Grayscale’s LTCN, BCHG unlikely to rescue Litecoin, Bitcoin Cash’s prices

As one of the largest organizations managing crypto-investment trust funds for accredited and retail investors, Grayscale recently crossed the $6 billion-mark with respect to Assets under Management (AUM). That’s not all, however, as over the past few years, besides catering to institutional investors, Grayscale has also seen increasing retail demand for crypto-exposure through 401k savings.

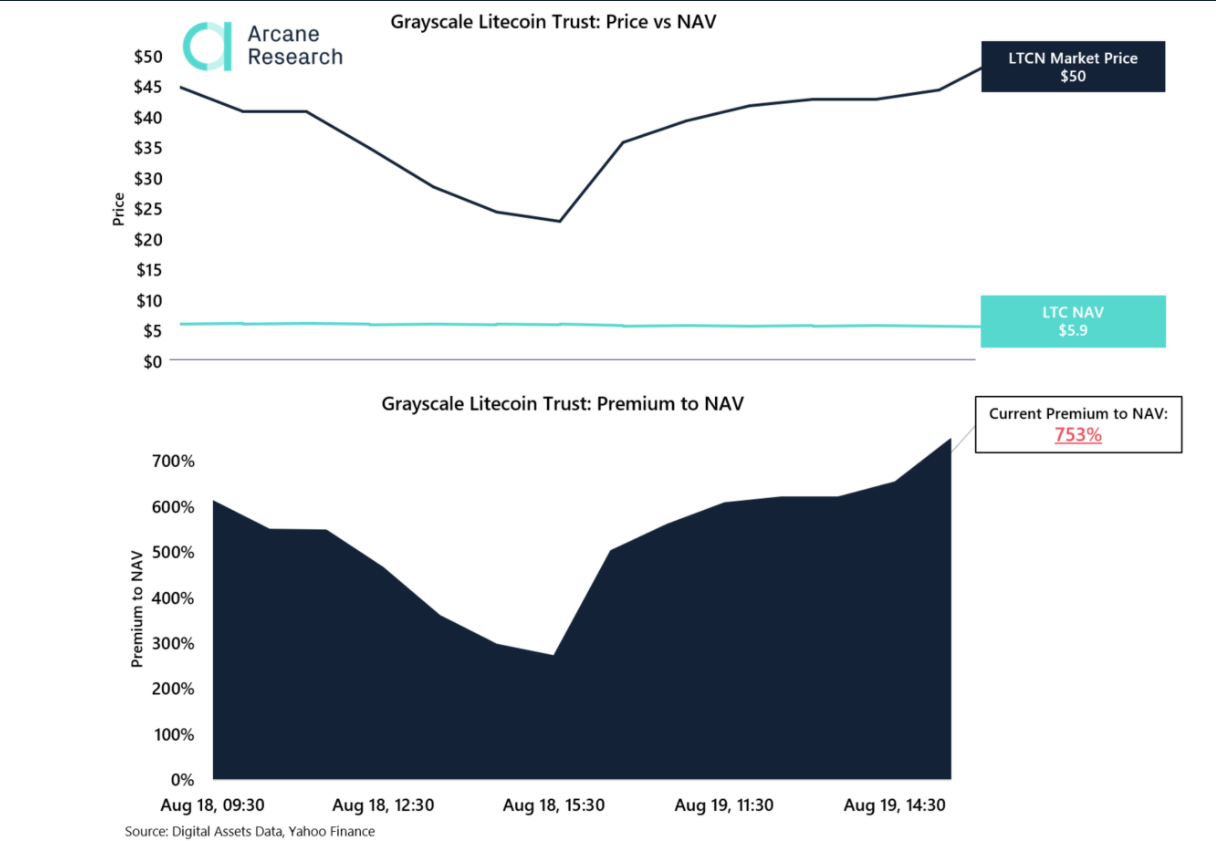

Now, according to a recent announcement, Grayscale’s Litecoin (LTCN) and Bitcoin Cash (BCHG) trusts have gone public in the market. Since the launch of Litecoin’s Trust on 18 August 2020, the product has traded with a massive premium on it. In fact, the premium on LTCN was a whopping 753%, at the time of writing.

A similar case was developing in the case of Bitcoin Cash as the premium on BCHG, at the time of writing, was as high as 351%. It should be noted, however, that the premium on Bitcoin Cash was falling over the past few hours, indicative of BCH’s contracting demand when compared to Litecoin.

Don’t count on Grayscale to re-invigorate Litecoin, Bitcoin Cash markets

Over the past few months, while crypto-assets like Chainlink and Cardano have ruffled some feathers in the altcoin space, cryptos such as Litecoin and Bitcoin Cash have lost a lot of steam. The latter cryptos have failed to register any notable highs, while major assets such as Bitcoin and Ethereum, at the very least, remain relevant to the market.

Now, there have been speculations about Grayscale’s introduction of Litecoin and Bitcoin Cash trust funds indirectly improving their respective market caps. Alas, the likelihood of either of those two happening is far from high.

To be clear, investing in Grayscale products is not exactly like investing in digital assets. A major disadvantage of investing in GBTC, ETHE, or LTCN now is the fact that traders end up paying high premiums and annual fees that are associated with the overall turbulence of the market.

Hence, such an accumulation of higher premiums for third-party products hardly translates into the growth of a crypto-asset in terms of market valuation.

Hence, the news is unlikely to push Litecoin and Bitcoin Cash into a bullish gear, especially since such momentum has been missing for months now.

![Reasons why Litecoin [LTC] investors should be concerned](https://engamb.b-cdn.net/wp-content/uploads/2023/12/ambcrypto_A_Litecoin-themed_scen-400x240.png.webp)