Evai.io unveils decentralised ratings model to bridge crypto and traditional finance

In the current era of the financial industry, cryptocurrencies have become a household name for investors and traders. Over the past decade, we have seen Bitcoin laying out the path for the rest of the industry, which has led to the current influx of crypto projects coming into existence.

The idea of investing in digital assets has spread like wildfire and it is no longer easy to sort out the good projects from a batch of bad apples. According to CoinMarketCap, there are 5862 cryptos at the moment, and surely not each and every one of them is a credible asset.

Now, in order to solve that conundrum, Evai.io has come forward with a world-leading unbiased cryptocurrency ratings platform that will provide a unique outlook and unbiased evaluations on the numerous digital assets on the market.

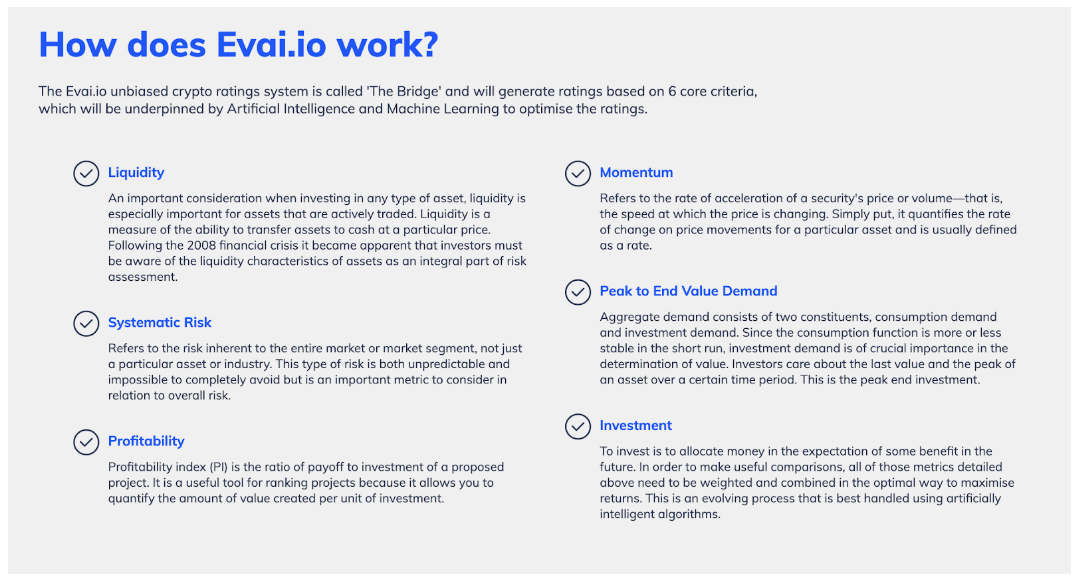

Founded in 2019, Evai.io has been evolving its unique digital asset ratings system named “The Bridge”, which is based on the breakthrough academic theory of Professor Andros Gregoriou at the University of Brighton. The foundations of his six-factor ratings model will be coupled with Artificial Intelligence and machine learning to generate accurate and unbiased crypto-asset ratings.

According to the organization’s white paper, the Evai.io rating mechanism is based upon these important fundamentals:

Source: Evai

Work on pioneering the new ratings system has run in parallel with the launch of the EVAI ERC20 token, which is available for investors to purchase and will also be used to reward developers who support the evolution of the ratings platform.

While the ratings system has been inspired by the research of Prof Andros Gregoriou, it’s development has been led by Matthew Dixon, Evai.io CEO and Founder who has over 30 years of experience in the world of finance and trading, after becoming a regulated Financial Advisor (CF30) in the United Kingdom (UK). Dixon has previously managed successful Fintech Investment funds under the FCA regulation and been a regular consultant to the World Bank.

AMBCrypto recently sat down with Matthew Dixon, in order to further understand the rating system implemented by Evai.io and its functionalities.

Q1. When you came up with the idea of Evai.io, what was the primary objective you had in mind? What is the void that Evai’s services are filling in the industry today?

Answer- I started trading back in 1985 and have witnessed and lived through several major economic crises over the last 35 years. I’ve always been interested in looking back on the past to inform the future. One of the things I looked back on was the crash, particularly of 2008, and what was the cause of that crash.

Fundamentally, one of the main reasons was the failure of ratings. Lehman Brothers are being rated AAA when essentially it was misleading. The analysis that I did indicated there was certainly a bias that rating agencies were being paid by the institutions they were rating, which certainly can’t be a healthy state of affairs. So it got me very interested in ratings and how that affects the markets.

So, when I started to increase my knowledge of cryptocurrency as a form of investment the obvious move for me was to start to do some analysis. At the moment, crypto investments are driven so much more by sentiment than by genuine fundamental analysis. You can make money following sentiments. It’s basically just following the trends, but eventually, people will get caught out.

Therefore, people need to have some clarity on where to invest, where value is, and sentiment isn’t a good indicator of value. We’re not looking at predicting the bet, the winner tomorrow, but we’re looking at where there is the fundamental value. And so ratings and education are vital to that. That’s where Evai comes into the picture and there’s nothing like Evai out there at the moment. There’s no real independent decentralized rating system available. So we’re genuinely excited about our ratings model and believe there’s a market for what we’re doing.

Q2. How would you differentiate Evai.io from other firms and organizations that might be offering similar types of services?

