European Central Bank conducts survey to gauge people’s trust in a digital Euro

After European Central Bank announced that the central bank wanted to “hear the views of the public and interested stakeholders,” with regard to the Digital Euro, ECB launched a “public consultation” survey on its central bank digital currency. As mentioned earlier, the bank hoped that this “consultation” would help them understand whether European people at large trusted and accepted the digital euro. Regardless of the outcome of its ongoing research and experimentation, ECB stated that it would reach a decision about launching the CBDC (or not) “towards the middle of 2021.”

ECB is said to have quickened its development of the CBDC project amid COVID-19 pandemic and framed the launch of the aforementioned public consultation in that regard. ECB claimed that in order to curb the spread of the virus, citizens have resorted to contactless payments, with many retail users investing in BTC and other private cryptocurrencies. This trend seems to have nudged lawmakers toward creating their own digital currencies. Moreover, ECB believed that issuing a CBDC could help them “cushion the impact of extreme events — such as natural disasters or pandemics — when traditional payment services may no longer function.”

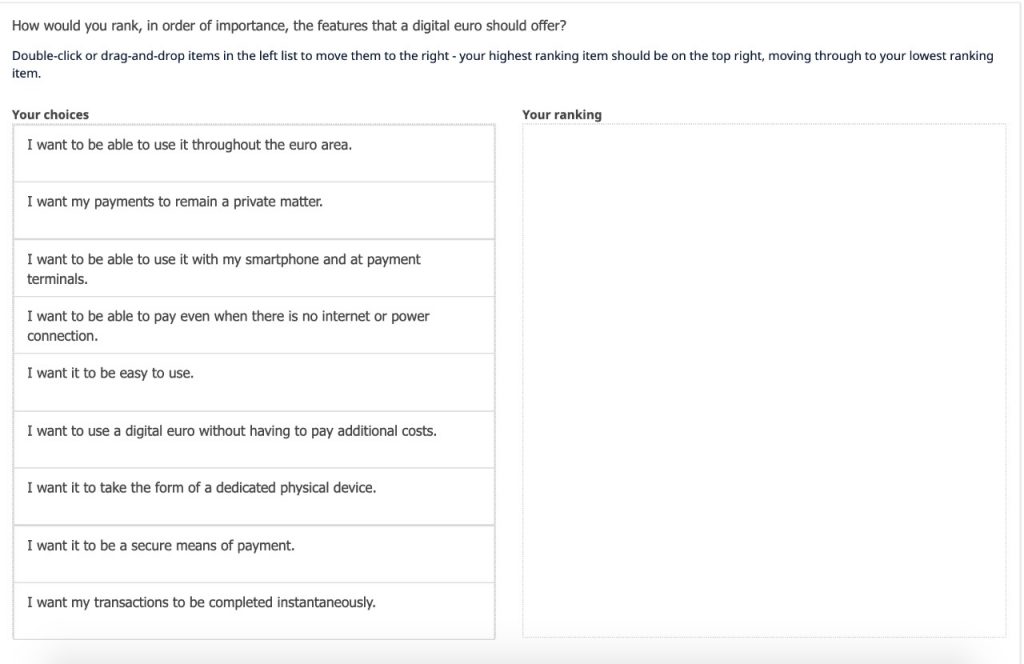

This survey, however, which is open to citizens, enterprises, NGOs, trade unions, and others has asked participants to rank aspects of the future CBDC, in order of importance, as seen in the image below:

In the survey, the ECB further invites respondents to comment on any specific challenges participants can foresee that would prevent them from using a digital euro. The survey also asks respondents to choose between a digital euro that would not need a central bank or intermediary to process every single payment and a digital euro that would require intermediaries to record transactions.

According to the ECB survey: a CBDC without intermediaries means:

Using a digital euro would feel closer to cash payments, but in digital form — you would be able to use the digital euro even when not connected to the internet, and your privacy and personal data would be better protected.

On the other hand, the ECB explained that a CBDC with intermediaries:

It could make it easier to integrate a digital euro into currently available electronic banking services and applications.

Other aspects of the survey gauge the perspectives of finance and technology professionals and include topics such as data protection and privacy, Anti-Money Laundering, cross-currency payments; use outside the euro area, and integration with merchant systems among others.

So far, ECB officials have insisted that the Digital Euro will only complement cash and not replace it. This electronic version of the euro will be stored in a digital wallet and will still be based on blockchain. However, it must be noted that since the digital currency is backed by a traditional institution, it will be highly centralized.