Why Ethereum Options’ August-September performances are underrated

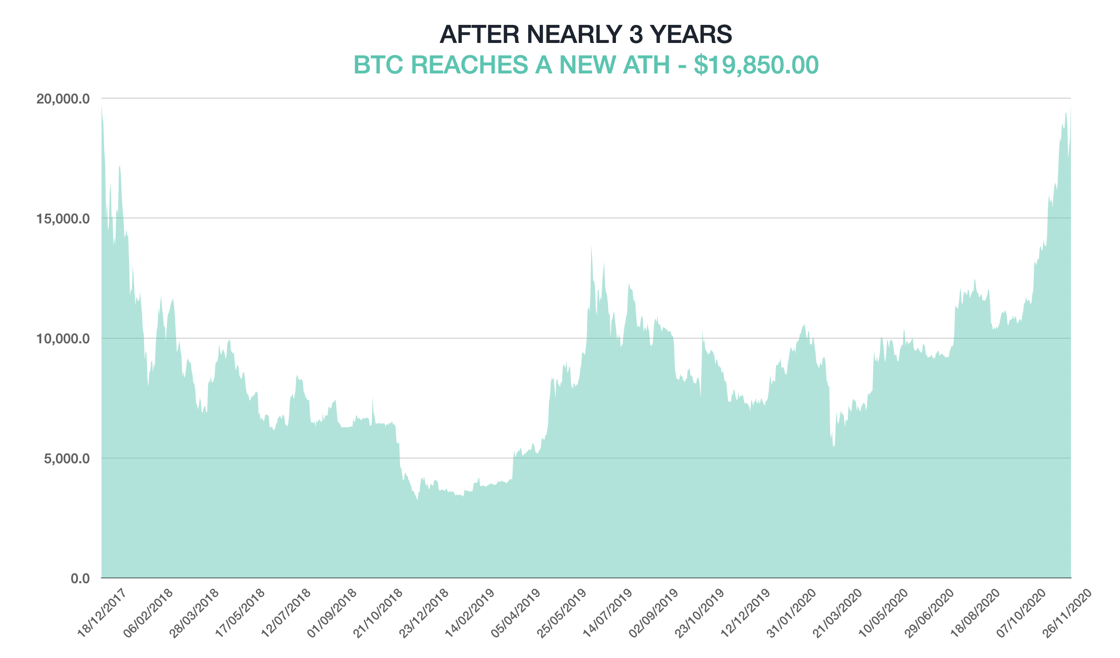

The memory of November 2020 will remain in the minds of Bitcoin investors and the collective crypto-industry for a long time. A rally ignited in mid-October finally realized its full potential in the penultimate month of the year, with many of the market’s premier crypto-assets climbing to new highs.

While most digital asset sectors pictured high demand, the derivatives market saw record-breaking Open Interest on the charts.

According to Deribit’s November Institutional newsletter, monthly notional turnover was recorded to be $14.3 billion, with a new average in daily Bitcoin Options. Over 25k Bitcoin contracts were traded every day, with unprecedented Open Interest levels of $4.8 billion witnessed too.

