For Bitcoin, can multisig be the key to jurisdictional problems?

Digital assets have been gaining traction lately, with more and more financial institutions and traditional investors taking an interest in them. Over the course of a decade, cryptocurrencies like Bitcoin have been able to experiment with varying use cases, with the king coin recently reinvigorating its safe-haven and flight to safety narrative. As its adoption rate in mainstream finance grows, digital asset custodians seem to have a larger role to play in shaping the future of cryptocurrencies.

On the latest episode of the Unqualified Opinions podcast, Mike Belshe, Co-founder and CEO at BıtGo, spoke about the role of institutional custodians in the digital asset landscape and the need for better custody solutions. Highlighting the crucial role technologies like multisig can play he said,

“The ability to have multisig where it’s distributed, not just across a few keys inside the same country, but can distribute those globally, we can create wallets which are actually resistance to jurisdictional problems.”

He went on to highlight that it opens up a lot of possibilities, one “where you can take keys, you might be able to distribute them across a couple of different companies – one to hold your backup key, one to hold your co-signing key.” Even when one is holding the last key, one can still build these in ways that one has control of the coin and the overall asset, he added.

With regard to the security measure deployed to keep exchanges secure, Belshe highlighted how centralized operating models can bring out inherent systemic risks. He pointed out,

“The much more likely vulnerability might be with exchanges that have gone fractional, unintentionally or intentionally. And it seems that multisig transactions should put these exchanges in a position where they could do proof of reserves.”

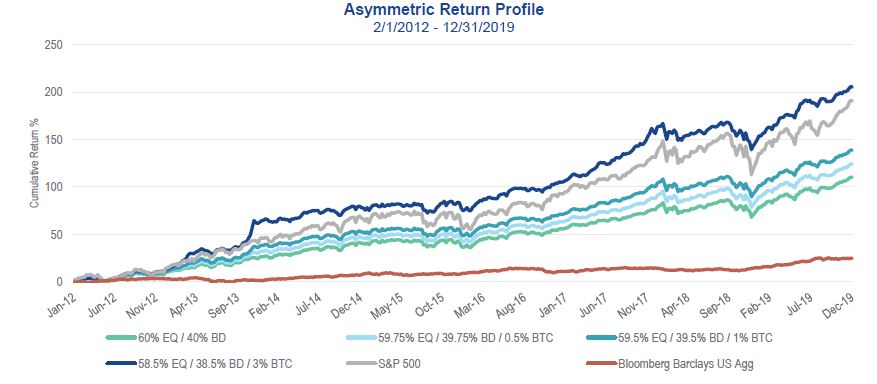

Source: The Investment Case for Bitcoin, VanEck

Bitcoin’s limited supply, the upcoming block reward halving event, and the fact that it has been the best performing financial asset of the past decade; all these factors have renewed interest from traditional investor circles. In fact, a recent report by VanEck had pointed out how a small allocation to Bitcoin, “significantly enhanced the cumulative return of a 60 equity and 40% bonds portfolio allocation mix while only minimally impacting its volatility.”

The increasing interest in digital assets like Bitcoin from institutional investors has also brought the role of crypto custodians to the forefront. According to Belshe,

“That’s actually good for security and for the ecosystem. We’ve benefited from that in terms of how do the custodians interoperate today, that is still growing. We need to do a lot more here. I think there’s room for interoperable protocols that will eventually emerge for how we can do atomic swaps between custodians, perhaps multiple assets in the same transaction.”