Ethereum in for stop-and-rush as traders look to pull the trigger

For the past few weeks, the focus in the cryptocurrency market is on Bitcoin, and for good reason. The largest cryptocurrency in the market endured its third halving on May 12 and is now primed for a big move. In this testing time, the focus on the altcoins has shifted, now Ethereum looks to bring it back.

Ethereum, the largest altcoin, amassing a market capitalization of $23 billion, has been trading flat at just above $200 since the beginning of the month. Now, looking at the sentiment of derivatives traders, it is likely to go through a pause in volatility, before a massive move up.

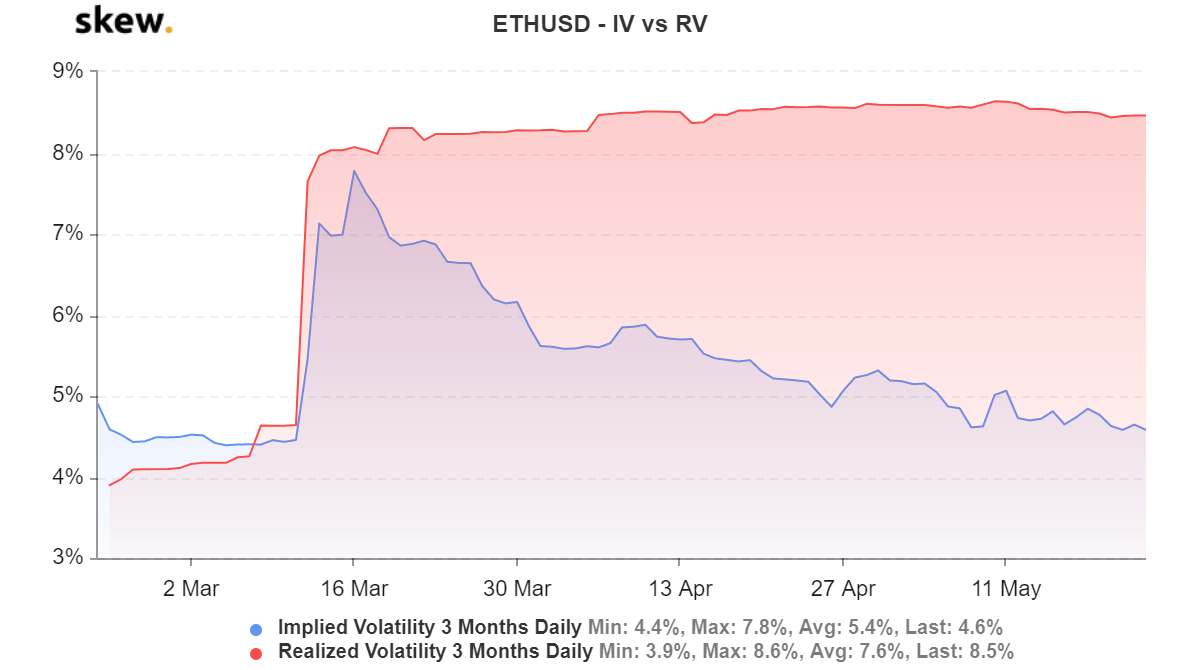

According to data from skew markets, Ether’s 3-month implied volatility [IV] has dropped to its lowest point in over two months, since the March 12 Bitcoin-focused price crash sent all the market metrics into a frenzy. At press time, IV of ETH has dropped to 4.6 percent, a steady decline since March 16 when the metric was as high as 7.8 percent. Additionally, while the IV is in a downtrend, the realized volatility [RV] is holding strong, due to the recent move of Ethereum. The RV for the altcoin has moved up from 4.6 percent prior to March 12 to 8.6 percent now, Indicative of a lowly volatility season for Ethereum going forward, relative to its historic moves.

