‘Fear’ hijacks Bitcoin premium rates; Volume to the rescue?

The cryptocurrency market has registered a wave of corrections over the past few weeks. In fact, the price of the world’s largest digital asset, Bitcoin, has fallen by over 14% since the beginning of September, with a host of liquidations on 2 and 3 September responsible for the cryptocurrency’s price falling below $10,000. However, Bitcoin soon managed to push above $10k and was valued at $10,256.98, at press time.

Despite the aforementioned corrections in the cryptocurrency’s price, most of the market’s traders seemed to be at ease in the face of the new level of consolidation, at the time of writing. As the spot market tried to stabilize, the Futures market was registering falling interest on the charts, as well as premium rates.

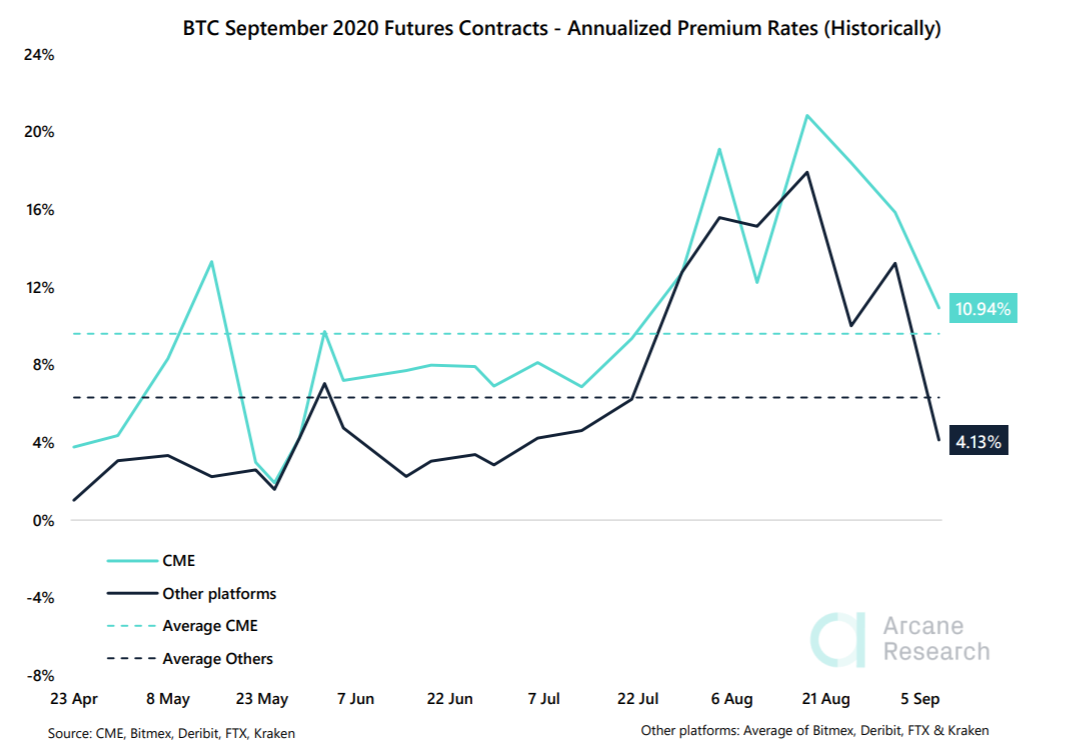

BTC Futures premium rates were soaring towards the beginning of August, a time when the market was rallying. However, the depreciation in the market’s value over the past 2 weeks has contributed to premium rates dropping sharply.

Source: Arcane Research

According to data compiled by Arcane Research, institutional traders appeared to be more bullish on the market, than their retail counterparts. Interestingly, even though the Chicago Mercantile Exchange’s [CME] premium rate was down 11% at press time, it was still registering a higher premium than retail platforms.

In fact, the average premium rate for the month of September for retail-focused platforms was 4%, its lowest figure in the last two months.

The falling price and premium rates could be the result of a shift in sentiment across the market. The crypto-market had remained in the “Extreme Greed” category for most of August. However, the unexpected sell-offs that ensued later seemed to push this sentiment down to a state of fear.

For many traders, such corrections didn’t come out of the blue. However, the sheer scale of it and the drastic change in sentiment came as a surprise to many. Alas, all didn’t seem lost as while the crypto-market was well-entrenched in the territory of “fear,” Arcane’s charts revealed that volume seemed to be returning to the Bitcoin market. In fact, the 7-day average volume for the week was up by over 60%.

If these figures were to climb even higher, some of the lost market confidence can be restored, pushing the price of Bitcoin higher.