Lifthrasir noted that if the hype surrounding Bitcoin’s value proves to be true and its price skyrockets, it may actually harm the Bitcoin ecosystem. He said,

“If Bitcoin grows in value such that it threatens the nation-states, which it already kind of is they’re going to clamp down on it and people underestimate how powerful the state is.”