Ethereum Options Realized Volatility vs Implied Volatility | Source: skew

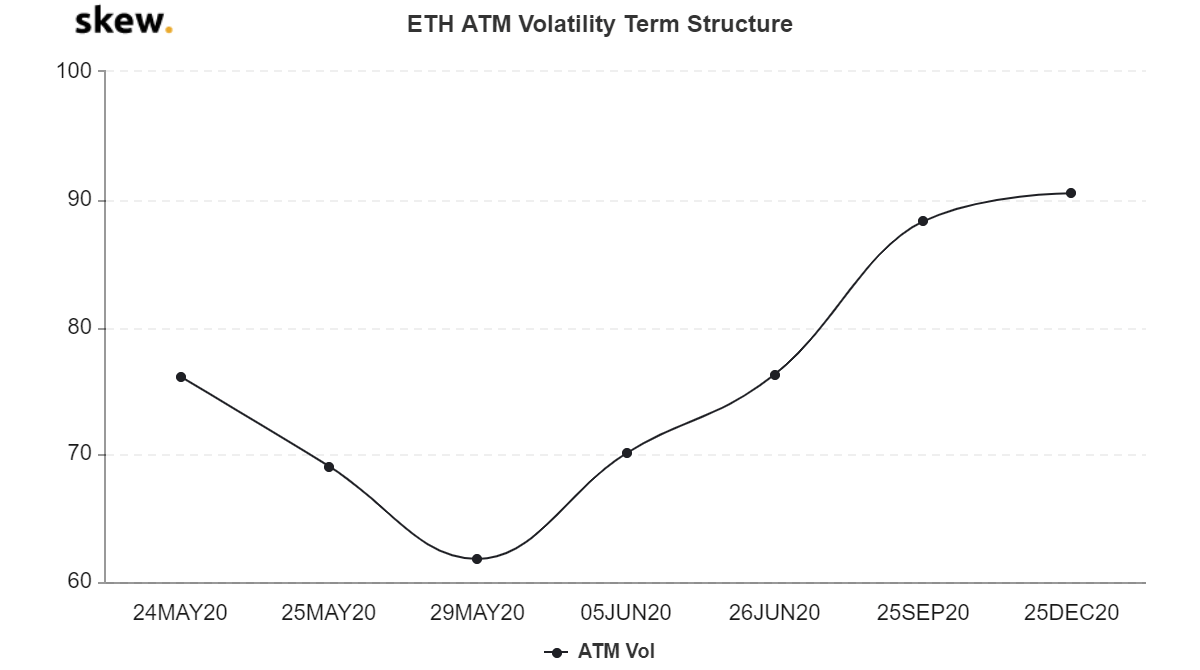

This volatility move, or lack thereof, is even pinched into a 1-month time frame. The 1-month at the money [ATM] implied volatility metric indicated a value of 76 percent, showing a disparity in the price of the cryptocurrency’s strike price on a one-month basis.

Looking at the volatility term structure for Ethereum options contracts, a dip before a move is observed. The term structure indicated a decrease in volatility by the end of the month [29 May 2020] followed by a steady increase to June and further into September. This move coincides with the combined expiry of options contracts set for 29 May and 26 June, with 91,900 ETH and 172,900 ETH contracts expiring respectively.

Ethereum Options ATM Volatility Term Structure | Source: skew

While this is the case for the derivatives market of Ethereum, the spot market is also waiting for a trigger. Data from Glassnode, the on-chain market analytics firm, suggested a decrease in outflow of Ether on cryptocurrency exchanges on 24 May. After increasing to a high of 16,000 ETH, the figure has dropped to below 11,000, Considering Ethereum is trading flat, and its implied volatility is low but expecting a rise in a few weeks, traders are at the ready to make a move on the price action.

? #Ethereum $ETH Exchange Outflow (2d MA) decreased significantly in the last 24 hours.

Current value is 10,408.110 ETH (down 40.1% from 17,387.788 ETH)

View metric:https://t.co/lqn3weo2j5 pic.twitter.com/aCZDwnIkWc

— glassnode alerts (@glassnodealerts) May 24, 2020