Ethereum, Bitcoin bearish after king coin’s fees drop by over 30%

Over the last week, the crypto-ecosystem has navigated a major consolidation phase. However, a few bearish sentiments were still seen in the market of the world’s largest crypto-asset.

According to the latest Coinmetrics report, Bitcoin recorded consistent growth in terms of Bitcoin fees for three weeks straight. However, the fees recorded a stark decline of over 30 percent the following week. Ethereum faced a similar situation, but its fees only dropped by by 7.3 percent. Bitcoin raked in daily fees of over $241K, whereas Ethereum garnered $85.1K, on average.

It has been speculated that the drop in Bitcoin fees was due to miner capitulation in the industry. Bitcoin’s price has been on a downward spiral for the past week and as was previously reported, weak miners are pulling out and increasing the sell volume.

Source: Coinmetrics

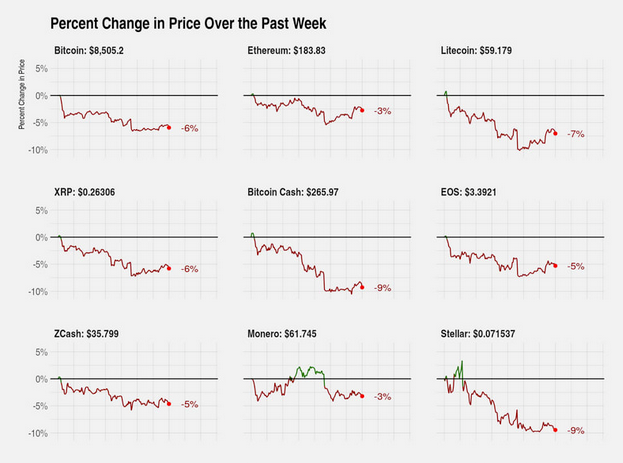

A majority of the top coins recorded a fall of 5 percent or more, unlike Ethereum, which managed to keep its losses to 3 percent.

The CM Bletchley Indexes also shared a similar bearish outcome over the week after the coins with large market caps performed below par, falling 6 percent off the back of Bitcoin and Ethereum’s performance. The report added,

“After Bitcoin’s very strong first nine months of the year, it seems that mid and small cap assets have found resistance against their BTC pairs. This is evidenced below where it can be seen that the relative strength of the Bletchley 20, and less so the Bletchley 40 has now persisted for the better part of two months. “

Additionally, Bitcoin difficulty continued to drop throughout the week, witnessing a drop of over 4 percent. However, the report claimed that a re-adjustment should take place in the next few days.

Previously, Willy Woo had claimed that Bitcoin’s present market scenario was approaching a unique set-up before the halving event next summer, as a bearish trend is apparent.