Answer- There are a few different things that I believe to be important differentiators. The first one is that we genuinely seek to be independent. We are not coupled with any exchanges or any media organizations. As I said, one of the big problems in 2008 was bias and the fact that people did not have to face any repercussions for releasing falsified ratings and the same could be predicted in relation to the cryptocurrency market.

I think the fact that we are decentralized, and our ratings are decentralized, is going to attract interest, knowledge, and technology from everywhere. That’s one important element.

Secondly, our foundations are rooted in an academic understanding of historical trends in financial markets, but also future thought leadership and its application. Our Head of Development, Professor Andros Gregoriou is a very well respected academic who has published over 80 papers in leading journals. He’s an advisor to many of the industry bodies and leading organizations including the CFA, London Stock Exchange, and Bank of England. So he’s really the ideal person to have onboard to build a deeper understanding and to translate his breakthrough theory into a practical application that will benefit a wide range of audiences from people taking their first steps into crypto to experienced investors and even hedge funds.

Source: Evai.io

Q3. Over the past few years, even though the image of cryptocurrency has improved, the largest digital asset industry is associated with the shadow of Silk-Road and many mainstream media outlets shade it under a bad light. As a financial ratings service provider, how important is Evai.io’s role with respect to building trust in the cryptocurrencies and the larger crypto market?

Answer- It is very important to build trust, yes that is true when you are dealing with anything related to digital assets. Since Evai.io has been founded we have actively pursued engagement with regulatory bodies such as the Financial Conduct Authority (FCA) in the UK and shared a fundamental overview of our business model. Ultimately we want to help investors navigate the crypto market and enable them to identify solid investments backed with a genuine use case.

In the UK, the government is also bringing in new advertising regulations for cryptocurrency-based businesses and this is another step that can help to build trust with our audiences and those who are considering crypto investments. Working within the framework of these new and rigorous standards, we can be assured that legitimate businesses will thrive and those that are looking to deceive consumers will be phased out.

The mainstream media also has a vital role to play in developing their understanding of how cryptocurrency works and how transactions are highly traceable. Within a couple of weeks of the twitter hack, the perpetrator has been identified. At times it seems mainstream media can be quick to jump on the bandwagon of Bitcoin being used for nefarious purposes when the reality is that its movement can be tracked and traced. Positive news stories around the new product offerings of Visa and potentially PayPal will also help to play a part in shining a spotlight on the benefits of cryptocurrency to consumers in terms of reduced fees, speed of transaction, and its role as a legitimate store of value.

Q4. Evai token pre-sale went live on the ZBX exchange on the 15th of July. How was the response received by the token and where do you see the market three months from now?

Answer- We have been excited and astounded by the Evai presale response as we rapidly sold out the initial presale funding rounds. The first tranche launched on 15 July on ZBX and sold out in half the time we had anticipated and the second tranche at $0.07 sold out in 3 days. The latest price is $0.15 with immediate effect. For those investors who got in early, they have seen a rise from $0.0025 in November 2019, so it has been great to reward their early commitment to our project. As we head towards our exchange listing in mid-September our target is for further growth and momentum as we get closer to launching the ratings.

The reason we linked with ZBX exchange in the first place was because of their reach into the far East i.e China and its parent company is the third-largest exchange in the world. So they are a key exchange for us to partner with on the presale with their highly engaged audience.

Evai registrations on the site are up about 300% since we went ahead with the pre-sale on the ZBX exchange. We were anticipating, it would take at least a month to fill that fund requirement but we have already achieved the target. So we’re now really happy to be ahead of schedule.

Such participation shows us that we are creating a massive appetite for what we’re doing, and it’s not just from a speculative drive. It’s bringing in a range of people, and they are recognizing that what we’re offering, is needed within the industry.

Q5. 2020 has thrown a real curve-ball in front of global blockchain firms and businesses dealing with cryptocurrencies. According to you, how bad are things likely to get, and how do you envision Evai’s roadmap to evolve?

Answer- Back in February, when talks of nationwide lockdown surrounded the globe, I was initially very concerned. However, interest in Bitcoin and cryptocurrency investments seems to have been accelerated during the lockdown and Evai has thrived off the back of this increased momentum and rate of adoption.

As far as the crypto industry goes, it’s an online and decentralised model that people can access anywhere in the world, and as we have seen businesses are increasingly becoming decentralized with more people working from home more than ever. So, these changes don’t impact our business. In fact, they are beneficial for our business model. So we don’t see it as being negative for us. What we believe is that we will be able to provide a reliable and trusted ratings platform that will empower the new wave of investors entering the crypto market.

After evaluating Evai’s platform, whitepaper, and speaking with Matthew Dixon, it is fairly evident that Evai.io is keeping the speculative part of cryptocurrency out of the picture. The platform is a genuine enterprise, filling up an authentic gap in the industry. As told by Dixon, it is not a speculative investment because it has a genuine business that has real investors behind it.

Additionally, the fact that Evai.io is blending traditional financial experience with Academic theory in building its operation is worth mentioning. Dixon has over 30 years of experience in the financial industry whereas Professor Andros, Gregoriou, Head of Investment Research, has acclaimed academic proficiency. Hence, the platform is creating a defined bridge between conventional and crypto-assets.

For more information on Evai.io, please visit their official website.

Disclaimer: This is a paid post and should not be considered as news/advice.