Bitcoin

For Bitcoin investors, can loopholes in tax regulation be a blessing?

Cryptocurrencies like Bitcoin have seen its adoption grow significantly in the past few years. The increase in regulatory clarity and the easy access to on-ramps has been a catalyst that has enabled more investors into the crypto ecosystem. However, for crypto traders, tax regulations continue to be a challenge in which the thin line determining compliance needs to be carefully navigated.

In the latest episode of The Pomp podcast, Chandan Lodha, Co-founder of Cointracker, spoke about the importance of understanding the intricacies of crypto tax and strategies that can help improve one’s yields. Lodha pointed out while the pain-points of traditional financial rails have spilled over to crypto there is no real need to reinvent the wheel altogether. He highlighted how tax-loss harvesting is a common practice for those looking to capitalize, he said,

“Basically a tax rule that will allow you to sell a cryptocurrency asset that you have at an unrealized loss and then buy it back. So the effect of that is you maintain the exact same cryptocurrency positions as you have before.But your tax bill is lower because you’ve internalized and realized in loss.”

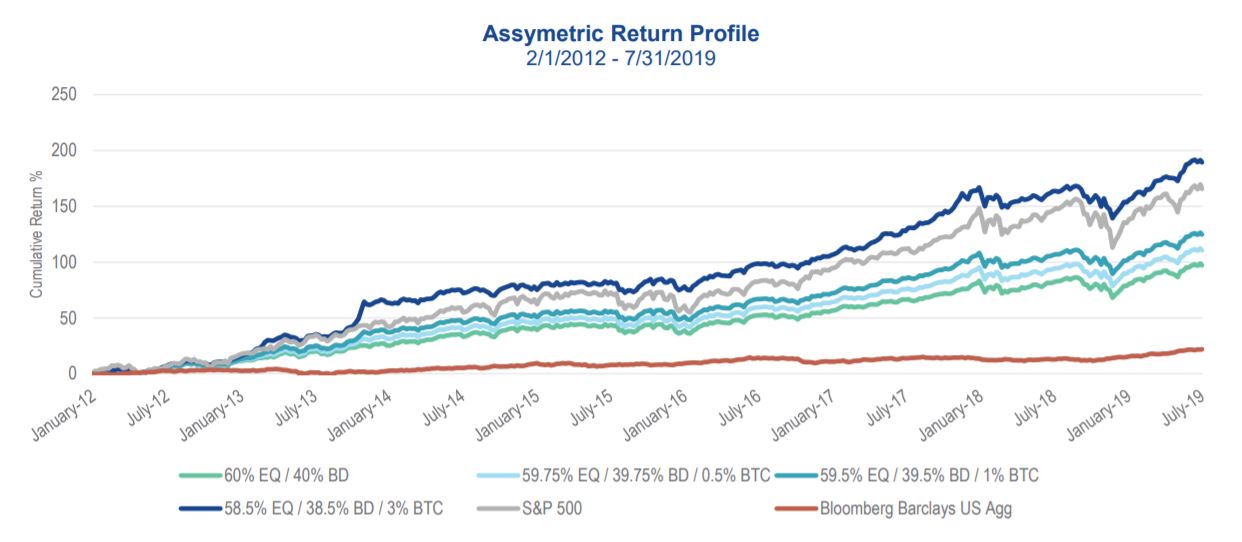

Source: VanEck

Interestingly, recent reports suggest that Bitcoin may enhance the risk and return reward profile of institutional investment portfolios, which has also been a key driver with regard to increased adoption from such investors. However many are concerned whether the tax regulations surrounding crypto fail to keep up with the industry.

Jake Chervinsky, Crypto-analyst and lawyer, in a recent interaction, echoed his concerns surrounding the current regulatory framework when it comes to crypto-tax. He highlighted,

“There are lawyers who specialize in very narrow areas of laws applying to the finance industry but it’s really hard to say in general how all of these different frameworks are applying to crypto broadly.”

The uncertainty and vague tax framework also have led to certain loopholes traders can take advantage of. Lodha also discussed the loopholes pertaining to practices involving wash-trading, he noted,

“You can still take advantage of not having to get your wash sales disallowed in crypto. The reason why it’s different is because the wash sale rule is specifically written in the tax code for securities, and because Bitcoin and other cryptocurrencies are classified by the IRS as property they don’t fall into the wash sale rule.”

In comparison to regular stock market investments, such rules can be taken advantage of by crypto traders dealing with top cryptocurrencies like Bitcoin and Ethereum as both are not considered to be securities by regulators.