FTX’s SBF comes under scrutiny as CREAM votes on de-listing FTT

The last few days have seen a lot of public debate and questions emerge around the use of FTX’s FTT token by Alameda and Sam Bankman-Fried to borrow assets for short-selling.

The issue in question initially arose after people accused SBF, a well-known industry figure and CEO of FTX, of borrowing YFI, allegedly destroying its price, before later selling it on Binance.

Following this, came the realization that $80 million of FTT (FTX’s native token, an exchange that is centralized in nature) is being used as collateral for $CREAM. Soon, there were many in the community who were questioning why the FTT token was added to CREAM Finance, despite it not being a popular token in the cryptocurrency market. In fact, according to Etherscan, Alameda is the only user of FTT with 96% crFTT.

What’s more, many in the community have attacked Cream Finance for the risk associated with having 40% of all collateral in a not-so-popular exchange token. “Reckless” was what DTC Capital’s Spencer Noon called it, with the exec going on to highlight that 25% of the entire $FTT float was in $CREAM too.

40% of all $CREAM collateral is a single centralized exchange token.

25% of the entire $FTT float is in $CREAM too.

This is straight up reckless from a risk perspective, and the people who are going to get hurt the most are $CREAM holders. https://t.co/uMBo08ITAI

— Spencer Noon (@spencernoon) October 8, 2020

As highlighted, the issue in question birthed a furious discussion online, one leading to a governance snapshot vote to determine whether to delist FTT from CREAM.

The proposal in question argues in favor of de-listing FTT, stating,

“If FTT were de-listed, no other users would likely be impacted; there is very little supply volume and very little borrowing demand for FTT. FTT is not a normal asset. Many assets can decline in price, but because FTT is a fully centralized token, if there is an issue, it can instantly go to $0, which is a safety risk for all C.R.E.A.M. users.”

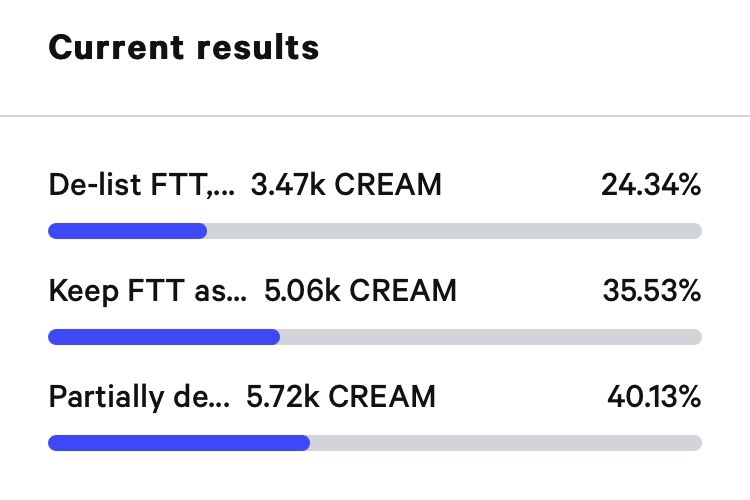

However, contrary to the popular backlash on social media platforms, the results for the same, at the time of writing, weren’t exactly supporting those who have called for the said de-listing. In fact, at the time, only 24.34% had voted to de-list FTT while over 40% voted to ‘partially’ de-list FTT by reducing its borrowing power.

Source: CREAM governance proposal

Whether CREAM users believe that FTT is a source of revenue that creates loan demand or whether they have been influenced by SBF’s opinion of this proposal on Twitter remains unclear at this stage.

Sam Bankman-Fried, for his part, argued against what he called “inaccuracies” in the said proposal. Not only did SBF claim that de-listing FTT would “drastically reduce borrow demand, lenders would no longer get interest, and TVL would go way down,” but he also argued that a 200 YFI short over days does not and did not destroy it (YFI).

In fact, on the same Twitter thread, SBF went on to state that single asset risk is not CREAM’s biggest risk. Instead, DeFi coins listed on this platform carried a “much much greater risk,” he claimed.

He argued that the $70 million combined value of ETY, YFI, BAL, COMP, CREAM, LINK, LEND, CRV, MTA, SUSHI, and UNI had a higher crash risk, adding that this basket was far more volatile than FTT.

15) In both directions.

On 9/1, FTT was 20% higher.

The *average* of the DeFi coins was 240% higher.

— SBF (@SBF_Alameda) October 10, 2020

Either way, the amount of $FTT collateral on CREAM Finance is 25% of the $FTT float and 40% of CREAM TVL. So, if the value of $FTT were to fall, lenders could be in a whole lot of trouble.