Ethereum held by exchanges grows by 5%; taking Bitcoin’s space?

If the difference between Bitcoin and Ethereum’s market cap is observed right now, it can be found that Bitcoin is ahead of Ethereum by a whopping $115.86 billion. At face value, there should not be a comparison of any sort between the two; however, it is human proclivity to compare the 1st and 2nd best in any field.

Over the past week, Bitcoin’s active addresses registered a hike of 6.3 percent. On the contrary, Ethereum’s active addresses registered a decline of 13.4 percent.

Source: Coinmetrics

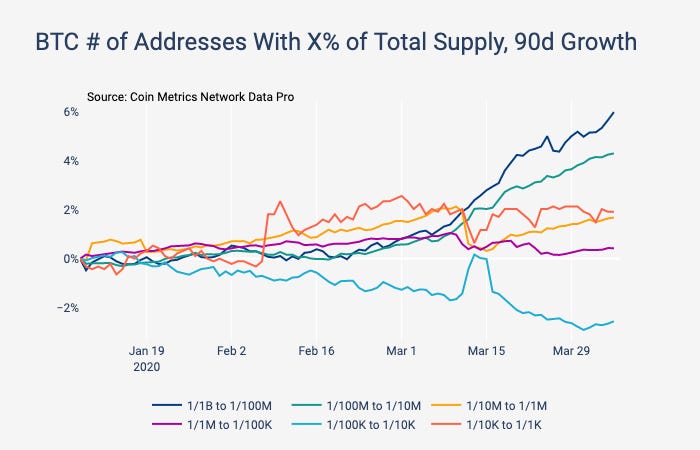

Now, according to Coinmetrics’ latest report, it was observed that the number of addresses holding a small number of Bitcoins had drastically improved since the collapse of the crypto-market on 12 March.

The report said,

“The number of addresses holding between one billionth (1/1B) and one hundred millionth (1/100M) of the total BTC supply (i.e. between 0.000000001% and 0.00000001% of total supply) has increased about 6% over the last 90 days.”

Additionally, it was also observed that the number of addresses holding between 1/100 millionth and 1/10 millionth improved by 4 percent as well.

Although both the aforementioned metrics were measured over a short period of time, the trend can be observed in the long-term as well. In fact, Glassnode’s analysis had suggested that the number of non-zero addresses for Bitcoin had risen from 22 million at the end of January 2019 to over 30 million, at press time.

Source: Coinmetrics

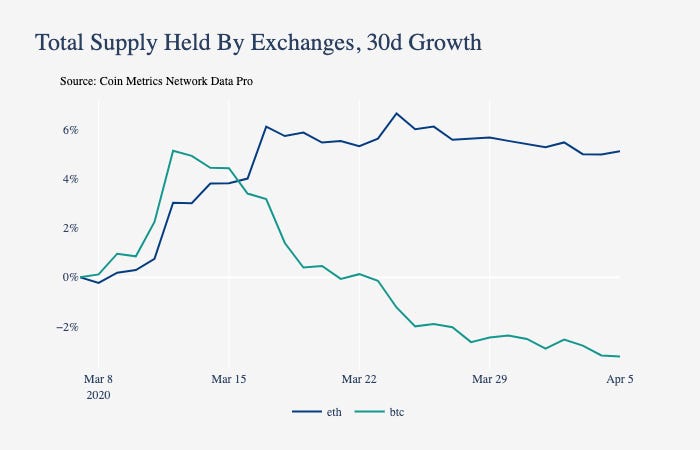

However, talking about comparisons, Ethereum may have taken the shine to exchanges over Bitcoin, in spite of the market crash. The report claimed that the amount of Ethereum held by exchanges over the past month had relatively increased whereas, the number of Bitcoins held by exchanges had dropped.

According to the aforementioned data, the number of ETH rose by 5 percent on exchanges, whereas the number of BTC held on such platforms dropped by 3 percent.

The positive hike in ETH sentiment was also observed in a recent analysis by Santiment. It was stated that the number of addresses on Ethereum had increased from 40,000 to 70,000 since the start of January, an estimated 75 percent incline in 4 months. This indicated that in spite of its recent share of market woes, the community identified the long-term narrative of Ethereum as an asset.

Source: Twitter

Similarly, in terms of exchange balances, data from Glassnode noted that since late 2019, the amount of Ethereum held in exchanges had improved by more than 21 percent to over 18,187,000, 16 percent of the total circulating supply.