Ethereum short-term price analysis: 22 June

Ethereum proponents are experiencing something similar to the days of the ICO bubble as Compound’s COMP token makes headlines. Additionally, the launch of ETH 2.0 has also increased interest in the largest altcoin. At press time, ETH saw a surge of 1.25% in the last 24 hours. However, the token’s price has appreciated by 3.75% in the last 8 hours and more seems to on its way.

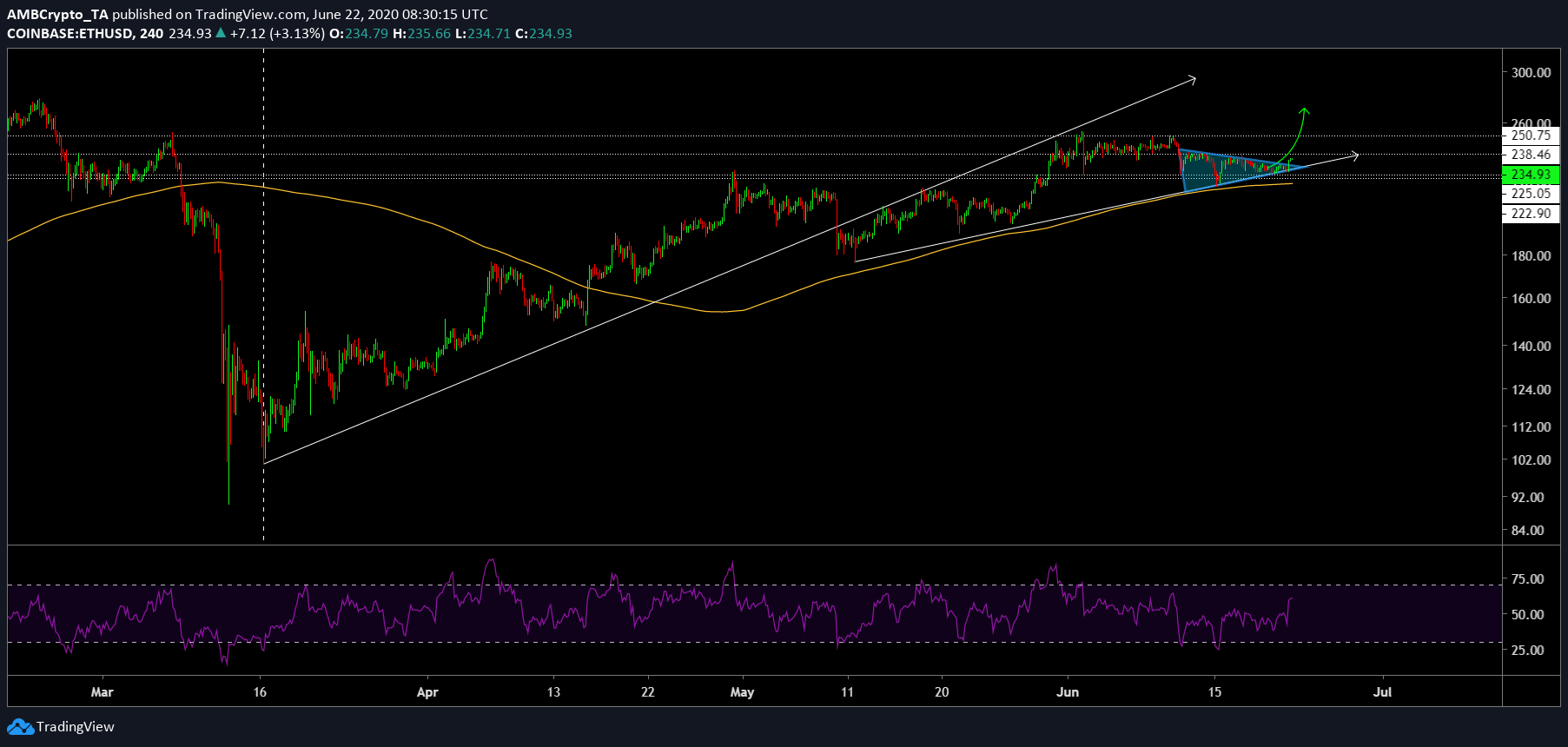

As the price bounces in the symmetrical triangle formation, the total market cap of ETH stands at $26 billion and has a massive 24-hour trading volume of $6.75 billion. While there is a renewed hype around DeFi due to developments around Compound protocol, there are things in the ETH ecosystem that need addressing. The high network utilization, enormous gas fees, due to a few smart contracts, and some of which are scams, have caused concerns about the shift to ETH 2.0.

ETH’s 1 Day chart

ETHUSD TradingView

In the last price analysis, the broadening wedge was highlighted and a potential increase in the price to $238. At press time the current price is $4 away from the target. The previously mentioned initial target $238 and the subsequent resistance at $250 are still valid.

Unlike in the last analysis, the RSI has changed quite a lot due to the recent pump. However, there is still a chance for the RSI to hit the overbought zone. This might yield in the price hitting $250, which would mean a 6.52% surge from the current price level of $234.

Additionally, the price has, [historically], found support from the 50 DMA [yellow] pushing higher. Hence, this push in the short-term could be substantial up to $250.

Conclusion

The targets remain the same as the previous article, with $250 being the final target. However, another possibility is the exhaustion of buyers at $234, followed by a dump to $225 [aka a drop of 4.32%]. Continued selling pressure could also push the price down to the 50 DMA [yellow] at $220.