Ethereum’s rising transaction fees may be a deal-breaker for day traders

Until quite recently, Ethereum’s price seemed to have surged overnight owing to the ongoing DeFi craze. In fact, according to many analysts, DeFi’s explosion has been the top driver for Ethereum’s growth. What’s more, DeFi’s Total Value Locked figures have grown from under $1 billion at the start of 2020 to upwards of $10 billion. This has not only multiplied ETH miners’ revenue, but increased transaction fees for traders as well.

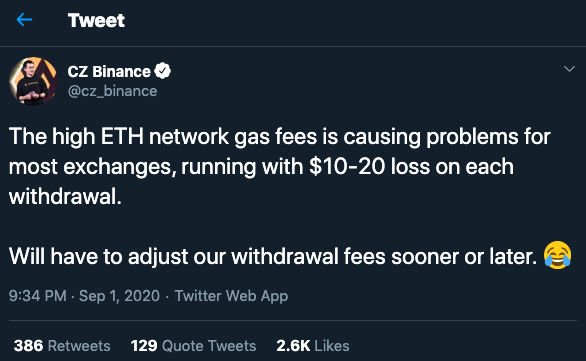

Hence, while the situation is rewarding for miners, the bargain is too expensive for a trader. In fact, according to Binance’s CZ, each ETH transaction is also contributing to $10-$20 losses to the exchange, with CZ going on to say withdrawal fees will have to be revised soon.

Source: Twitter

Binance’s move to increase withdrawal fees is sure to be emulated by other exchanges, and this will impact the profits of day traders and arbitragers. On the contrary, HODLers will be the least affected by high withdrawal fees because they withdraw rarely and high/low fees do not affect them.

This is a real challenge since traders are the biggest users of deposit and withdrawal features available on exchanges. In the case of day trading, a major challenge faced by traders is that the volatility is much lower than what can be found over a longer interval of time. While there are multiple profit booking opportunities, however, the margin is small. With high withdrawal fees, the profit gained will be nominal since a huge chunk will go into paying these fees.

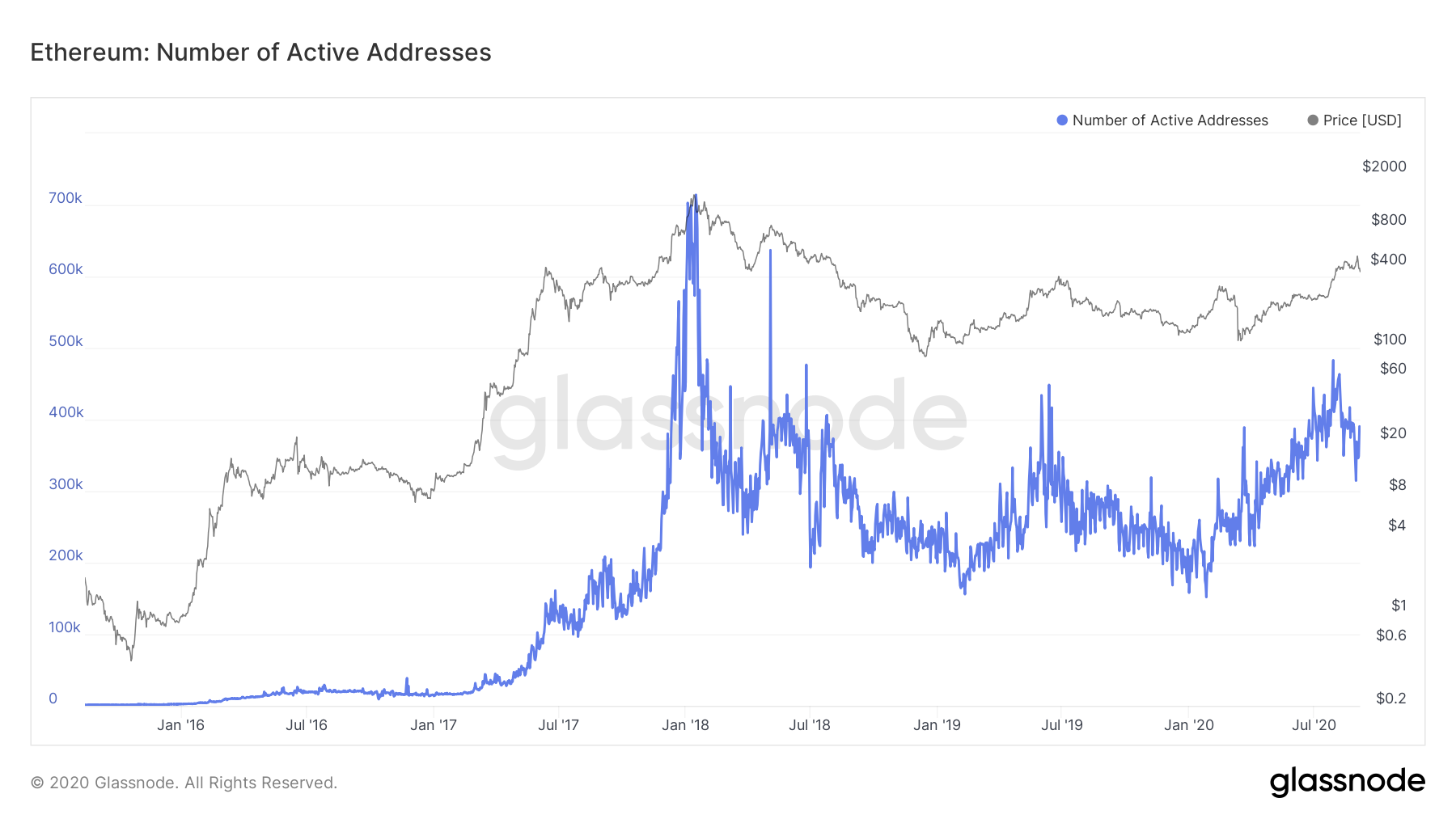

The risk-reward ratio is skewed against day traders. In fact, this problem is more serious for traders who profit through arbitrage on multiple exchanges or run arbitrage bots. The rise in ETH withdrawal fees may bring down their incentive for trading. While the number of active ETH traders has increased steadily over the past 90 days, if withdrawal fees are increased and profits become smaller, this number may drop.

Source: Glassnode

If the withdrawal fees are indeed revised on Binance, it may increase by $10-$12 per transaction as per CZ’s tweet. Needless to say, most of the market’s other crypto-exchanges might just follow suit.

Source: Glassnode

With an increase in withdrawal fees, arbitrage bots may run in losses as profit margins will continue to shrink. This may reduce the demand on fiat to crypto exchanges. Day traders should anticipate this possible drop in ETH prices and plan positions accordingly.