Bitcoin and Ethereum Options highs

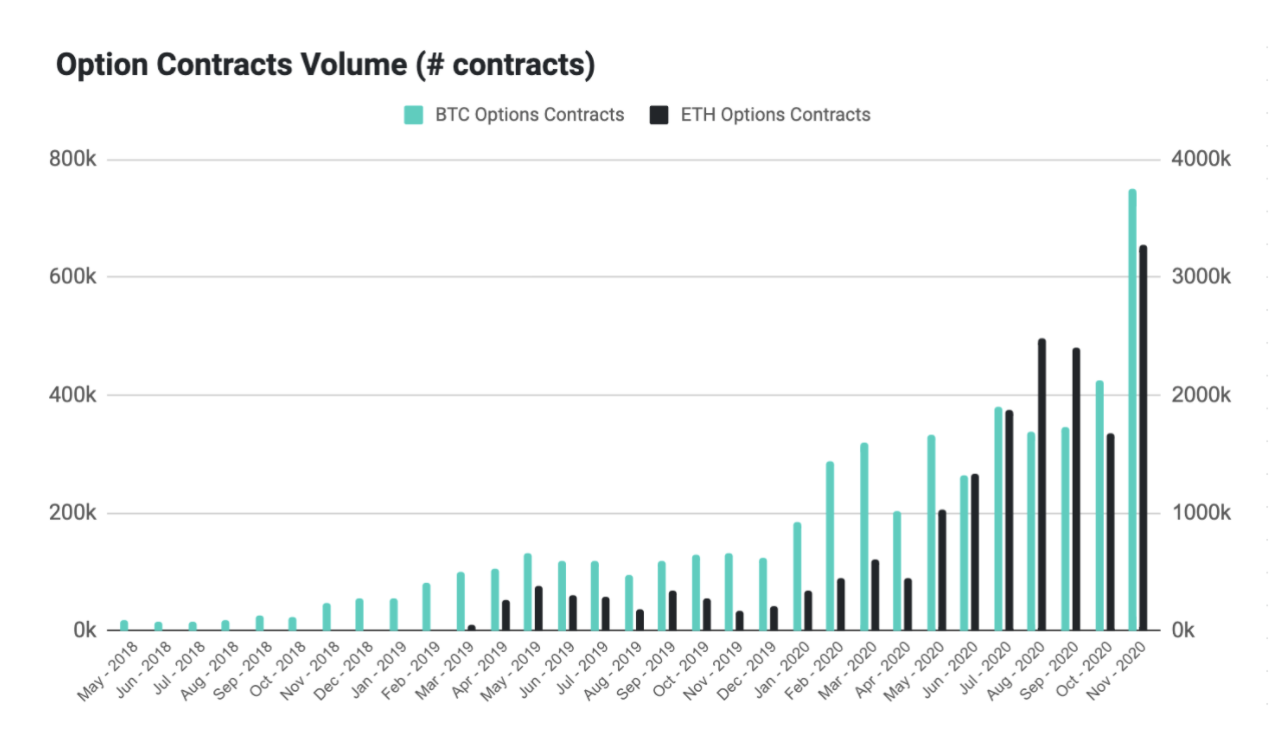

Source: Deribit

Bitcoin and Ethereum prices appreciated by 40% and 55% respectively, both price movements that had a massive impact on BTC and ETH contracts. According to the aforementioned report,

“750,123 BTC options contracts were traded in November 2020, up 77% versus October 2020.

3,270,065ETH options contracts were traded in November 2020, up 95% versus October 2020.”

Here, it is also important to note that December is currently on course to witness its highest expiry with 31% in total BTC OI and 44% for ETH OI.

Ethereum held the fort when BTC was down?

While these data sets are extremely attractive on paper, it is important to take note that before the start of October, Bitcoin Options were losing a lot of traction in the market. Its price held steady above $10k, but it was not moving the needle on the derivatives platform in any significant manner.

On the contrary, during this period, Ethereum Options were harnessing immense Open Interest from retail investors.

From the attached chart, it can be seen that Ethereum contracts volume overtook the same for BTC in the months of August and September 2020. While BTC did take the lead again over the past couple of months, it is fair to say that Ethereum kept traders’ attention and maintained their presence in the market.

When BTC failed to gather interest in between, ETH Options kept the collective OI at a considerable level. It is plausible, therefore, that these traders kept track of Bitcoin’s performance as well, and rather than exiting the market, they remained in the space due to Ethereum’s activity.

Today, Bitcoin and Ethereum Options are competing for a higher Open Interest among themselves. However, BTC contracts might have to be grateful to traders keeping their eye on the space, thanks to the performances of the world’s biggest altcoin.