Ethereum, Tezos, Crypto.com Coin Price Analysis: 05 July

Bitcoin’s efforts to breach its immediate resistance on the charts and head towards $10,000 continue to be in vain, with BTC falling on the charts again over the past 24-hours. While the world’s largest cryptocurrency didn’t fall by a huge or a very significant margin, its effects were felt by the market and its altcoins, including the likes of Ethereum, Tezos, and Crypto.com Coin.

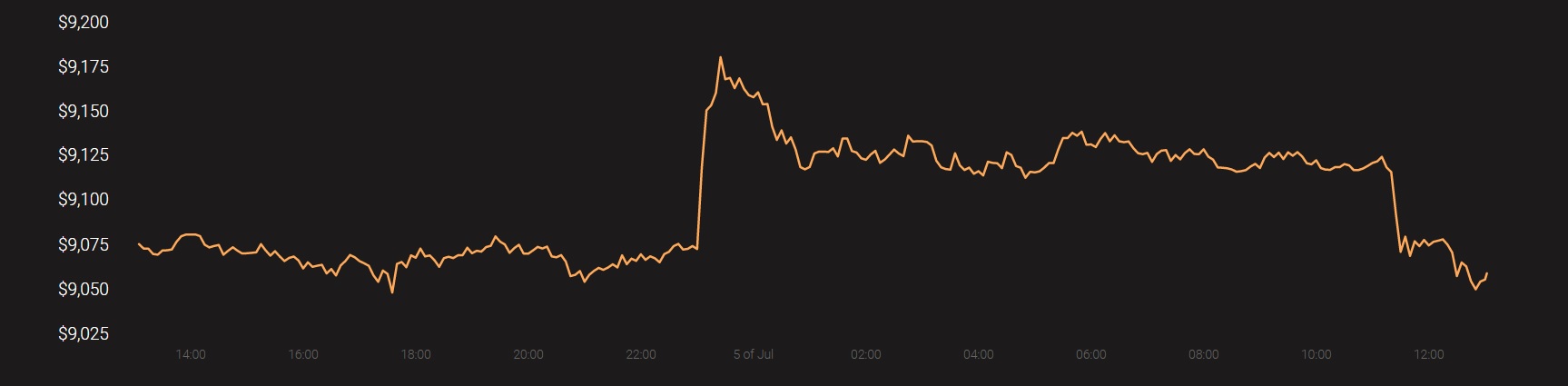

Source: Coinstats

Ethereum [ETH]

Source: ETH/USD on TradingView

Ethereum, the market’s top altcoin, mirrored Bitcoin’s movement as the king coin fell on the charts. Like Bitcoin, it didn’t dip by a lot; the same was a sign of the stagnancy that has permeated the crypto-market, with ETH trading within a $50 price band for over a month now. At the time of writing, ETH was trading at $226.89, still some way away from its immediate resistance on the charts.

Ethereum’s market indicators gave missed signals, however. While Parabolic SAR’s dotted markers were well below the price candles and underlined the bullishness in the market following a minor uptick in price yesterday, MACD indicator underwent a bearish crossover on the charts as soon as corrections took over.

Despite the fact that ETH’s price performance has disappointed many in the community, with ETH 2.0 looming, this might change. However, this expectation is dampened by the fact that historically, ETH 2.0 has been plagued by project delays. While July 2020 was the date given early in the year, there haven’t been too many updates in this regard lately.

In fact, Ethereum’s Vitalik Buterin recently commented on the delays in a recent podcast, claiming that Etheruem had underestimated how much time Proof-of-Stake and Sharding would take to complete.

Tezos [XTZ]

Source: XTZ/USD on TradingView

Tezos [XTZ] has been one of the market’s best-performing cryptos for some time now, with XTZ noting YTD gains of 66% on the charts. However, its historical price-performance aside, XTZ hasn’t been doing well lately, with the crypto on a steady downtrend on the charts since the first week of June. Its downtrend over the past month or so has been punctuated by sudden dips in price, such as the one that followed Bitcoin’s fall on the 24th.

Like Ethereum, Tezos too fell over the last 24-hours, its depreciation more pronounced than ETH’s, with XTZ trading too close to its support levels at press time.

While the widening mouth of Bollinger Bands pointed to incoming volatility in the near-term for Tezos, Relative Strength Index had stabilized somewhat after noting a steep fall towards the oversold zone.

Tezos was in the news a few days ago after Bolt Labs announced that it will be integrating its off-chain Bitcoin private payments protocol to the Tezos blockchain. However, this development seemed to have no effect on the crypto’s price.

Crypto.com Coin [CRO]

Source: CRO/USD on TradingView

CRO, the token native to the exchange platform Crypto.com, has been on an exponential run this year, with the crypto recording YTD gains of 279.88%. Not only has CRO’s growth in market cap taken the crypto-community by surprise, but so has its rapid rise in CoinMarketCap’s rankings. In fact, at the time of writing, with a market cap of $2.3 billion, CRO was ranked 10th. Over the last 24-hours, CRO noted a minor dip in the charts, with the same following a 5% hike over the 24-hours preceding it.

Many have raised questions about CRO’s sudden appearance in the top echelons on the cryptocurrency market, with its 330% gains since Black Thursday raising quite a few eyebrows. However, Crypto.com CEO moved to quash any untoward speculations recently, with the exec claiming that CRO’s growth has been driven by user growth and products.

While Awesome Oscillator noted some bearish momentum gaining steam, Chaikin Money Flow was right at the zero mark, a sign of capital inflows being equal to the capital outflows in the market.